- September 19, 2023

- admin

- 0

Year 2023 has been really tough for option selling, stop loss getting hit frequently, witnessing multiple reversals and lot many spikes. This is what most of the option traders have been complaining about this year. Did the introduction of daily expiry with different indices killing the backtest results?

If we compare IndiaVix with 2017 vs 2023, its almost similar. But, year 2017 was lot easier for option sellers. What has really changed in 2023? I wanted to find out how many frequent spikes and reversals happened this year that people are complaining about.

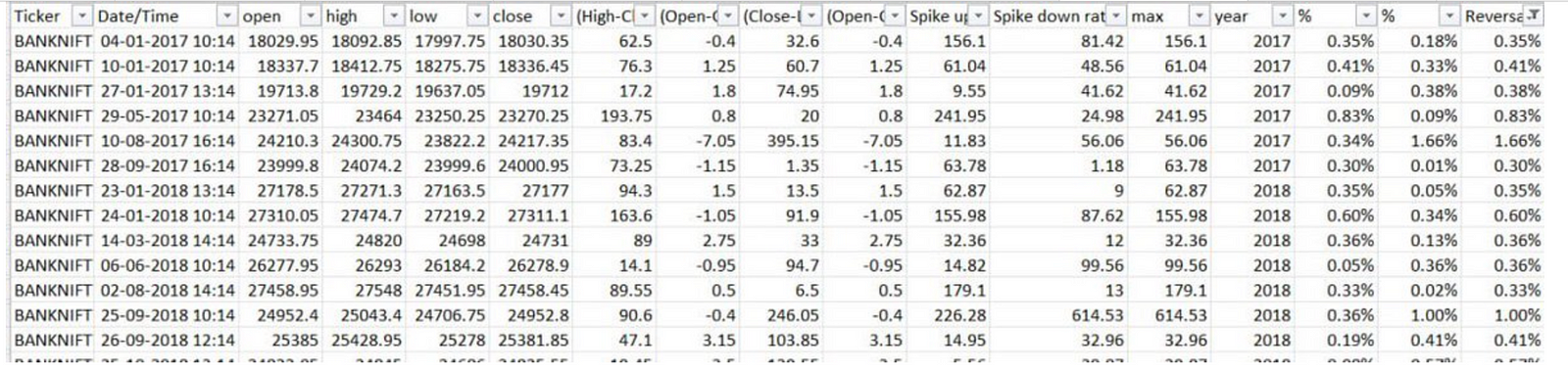

First, how do we sudden spikes? Big moves in a short span of time. Instead of calculating High-Low range, need to find out Open to High, Open to Low during intraday 5mins time frame, this shows how much high or low BNF moved up in just 5 mins. Filter those days with range >0.5.

