- September 21, 2022

- admin

- 0

Be it Fed rate hike or RBI rate hike, it always creates a lot of volatility in stock market. Mainly media keeps talking about such rate hike news that could impact the decision making process of an investor/trader. In this article,

- We shall explore how interest rate hike impacts stock market

- Historically how stock market moved when there is a rate hike?

- Why FED interest rate hike is causing lot of volatility in markets this time.

- What investors should do going forward, should they need to hold or exit their investments.

Let’s consider you want to purchase a car or house, you opt for loan from banks. Consider if bank is lending you the required money for the interest of 1%. With such a low interest rate, you would obviously borrow more money and spend it. With such lower interest rate, many people will be interested to borrow from banks and they will also invest in other asset classes like real estate, stocks etc. When more people buy, demand goes up and hence the asset prices also goes up.

When you have lot of money in hand, you dont negotiate much, you tend to spend more. So obviously prices of many commodities goes up and thus inflation increases. To control the inflation, central banks rise interest rates, so that number of people who are borrowing from banks will go down, the purchasing power goes down, so when demand goes down, prices of many commodities also goes down and thus inflation comes under control.

The cycle of rising interest rate and decline in interest rate is normal. During COVID pandemic, central banks across the world reduced interest rate to encourage companies and individuals to borrow money which can help in the growth of companies.

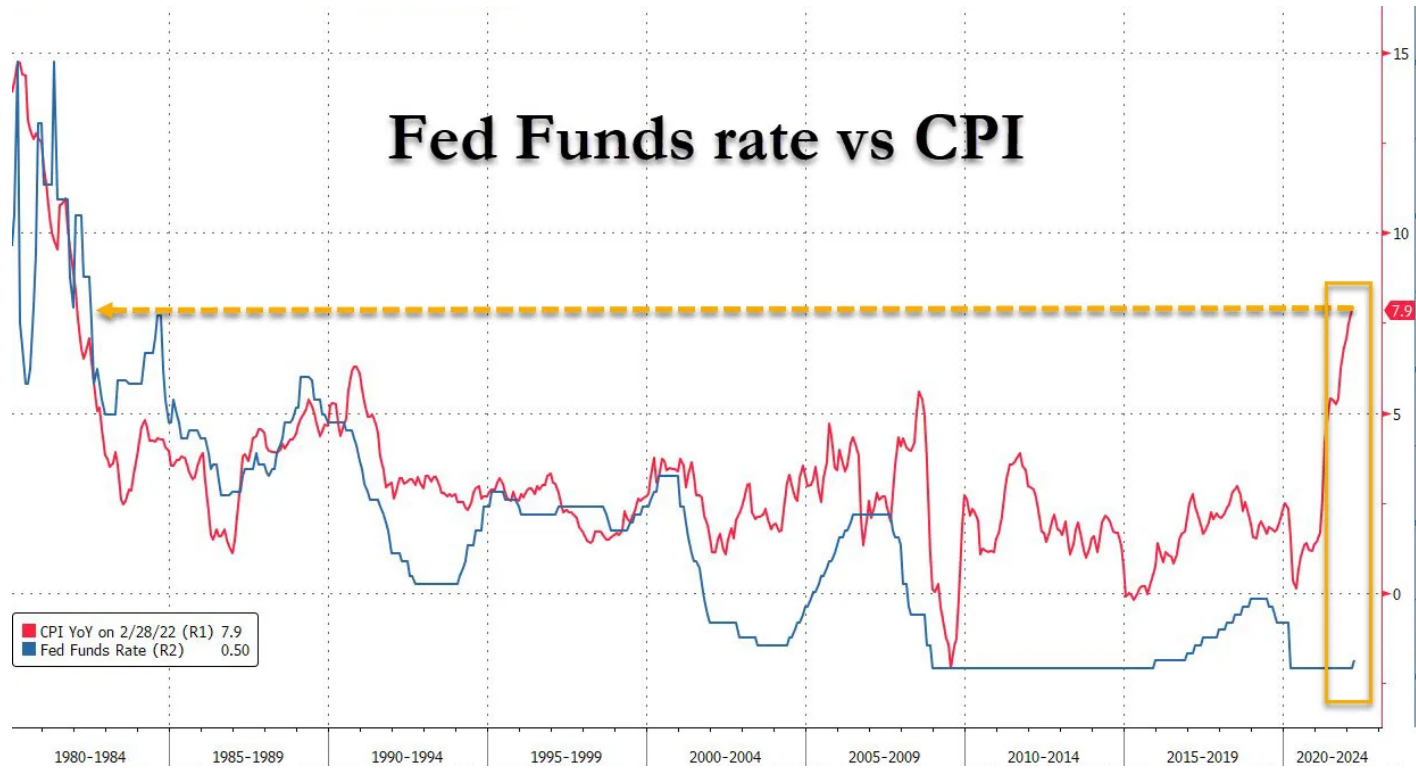

Here’s the US Interest rate chart, after global financial crisis in 2008, FED reduces the interest rate to near zero level and maintained the same till 2017 and slowly they raised the interest rate and by 2020 after COVID hit, again interest rate was brought down near 0.25%.

