- December 14, 2022

- admin

- 1

When it comes to trading most of us are busy with backtesting multiple option trading strategies with no code platforms but when it comes to investing very few charting platforms available to test long term investing methods. Over the last couple of years, I did n number of research on systematic investment methods to beat the index returns.

- What happens if I do SIP only during market corrections ?

- What happens if I pick stocks based on momentum rules?

- What happens if I select stocks based on fundamental approach?

Almost all such research ended up giving good results. Here’s couple of Quora answers related to best way to pick stocks for long term investing.

Inspite of writing so many articles on stock based investing, why I decided to stick to index funds? If you observe the historical events, it doesn’t matter how many years you hold a stock, it’s all about how you react in those few months when stock corrects big time?

Long term investing is not something that you do for 5 years or 10 years, it’s a commitment you make with yourself to invest for prolonged period of time with an intent of not selling it. As Warren Buffett says, ideal holding time for an investment is “forever”. So when I commit to invest every month over 30, 40 years of my hard earned money, I should have strong conviction on the stocks I invest in? Will I invest in stocks just because my backtest gave me phenomenal returns? No, when shit hit the roof, your backtest goes for a toss.

Remember DHFL / Yes Bank were once considered to be fundamentally best stocks. Even they were part of Nifty 50, but look what happened to them now?

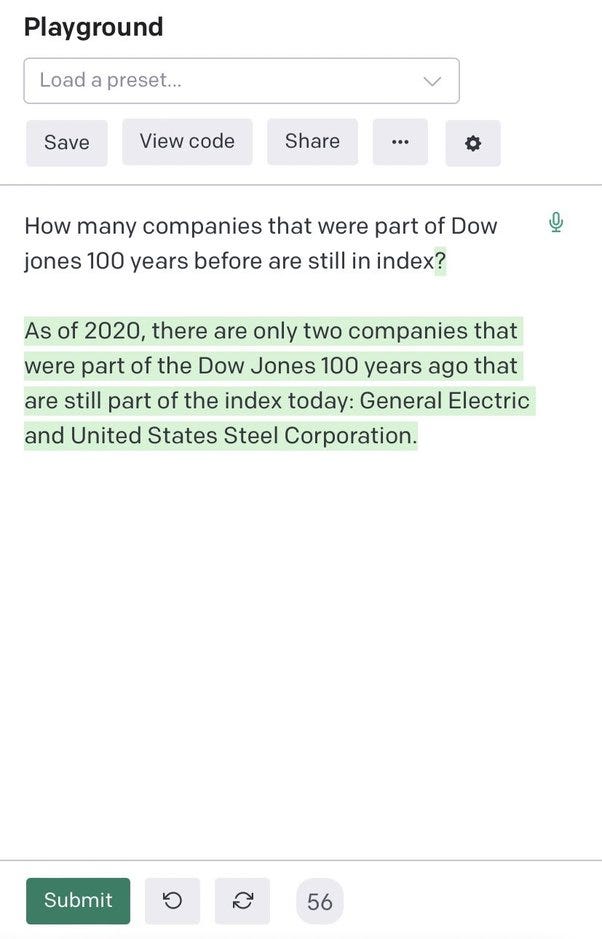

Do you know how many stocks that were part of DowJones when it was launched are still there? I used OpenAi to find this info. Only two companies still exist.