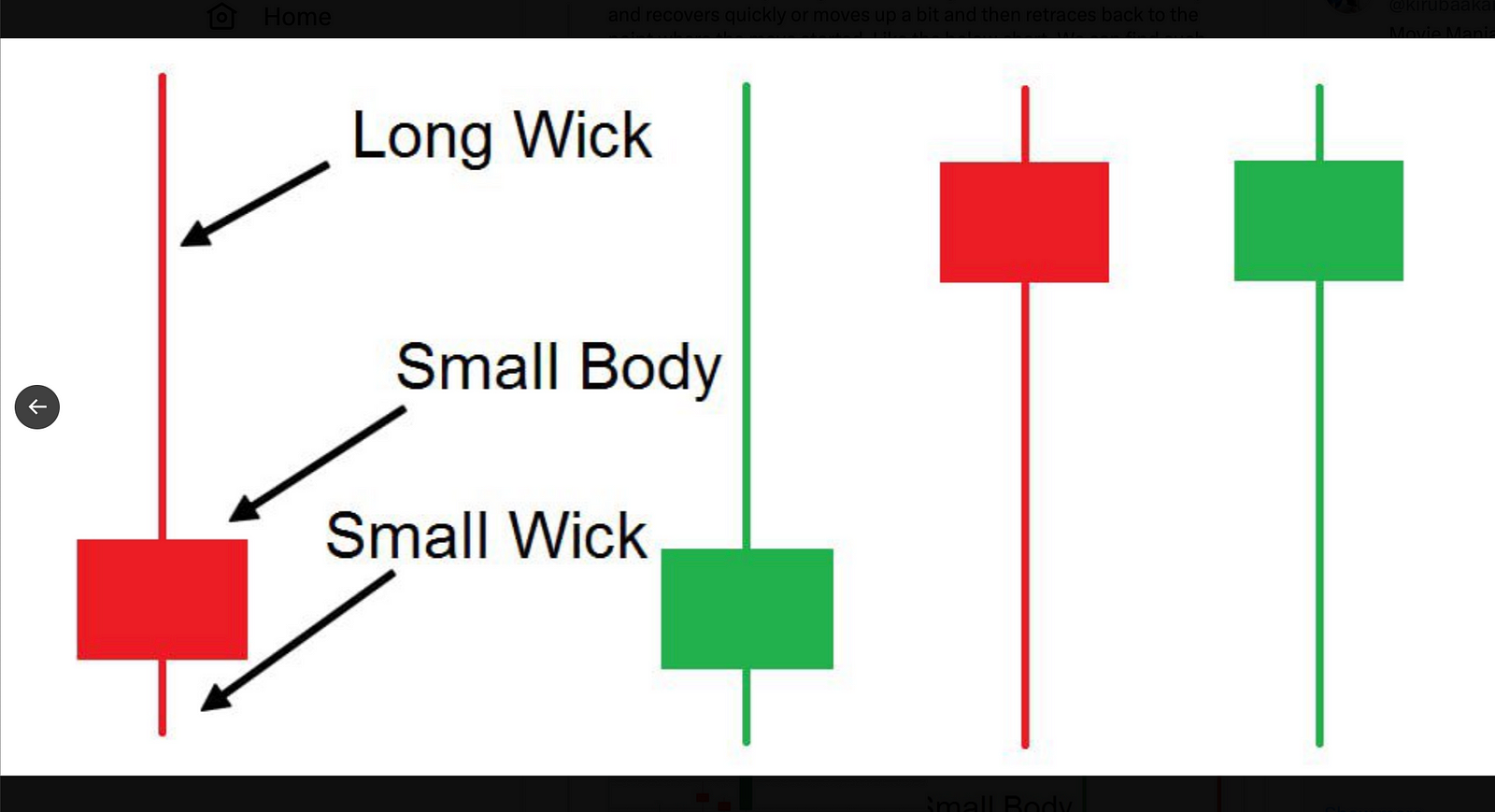

Next, how do we quantify reversals? Days like this where market drops and recovers quickly or moves up a bit and then retraces back to the point where the move started. Like the below chart. We can find such days through higher time frame with pin bars

