- October 7, 2023

- admin

- 0

There are more than 2500 mutual funds schemes in India which are managed by more than 45 AMC’s. Out of these, there are 30 different midcap mutual funds with total AUM of greater than 2.5 lacs crore which are being by managed by more than 400 Fund Managers across India. Most investors, when they try to invest in any mutual funds, they mostly go after performance track record. But problem is these fund managers don’t stick to one mutual fund house, just like us, they also change jobs. What seems to be the best mutual fund today might not be the best one tomorrow. So you can’t really rely on the fund manager in the long run.

By investing in index funds, the returns are decent enough but by investing factor based index funds, we tend to make much better returns than the traditional index funds, and also we can tend to beat most of the normal mutual funds. The best part is, we are not relying on any fund managers here.

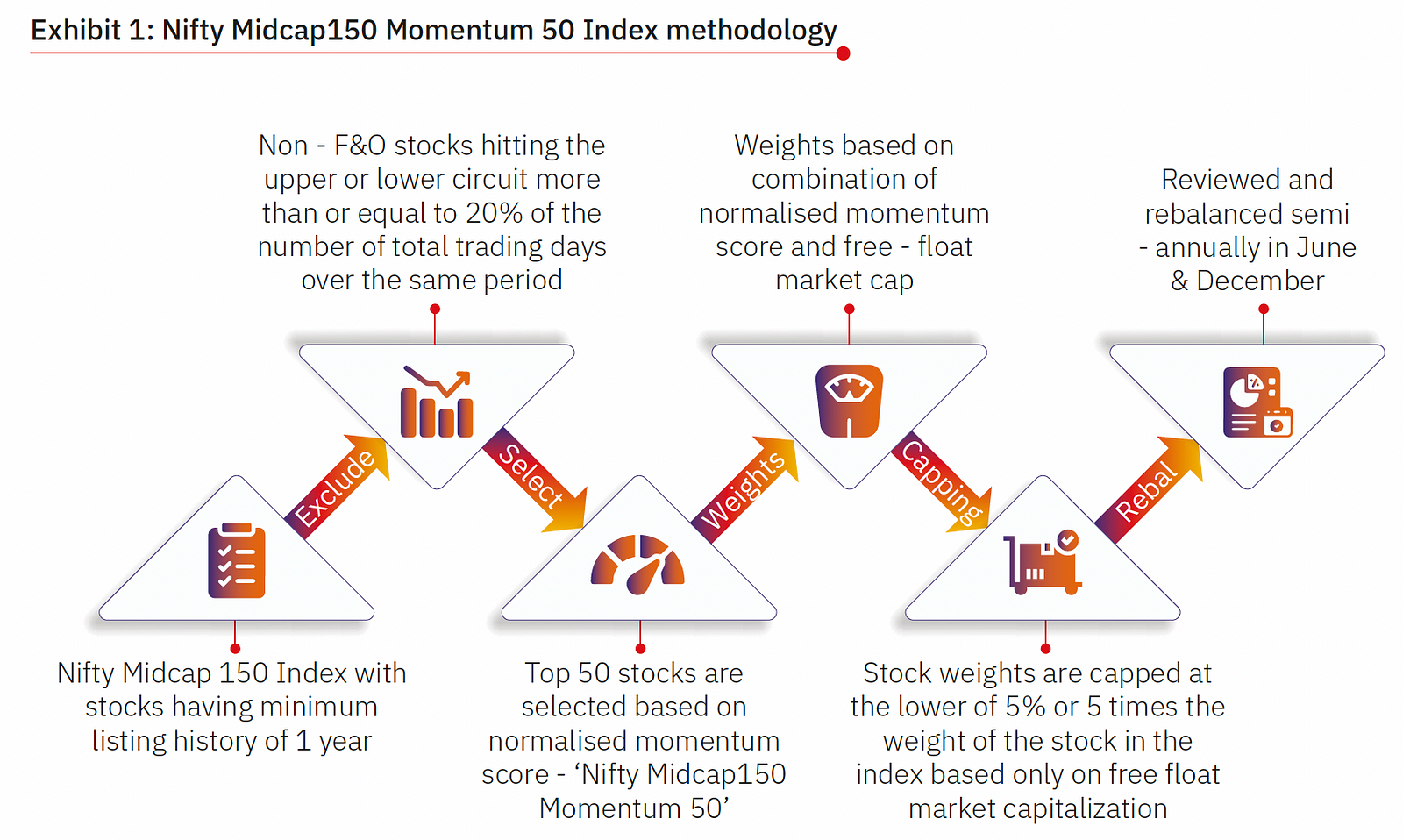

Nifty Midcap150 Momentum 50 Index is one such Index fund that tracks 50 high momentum stocks within the midcap segment.