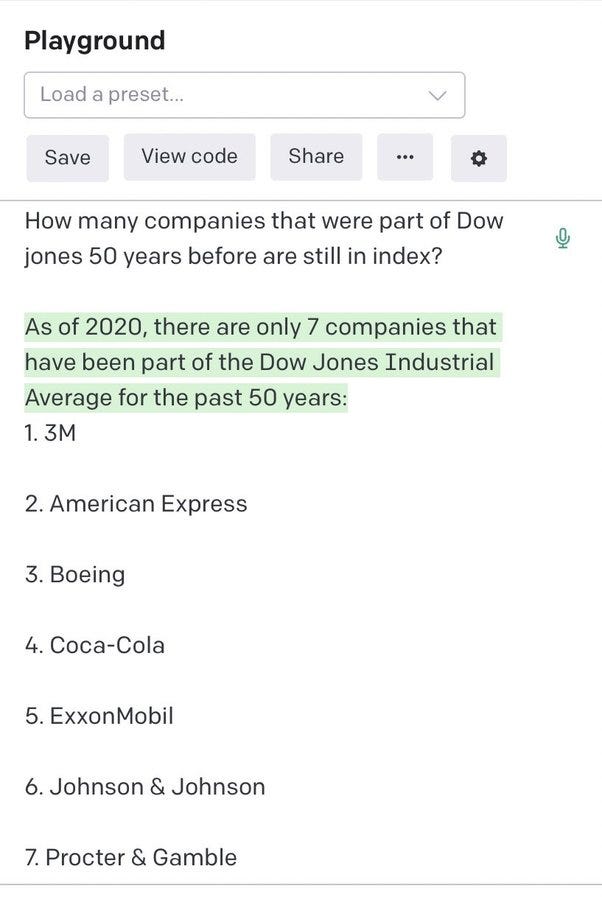

Did you know? Only 7 companies that were part of DowJones 50 years before still part of index.

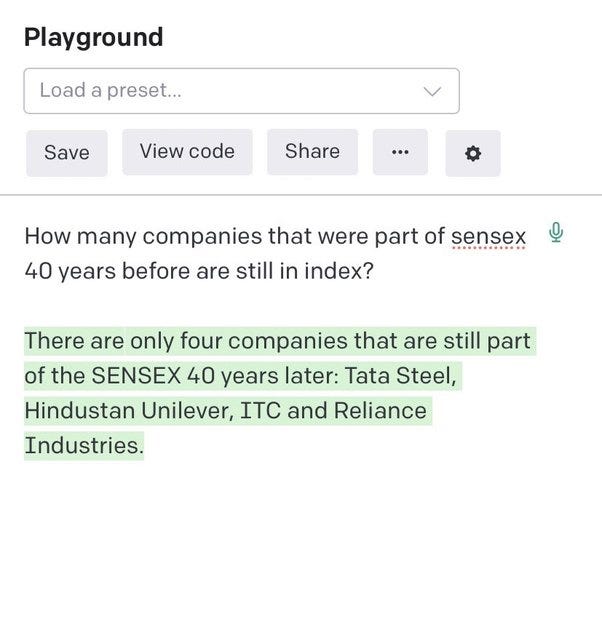

With respect to Sensex which was created 40 years ago, only four companies that are still part of Sensex 40 years later.

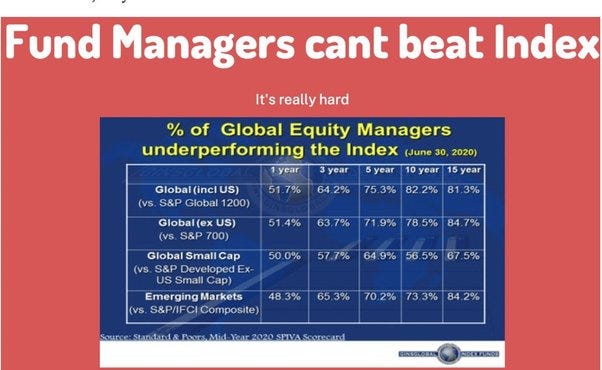

Doesn’t matter how robust the company business is, eventually one day a fool might end up running the business and bring down the total empire. Picking the right stocks and investing regularly in them is a tough task even for fund managers. That’s why 85% of fund managers fail

So odds are completely against us when it comes to investing in stocks. Whereas investing in index funds gives me peace of mind, I don’t need to panic when market crash. Because I won’t have any stock portfolio to compare it with index, as I have invested in index directly. I don’t need to worry about quarterly results. I don’t need to worry about what the management of a company does There is a sense calmness and the habit of investing regularly every month becomes easier. Mostly importantly I don’t panic during market correction.

All I have to do is just invest in Index fund, I can also pledge them and use that for my trading, hair cut will be very minimal compared to stocks. So added advantage. People compare Nikkei Index when it comes to index funds investments, as Japan stock market was not able to break all time high for many years. But ppl forgot very important point here, Japan witnessed one of best bull run between 1940s to 1990s , for years it made huge returns

None of the other world markets were able to give such outstanding returns, when the bubble burst eventually in Japan, market went into consolidation phase. Where the average returns between 1990 to 2022 was just 6.4% So this average return is after a period of bumper returns

Conclusion : There are many strategies out there which can beat index returns, but eventually it all comes to one’s psychology, your patience will be tested when stocks in your portfolio underperforms for a long time, you lose your sleep when your portfolio crashes more than the index, when 85% of the fund managers in the world can’t beat the index returns over the long run, it clearly denotes just having the right skill alone is not sufficient, you need to have the right mind set to stick to your investments during adverse times and that becomes easier only when you invest in index funds instead of direct stock investment.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Very nice analysis