- March 3, 2021

- admin

- 5

I was reading a book “Bulls, Bears and Other Beasts” which covers the last 25 years of Indian Stock Market history, major events, biggest scams and how Sensex climbed from 1000 levels to 50,000 levels now. In one of the chapters, I read about why FIIs (Foreign Institutional Investors) showed huge interest in investing Indian Stock market during the 1990’s.

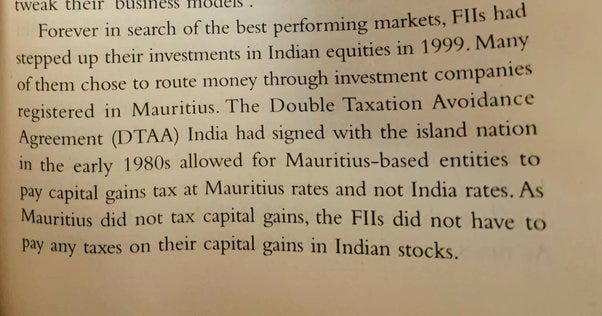

There was a term called Double Taxation Avoidance agreement, India has signed with Mauritius, which basically means FIIs who have registered their entity in Mauritius need not pay any tax on capital gains to Indian Government and they have to pay tax based on Mauritius country, but this island nation do not have any tax on capital gains. This is an attractive offer for FIIs, as they don’t need to pay any tax for the gains they make here.

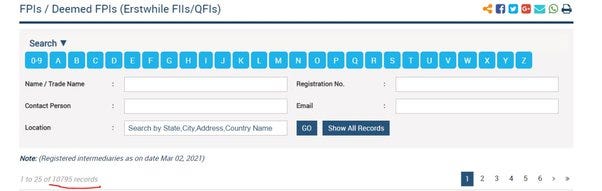

Later when I checked in SEBI website, I could see that more than 10,000 entities are registered FII that belong to different countries across the globe.

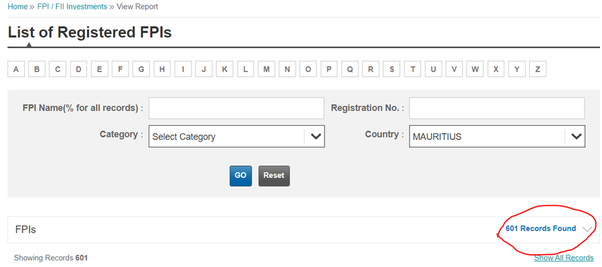

When I checked the NSDL website about the list of companies that are registered in Mauritius, there are 601 companies. Foreign Institutional investors are big fund houses with huge capital, when they make an investment in any stock that can easily gain attention among the investor community, which in turn would bring more investors interested in the specific stock where FIIs have shown interest.

Secondly, many promoters of Indian companies usually register a benami entity in Mauritius. Why? These promoters wanted to manipulate their stock price and move it higher, so that they could exit some of their holdings at a higher price. So what these promoters would do is,

- Fund these foreign institutional investors to buy their stocks in open markets

- When a FII buys a large chunk of shares from the open market, words spread and many other institutions would show interest in the same stock, and they also end up buying it.

- Eventually it appears in the media, which gains the attention of retail investors. Seeing the price moving up, more retail investors end up buying the same stock, pushing the price much higher

- Finally once FIIs/Promoters desired price target is met, they start offloading the shares and make money. Retailers would get caught by buying at a higher price.

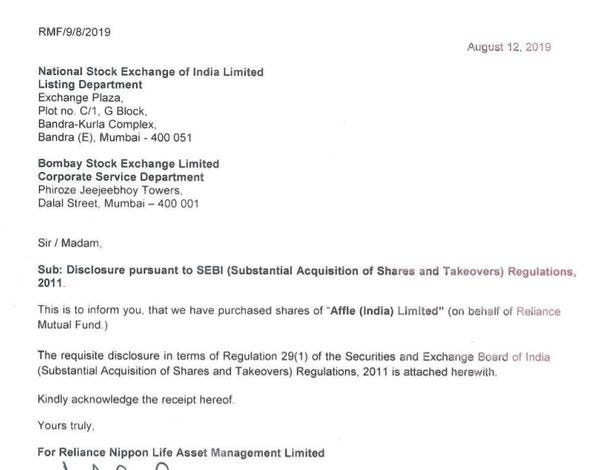

This is how most of the pump and dump happens in the stock market. How could we make use of this information to our advantage? As per SEBI regulations, if any entity acquires a large stake in the open market, they have to disclose this to the exchange. Listed below a snapshot of how the disclosures look like.

There are other established legitimate fund houses/entities also there. Both good and bad apples are there, but tracking these apples would really help an investor/trader to make better decisions.

So we decided to pull up all these 600+ Maturities entities and compare that with bulk deal, block deal and SAST29 disclosure and deals on daily basis, if any of these Mauritius entity shows up in such deals, our BOT would immediately check the following information

- Name of Entity which made the transaction.

- Type of Transaction — Buy or Sell

- Name of the Stock

- No of shares acquired/sold

- What was the change in share price on that day

Once an Investor gets this information by day end, he can act on it. Either he can piggyback the FIIs, by replicating the same transaction, for example if FIIs bought it, he too can buy the same stock and quickly exit from it when the stock moves up further. If an FII sold a stock and the investor is holding that stock in his portfolio, he can also exit from it, if he wants to follow the FII route. Keeping track of these entities’ transactions closely can definitely help us in making short term trading decisions to a greater extent.

We would publish this Mauritius FII information every day in our Telegram channel and Twitter handle automatically through our bots.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Excellent information you are providing to retail investors. Thanks Kiru

Great Feature

There are no message on twitter or telegram kiru sir???can u update from now onwards plz?

HI KIRUBA i read this book because of ur reference super best book to learn indian stock marker history

Very good