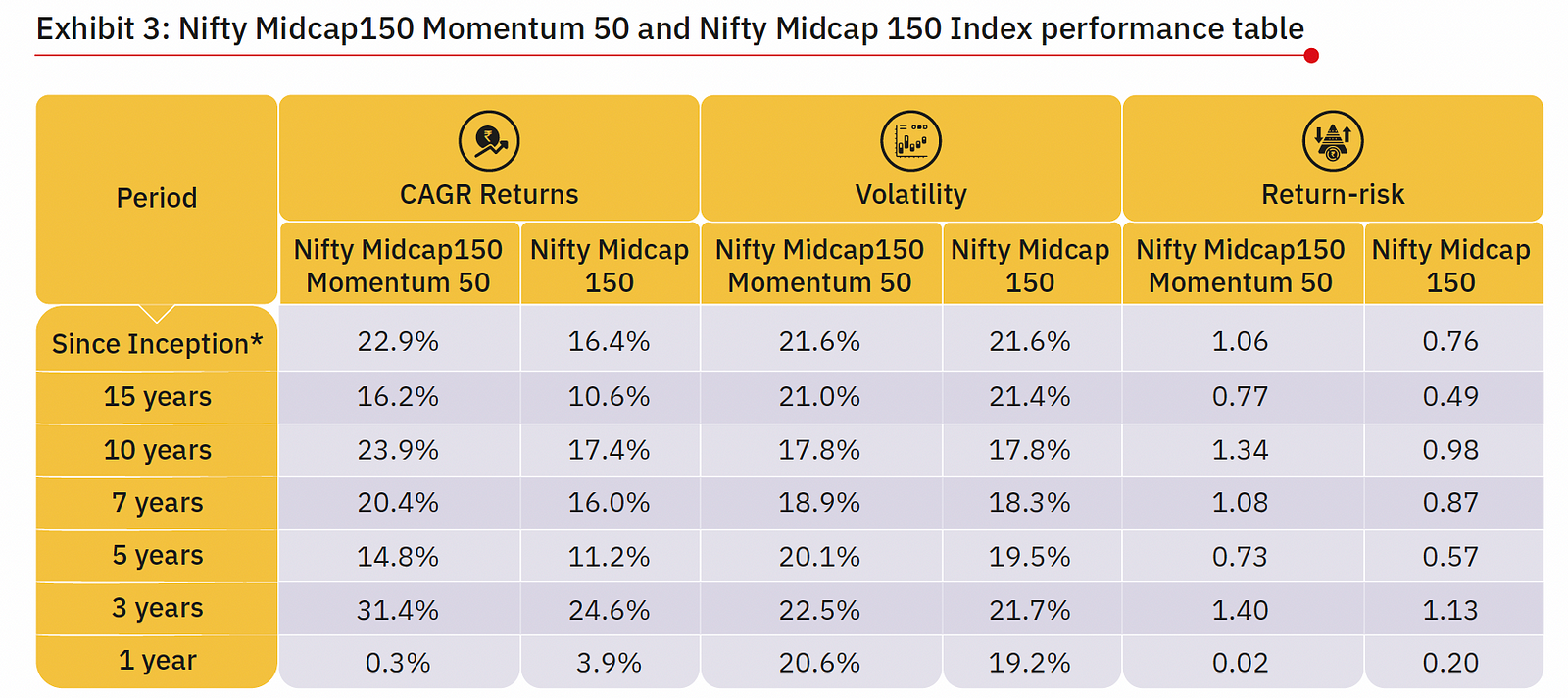

The Nifty Midcap150 Momentum 50 Index has outperformed the Nifty Midcap 150 Index over the long term horizon

Even the risk adjusted returns are much higher with Nifty Midcap150 momentum index, where it has outperformed the index with a greater extent but with the same risk. Since inception, Nifty Midcap150 momentum index has given almost 23% CAGR.

