- January 15, 2020

- admin

- 3

Its because you give utmost importance to entry and least bothered about exit. Lets see how does a typical intraday trader starts his day?

He first scans the news paper and looks for what’s hot topic currently? He sees a news like this

AGR verdict: Supreme Court to hear telcos’ review pleas in closed chamber today

Telecom companies, who are looking at a payout of Rs 92,000 crore, had sought urgent relief on the AGR verdict earlier this month

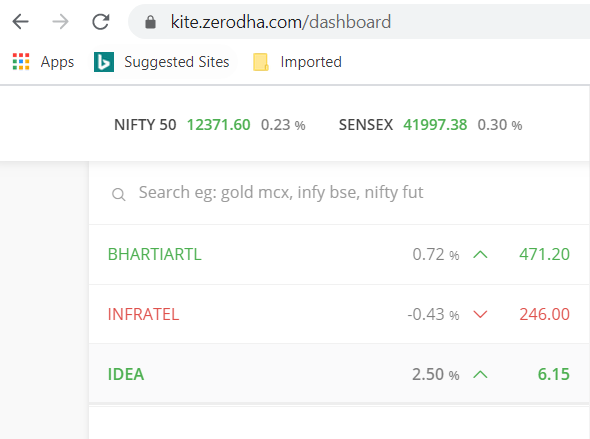

Then he decides, ok, Today its going to be the day for Telecom sector stocks. Any of these stocks can move violently, we can get in quickly when it moves and make some quick money. He then adds these stocks in watch list and keeps staring at it like an Eagle, waiting for some move.

But once the market opens, the movement that he expected in the stocks isn’t happening, the stock is moving in tight range, it neither in uptrend nor in downtrend. He wanted to get in, waited for hours, but still unsure which side stock would move.

He brings his own decision, he thinks this stock might move up more, so he buys the stocks finally.

And waits. No much movement still. Again waits. He keeps staring at the MTM screen. PnL is oscillating between + and -. He is nervous, because he bought huge quantity of Airtel stock, he is so sure that stock will definitely move up, all he thinks now is,

How much am I going to make in this trade?

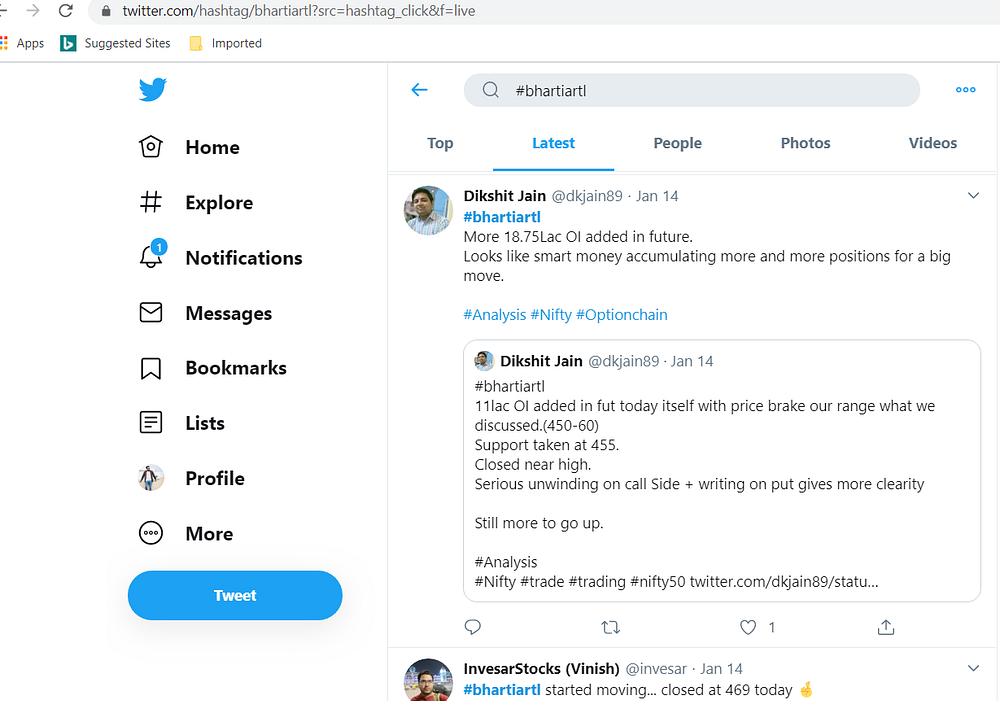

Now after waiting for sometime, he wants to confirm or get some reassurance that he is right. So he logs into social media and checks what others are talking about his stock. He searches for this stock name in twitter and he is happy that even others are also bullish on the stock, as many people tweeted that this stock will move like a rocket, OI added, volume increased, blah.blah..

Now he is even more confident, so he decides, probably he should add more positions, what could go wrong, when the entire world thinks my stock is going to move up. So he adds even much higher position and finally he is happy when sees those uptick in the chart, with each 1 rupee movement, he is making 1000s of rupees profit, in few minutes down the line, he is already made 3 months of his salary as profits in just one trade.

He is lot more confident, and thinks trading is much easier than what he taught. So pumps in more capital later and blows his account, only to realize Trading is simple but not easy. As he kept on losing in every trade.

Why did he lose?

When trading with huge position size, even a small movement opposite to his direction can wipe out not only all his profits, but it could wipe out his capital as well.

Instead of asking How much am I going to make in this trade? if he asked How much am I going to lose in this trade? he would have realized the risk in the trade, took position accordingly.

- Always be a rule based trader not a news based trader. When you are trading based on random news, your trade results will also be random in nature. Some days you make profits and many days you keep losing.

- Do not have a belief that you can make money without losing money. Imagine you run a small restaurant that sells only biriyani. Some days, it sells like hot cake, all your Biriyani gets sold out in few hours. And some days, there are still some which are unsold. What do you do? Do you feel bad that you are not able to make it sold out every day? You really accept the fact that some days there will always be left over, you accept that loss. You don’t crib, because that’s how business works. Then why you are not able to accept the loss in trading? Losses in trading is part of the business. Accept it.

- You enter into a trade in intraday, but you end up facing minor by end of the day, now you think, probably you should convert this intraday trade into positional, since you can expect profits by tomorrow if you hold. Don’t do that. If its intraday trading, it has to be closed before 3:20 PM. Just because its not making profit for you, don’t convert that into positional trading. You may end up in much higher loss.

- Remember, you are making loss because you are not following any trading system. Follow a trading system, learn about position sizing to understand how much to risk on each trade.

- Executing the trades flawlessly as per your trading plan is the only holy grail in markets. If you do not have a trading plan, create one first.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Go with a plan… Great article sir 🙂

Position sizing, exit and the right trading mindset are all important. Thanks for pointing out and reminding traders.

Good information for beginners..