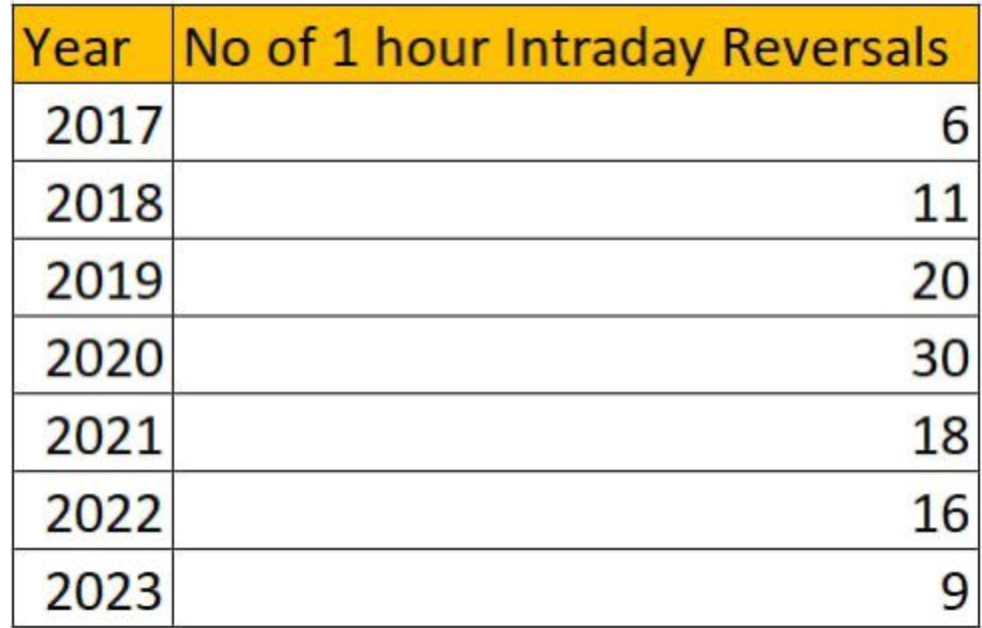

On an hourly time frame, if we calculate (High-Close)/(Close-Open), you get the spike ratio. Higher this value, larger the wick which in turn denotes max reversals.

Basically comparing the body of the candle with the wick, higher this ratio, higher the reversals.