But currently US is facing one of the worst inflation period. The inflation is around 8% in US which is at 40 year high. So the FED doesn’t have any other option than increasing the interest rate and control the inflation. If they continue to hike rate at a moderate speed of just 0.25% or 0.5% then it wouldn’t help much so FED might be aggressive with their rate hike going forward which has caused lot of stir among equity investors.

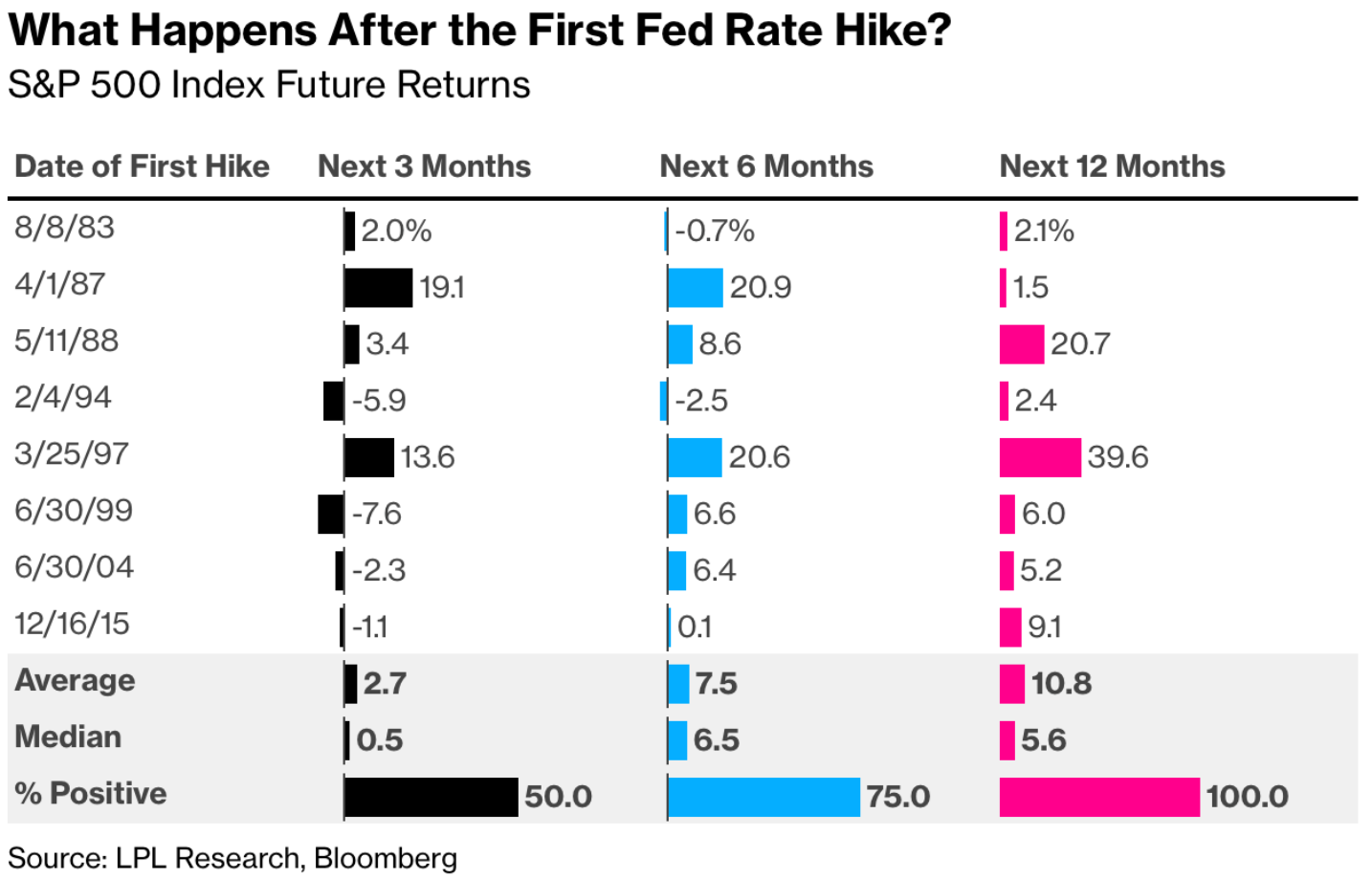

But does the rate hike really have impact on stock market? Let’s check the historical data. In last 40 years, there were multiple instances of rate hike, it always had a impact on stock market for short term. But over the 12 months period, market has always moved up. Not a single instance it ended up in negative returns. So it is clearly evident that all such rate hikes can have short term volatility but on the long run it doesn’t have any impacts.