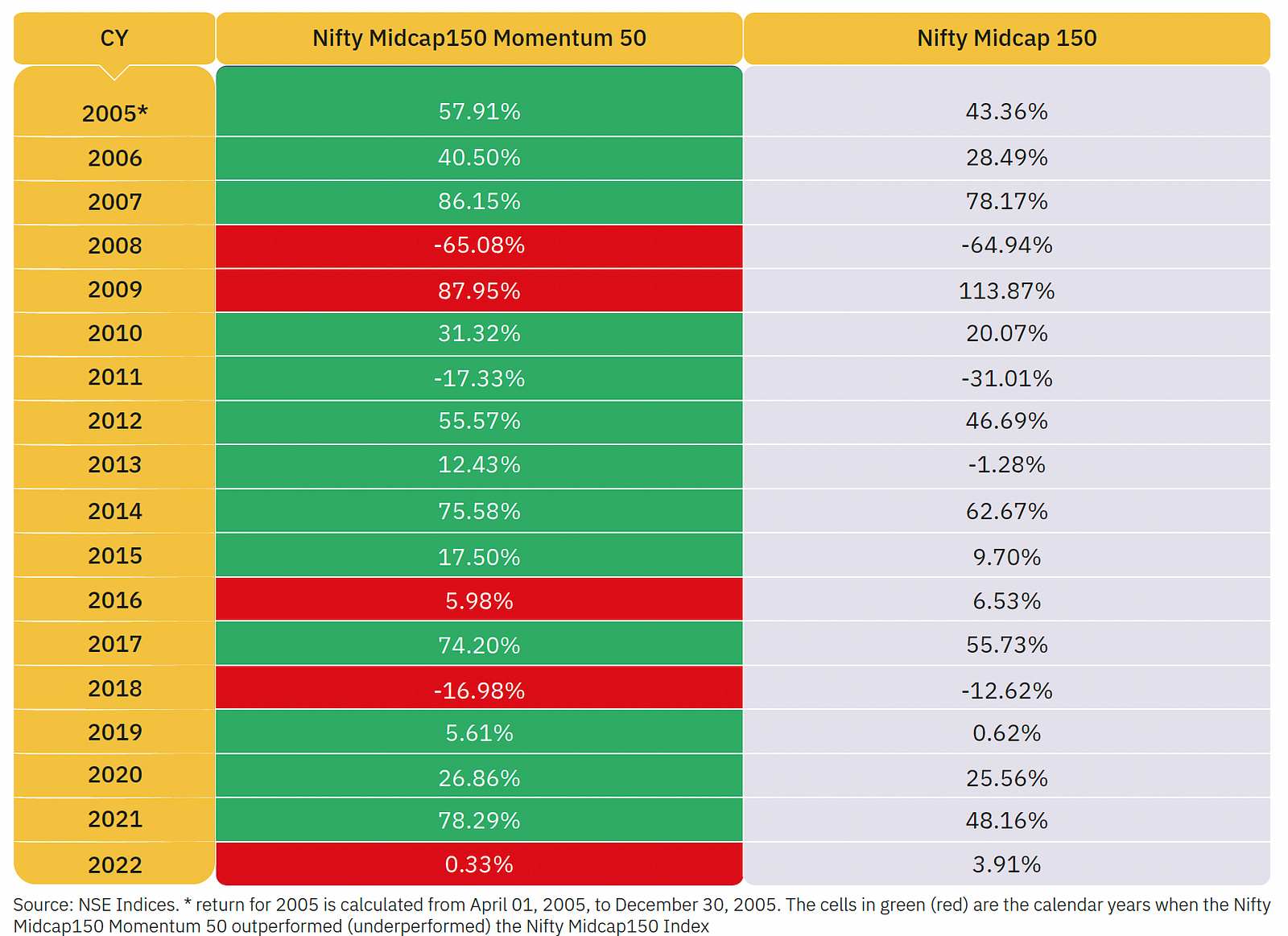

The Nifty Midcap150 Momentum 50 Index has outperformed the Nifty Midcap 150 Index in 13 years out of the last 18 calendar years.