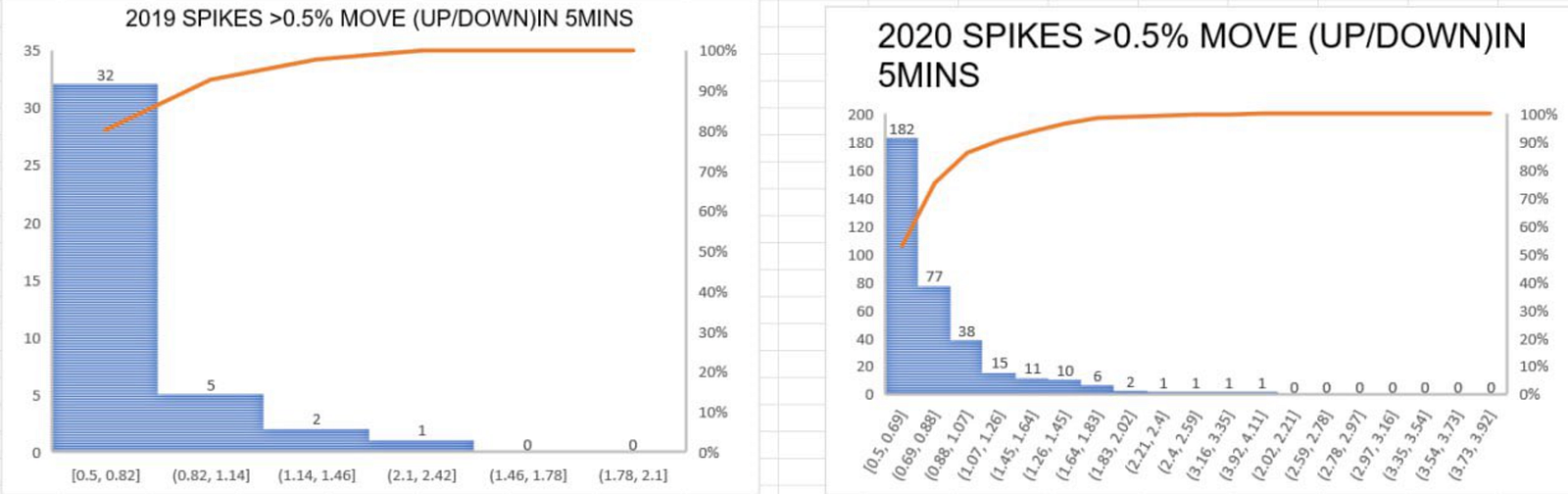

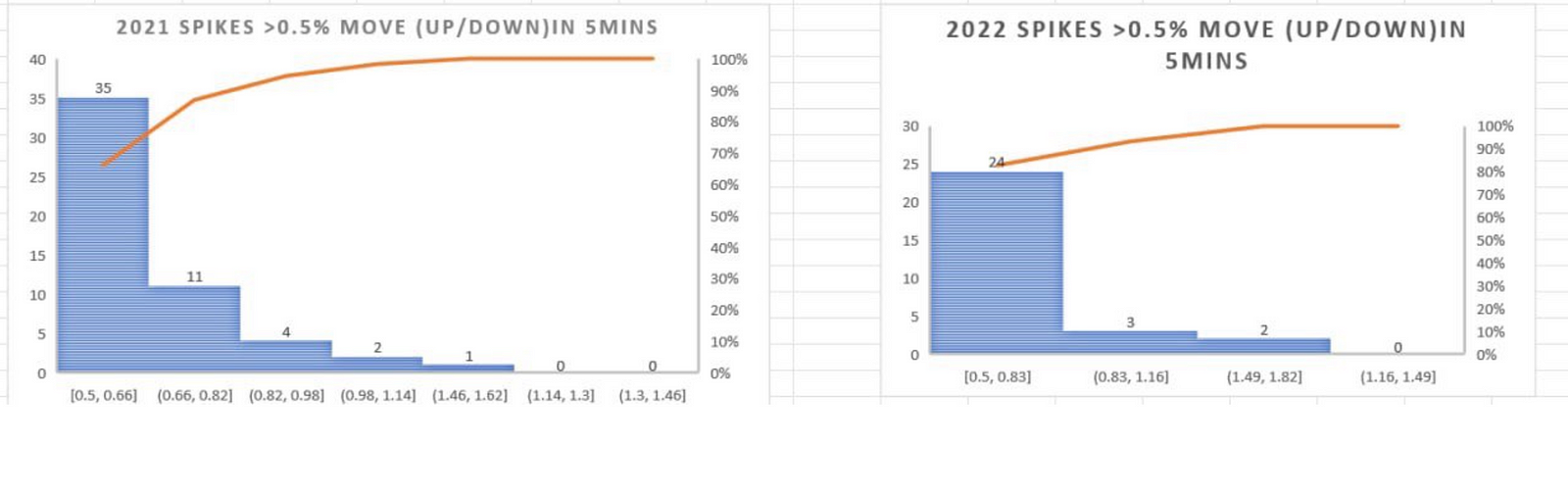

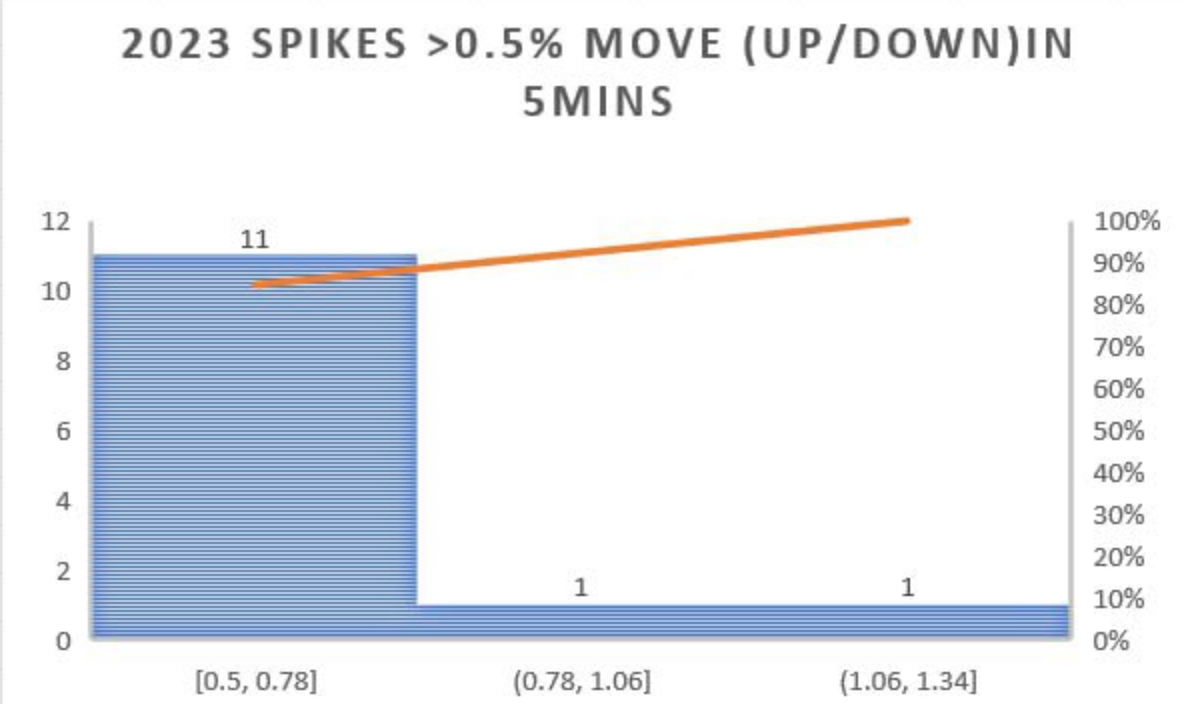

I wanted to find how many spikes happened, i.e candle Open to High, candle Open to low during intraday time frame that are greater than 0.5%, if bank nifty between 10:45 to 10:50 moves up from 45000 to 45300 on the upside in 5 mins, then (45300–45000)/45000=0.67% like wise if BNF from 12:25 to 12:30 moves down from 43350 to 43020, then (Open-Low)/Open = (43350–43020)/43350=0.76%, we capture such occurrences whenever this ratio is >0.5% if we do this analysis to get no of spikes happened in each year, this is what we get.

But year 2023, data says that we haven’t really seen high no of such big spikes in short span of time. Only 11 such occurrences. This is again similar to year 2017 where only 7 such occurrences were there.

Then I have calculated the hourly intraday reversals, how many no of times we have seen such reversals. Considered only those days where wick of the candle is >0.30% so that it will be long enough to be considered as big reversal.

When we do this calculation from 2017 to 2023, to find how many such occurrences happened year wise, we haven’t seen any significant reversals this year statistically. It’s just 9 such big reversals.

All directional systems like breakout or trending following system rely on few huge moves in a year, even though we have hit all time high and stocks from small cap, mid cap, large cap rallies big time, there aren’t much big moves happening in intraday time frame. After 2017, we are witnessing lowest no of > 1% intraday move occurrences this year. Hardly any trending moves happening in intraday time frame.

Checking all the underlying moves,there is no conclusive data here on why we are seeing different price behaviour with indices this year. Usually when the underlying moves, the respective option values moves, but due to rise of large no of concentrated option sellers across different indices who largely deploy short volatility systems, taking a positions in derivatives is affecting the underlying now, which isn’t allowing indices to make any significant moves?

People use to backtest two different set of strategies , one for Thursday expiry day & another for non expiry days, because the assumption here is market behaviour is different on expiry days. So accorindgly they created a non directional & directional systems. But now with 5 different indices expiring on 5 different days, the earlier concept on which you backtested might not be valid any more since the overall structure itself has changed. People who used day filters and created systems would find it difficult now.

Market moves are not just two types like trending phase and sideways, it can move in four different phase Trending with volatile move, Trending with non volatile move, non trending with volatile move, non trending with non volatile move.

Plan how you can handle all such moves with your trading system to surive long enough in this market. Just using day filters for your option trading system to decide stop loss might not be working anymore. Try to build systems based on core principles.