- October 18, 2021

- admin

- 13

We all heard multiple stories like Instead of buying Royal Enfield bike, if you have bought Eicher Motors shares 10 years back, you can buy a BMW car by now. Instead of buying Maruti 800 15 years back, if you have bought “Maurti” shares instead, by now you can buy a big bungalow with a Mercedes Benz on your garage. Rs.10,000 invested in Wipro during 1990s would be worth 1000s of crores by now.

Am really tired of hearing all these stories, can we really make such exorbitant returns? Is there any way to identify next Eicher Motors, next Infosys? How can we find multibagger stocks at a early stage? I really don’t believe in fundamentals analysis when it comes to identifying multibagger stocks.

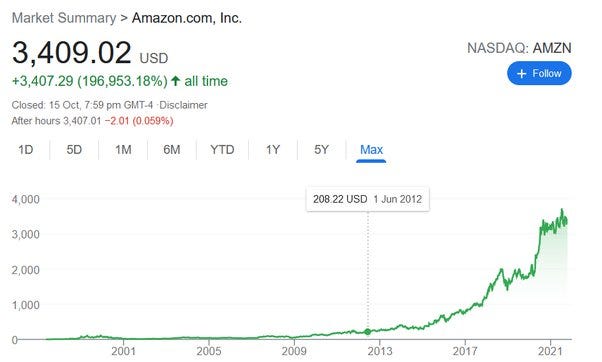

Amazon gave 200 times returns, but 15 -20 years before do you think Amazon stock had the best fundamentals? No, definitely not. In fact, companies which had the best fundamentals 15–20 years back was General Electric, Ford Motors etc. But look where these companies are currently.

Stock price appreciation is completely based on what the company is going to do in the future not what the company has done so far. Amazon had lot of potential to grow but had poor fundamentals, but its stock price has grown exponentially in last 15 years by achieving what was considered as impossible by many companies.

If there is one thing that is so common with all these multibaggers is “nothing”. Yes, none of multibaggers share same business structure or leadership. Every single company follows their own rule, own process. So I wanted to come up with own rule based investing approach using which we can enter into the stock which can potentially become a multibagger. A stock go down only 100% , that’s the maximum loss we can face but it can go up 10,000% or 20,000%. If you place all your bets on single stock, you can lose all your capital. But if you segregate your capital into multiple stocks, even if 80% of your portfolio goes bust, still remaining 20% of your stocks can end up giving multi fold returns which will not only cover up your losses, it can give you wild profits as well.

So the only way to identify multibagger stock is to invest in basket of stocks, which is obviously be mixed with lot of stones and few gems, but no way to identify those gems directly, as the time goes by market will reveal what are gems and what are stones.

What we really need to do is divide your capital and invest in stocks that satisfies the given rule and continue to hold onto it until it gives exit signal. If the stock is really a junk, it will be exited. If its really a gem it would continue to climb up year after year.

Here’s the rules to identify multibagger stocks

- Find list of stocks that has given multi year breakouts. We are considering minimum of 5 years period. So the stock has to breakout from its last 5 years high price. Larger this time period, higher the probability of multi fold returns

- We are entering into the stock, the moment its 5 year high is crossed.

- We will continue to hold the stock until its 5 year low is not broken. Remember our goal is to identify multibaggers, so we need to give enough room for the stock to go against us. If we use last 20 days low or 6 months low or 1 year low as trailing stop loss, its definitely going to get hit. If the Stop loss is hit, we need to wait for 5 year multi breakout again, we cannot simply reenter. That’s why we keep wider stop loss.

- Invest only a portion of your capital into these stocks

- You can have price filters as well like investing only in stocks with LTP less than Rs.50

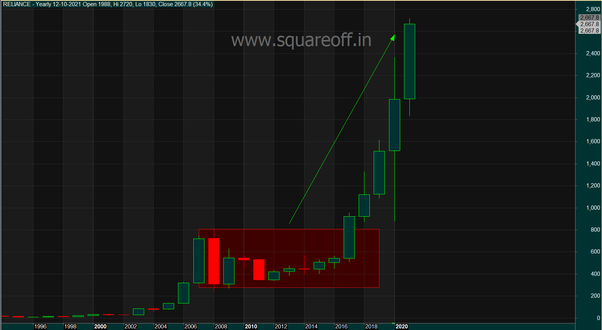

Example: Reliance

Reliance stock was trading in a narrow range for 8 long years, then by 2017 it broke out from its 8 years high price and after that it gave more than 300% returns in last 3 years.

Tata Power

The stock made a high of Rs.151 in the year 2010, for next 10 years it never crossed that high. But this year in 2021, TATA POWER was able to cross the multi year resistance level of Rs.150. What happened after that?

