- September 10, 2019

- admin

- 7

I was reading an interesting question on Quora

https://www.quora.com//How-can-I-sort-the-top-5-stocks-in-the-Nifty-50-A-few-people-say-that-its-good-to-invest-in-the-top-5-companies-from-the-Nifty-50

It made me curious and I spent next few hours of my time on the research work.

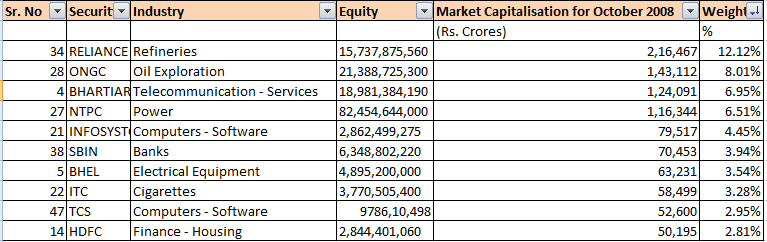

The list of Nifty 50 stocks and their weight-age gets changed every month and the same is shared in NSE site.

The top 5/10 stocks actually decides the movement of Nifty index.

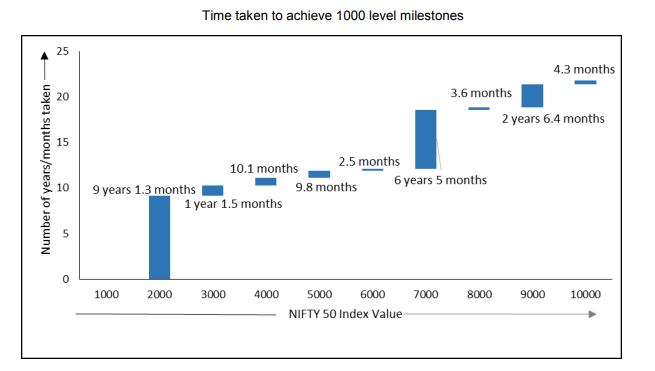

From its base value of 1000 in November 1995, the NIFTY 50 reached the 2000 mark in December 2004, taking 9.1 years to double. Thereafter, the journey of NIFTY 50 was swift wherein it reached the 6000 mark in only 2.9 years. It took another 6.4 years to reach the 7000 mark in May 2014 from 6000 in December 2007. The 9000 level was achieved in March 2017 which was relatively faster from 7000 level taking only 2.8 years.

The flagship index ‘NIFTY 50’ hit the 10,000 mark on July 25, 2017 taking only 4.3 months to move from 9000 to 10000.

As you can see in the below chart, Nifty has moved up slowly and steadily over the last 20 years. It shows that if we stay invested in Nifty, we could generate good returns over the long run. But practically its difficult to invest in all Nifty 50 stocks every month.

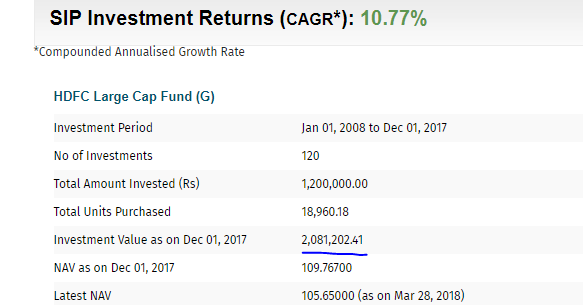

So the solution is do an SIP (Systematic Investment Plan) on Top 10 Nifty stocks every month. I have tested this process with the last 10 years of historical data.

- I have to download all Nifty 50 stocks from 2008 to 2017.

- And again each month, I need to find out what are the top 10 stocks based on weight-age.

- Calculate the total returns on my investments assuming I invest 10k on 1st of every month on these top 10 stocks.

(It took my whole Sunday evening time to complete this task)

If someone has Invested Rs.10,000 every month on Top 10 Nifty stocks for last 10 years, his total investment would have been Rs.12 Lakhs, where as his total fund value would have been more than Rs.20 Lakhs.

Even I compared the same with one of the best performing Large cap mutual funds. The returns are almost same.

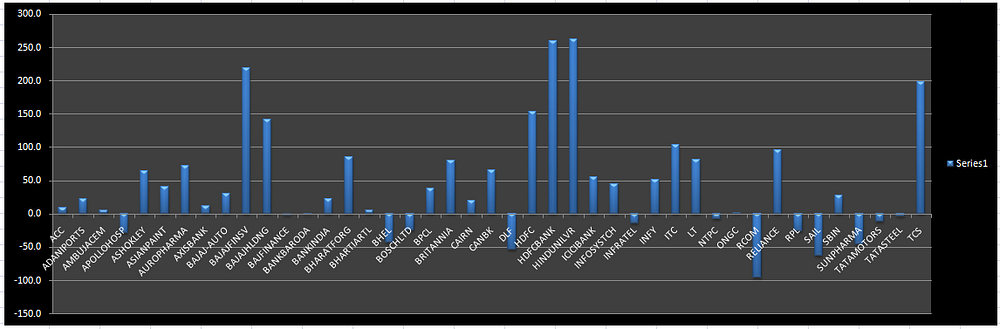

The Good part with this kind of investment is as the Top 10 stocks keep changing at regular intervals, we would always stay invested in the best companies. For example, stocks RCOM and DLF were part of Top 10 Nifty stocks in 2008, however in few months these stocks weight-age were reduced and later were removed from index. So our monthly investment towards these bad stocks would have been stopped. There were companies like TCS, ITC, HDFC played a vital role in wealth creation.

This is one the easiest and simplest way to Invest in Nifty to get much better returns with least risk.

For more such analysis and stock market articles, follow us at our Telegram Channel and blog.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Veri nice

Thanks

Great Article

When They Get Removed From Top 10 Of Nifty 50 . Will We Sell Our Position In That Stock Or Stay Invested But Stop SIP ??

Should stop the sip

Hi, Thanks for the analysis. It would be interesting to see if we would have invested the same amount of money in said duration in ETF (NiftyBees?). Case 1: Investing in ETF gives less return -> this strategy wins, Case 2: ETF gives comparable return -> we do not have to take the headache of finding which one is at top 10

Also, have you considered investing on 1st of every month vs 15th vs 25th just to take sell off in to consideration. Also, we can think of weekly expire to it.

Can we collaborate to see some of these data together?

Nice