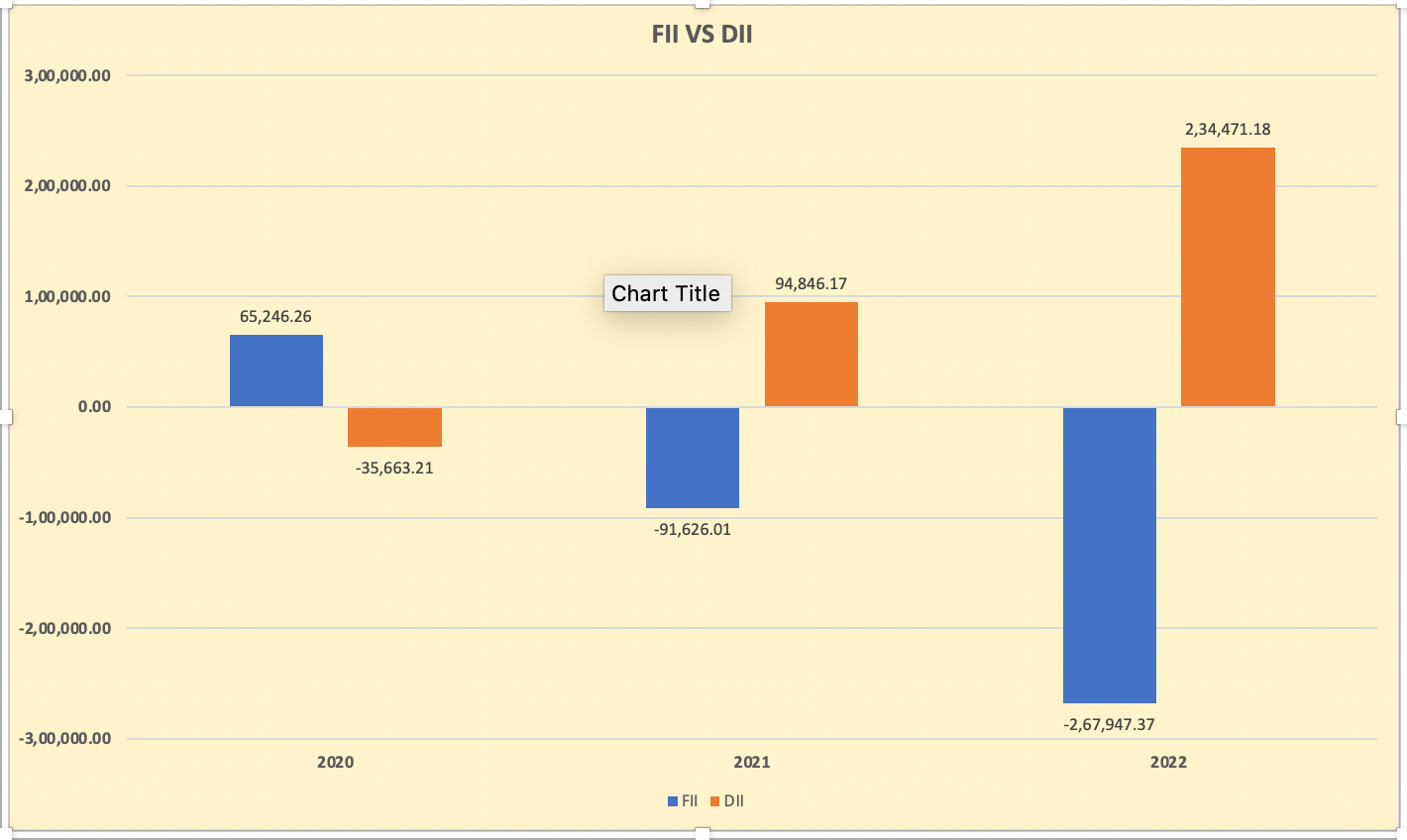

FIIs anticipated the rate hike this year, that’s why they have exited from many emerging markets, they want to cut down the allocation towards risky asset classes. Since borrowing cost would go up, it would be really hard for the FIIs to get cheap capital. Hence they started selling their holdings, this year 2022 has witnessed a major outflow from FIIs.

In the year 2020, FIIs bought 65k crores worth of stocks but in the year 2021 they sold -91k crores worth of stocks and in year 2022 so far till date FIIs have sold -267k crores worth of stocks. Five to ten years before Indian stock market was largely dependent on FIIs, if they exit we would see a huge decline in our indices but retail participation has grown tremendously over the years, DIIs were able to absorb most of the selling pressure from FIIs. And the regular monthly inflow through sip has also supported our markets to a greater extent.