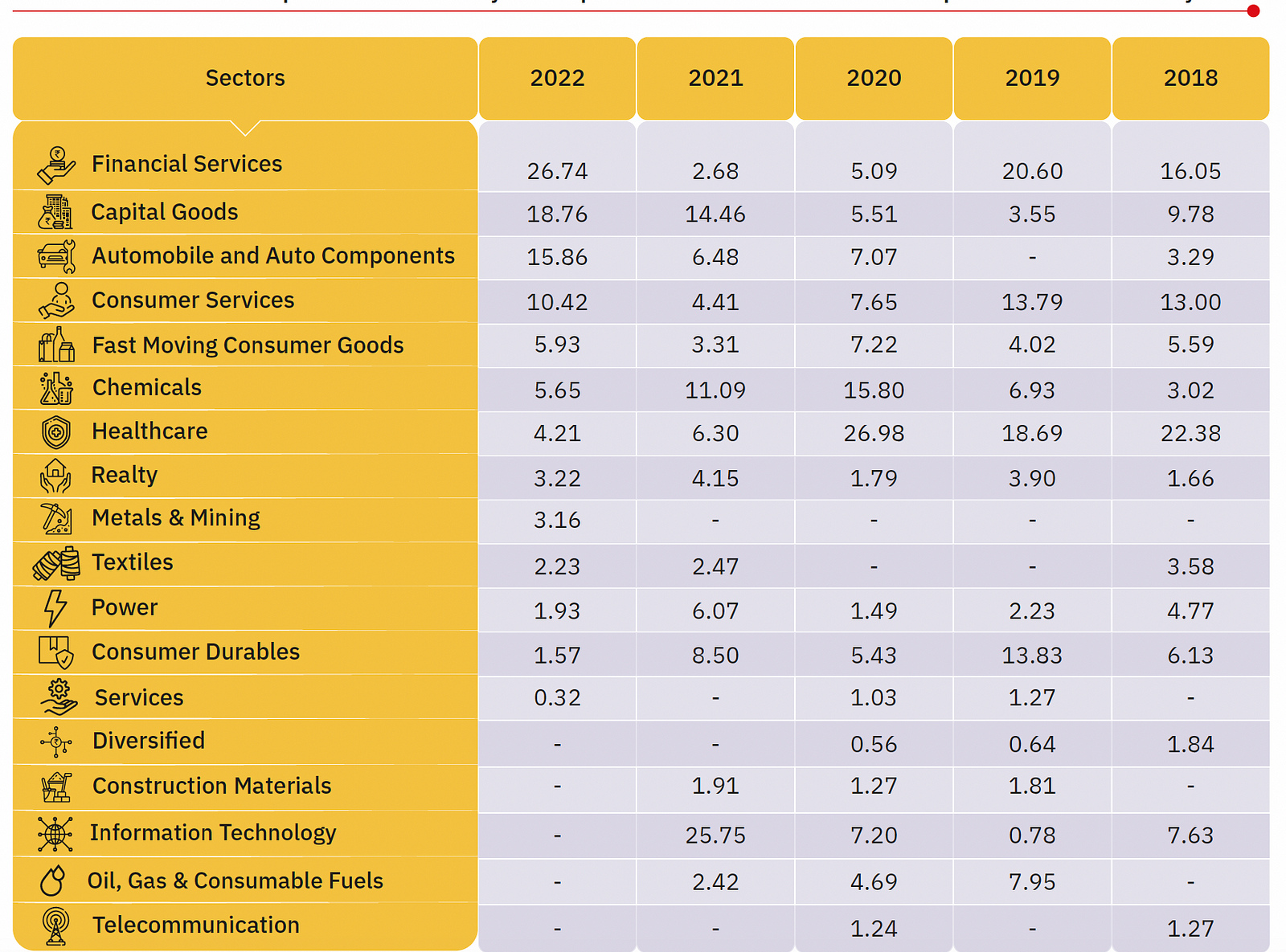

Just like Nifty200 momentum index, even the Nifty Midcap150 Momentum 50 Index also adapts to changing market conditions and increases the weight to currently outperforming sectors.

The Momentum factor’s basic premise is that stocks that have outperformed recently may continue to outperform, and vice versa. Thus, the Nifty Midcap150 Momentum 50 Index aims to overweight outperforming stocks/sectors relative to its parent index and adapts itself as the market outperformers change.

Nifty200 Momentum index focuses on top 200 companies that includes both large cap & mid-cap stocks, but larger allocation goes towards the big blue chip companies, so returns are relatively lesser but with Nifty Midcap150 it is purely based on midcap stocks, hence returns are much higher than the Nifty200 momentum index fund. If you are expectation is to make higher returns with the same drawdown as midcap sector, then Nifty Midcap 150 momentum index would be the best option.