TATAPOWER continued to move up day after day once it crossed Rs.150, currently it is trading around Rs.250 levels. That’s more than 66% returns in just one year. But most us will not have patience to hold onto winners, we will lot of patience to hold onto losers because we expect one day this loser can become a winner and this winner which we currently holding might turn out to be a loser soon, so its better to get rid of it.

If you really want multibaggers, you should come out of this mentality of selling too soon.

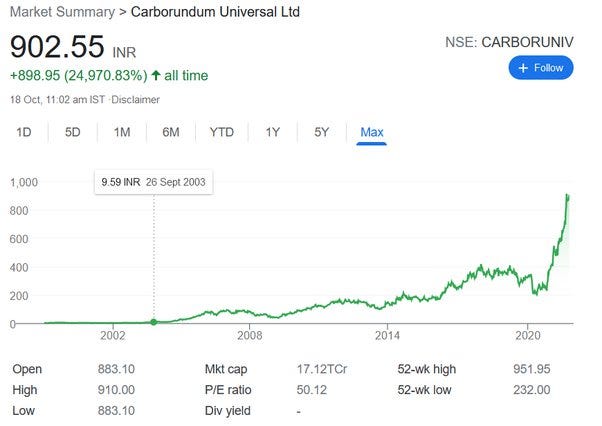

I have tested the above rules to check what were the list of multibaggers we were able to identify at early stage. Stocks like Carborundum Universal Ltd came in the list by 2003 itself and since then for last 18 years it never gave a sell signal which ended up with more than 25,000% returns.

Nacto Pharma is another stock which gave entry signal in 2002 that also ended up in multi fold returns.

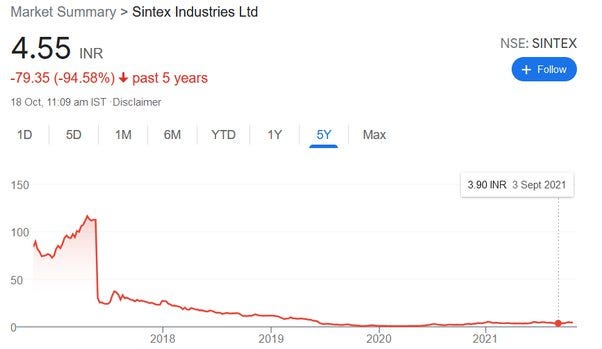

But not every stock we pick can end up with multi fold returns, as mentioned earlier there will be some gems and lot of stones will also be there, Sintex is one such stock which gave signal in 2015 ended up losing more than 90%. That’s I insisted on investing only a portion of your capital in such stocks. Consider you have invested Rs.10,000 in Carborundum and another Rs.10,000 in Nacto Pharma and Rs.10k in Sintex. By now, your invested capital of Rs.30,000 would be worth more than Rs.50 lacs in spite of losing 95% with Sintex.

Profits you can potentially make from few stocks will be enormous which can not only offset the losses from junk stocks, overall it can end up giving multi fold returns. Some of notable stocks which made multi year breakout this year are BALRAMCHIN which recently broken from 15 year resistance level, and currently in profit of 85% after breakout. TATASTEEL is another stock which broken from its 14 year multi year resistance level of Rs.1050 and currently trades 26% above this level. TORNTPOWER and TATAPOWER broken out from their 11 year resistance level. McDowell-N is the only notable stock which has recently broken from 6 year resistance and still trades around the same level which can potentially make higher move from here on. Traders can use platforms like chartink to scan for such stocks based on the rules explained above.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Thanks. good Analysis

Excellent research

Good article

excellent

Fab!

Wonderful analysis.

Great research and analysis.. Insightful

Excellent analysis… what is the sell signal.. when do we book (full or partial)..

This is a great article..

Very well explained strategy. Its edge is law of large numbers. Kudos for research. A follow up question on this. Where did you get data of stocks which gave breakout in past years. Trying to develop my own system. So need data for this type of methods. Can you recommend any vendor/site for this data?

Hey,

Interesting article. Actually, I have started investing in this idea for the last 3 months(before I read this blog). The problem that I see is the portfolio will keep adding a lot of stocks. I am already sitting on a portfolio of 15 stocks within 3 months time.

We should be able to prune this to a lower number & rebalance the portfolio frequently and probably build a ranking algo that weeds out the low probability ones.

thanks

Rajesh

Interesting. I have been trying to use a method similar to this in the last 3 months. I am sitting on a portfolio of 15 stocks in 3 months. How do we rebalance appropriately? Need to have a ranking method that can help prune.

Any thoughts?

i have just discovered your website and I must say I am really liking it