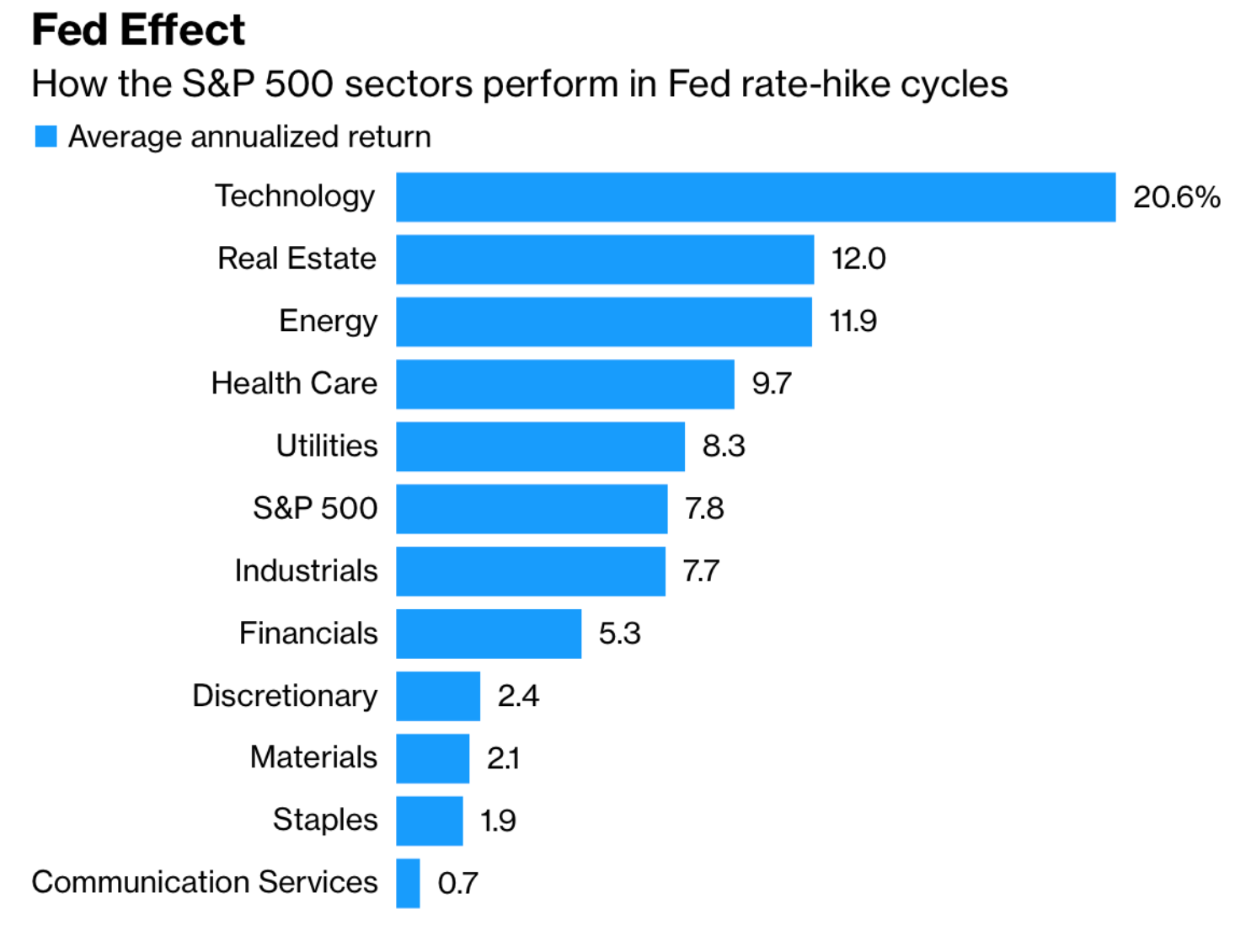

So from the above data it is evident that rate hike doesn’t cause much harm to equity markets in the long run, which sector will be least affected and which sector gains the most because of rate hike? lets check

Historically when there is a FED rate hike cycle starts, Technology stocks tends to gain the most compared to other capital intensive sectors. When there is a rate hike, borrowing cost goes up. So many capital intensive companies find it really difficult to maintain their profitablity but whereas tech companies which are mainly focused on SAAS based service and software firms generates huge cash flow which helps them to sustain such periods.

Since many tech stocks has already undergone a correction, its good time to invest in these stocks. Rate hike cycles has happened in the past and will continue to happen in the future, the volatility caused by these events would shaken up the weak hands who tend to panic and exit their investments at the wrong time, investors who stay invested and stick to their portfolio at times of such heightened volatility eventually gains the most.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.