- March 1, 2021

- admin

- 8

Strategies don’t fail, its the trader who trades these trading strategies mostly fail because of one single factor called Drawdown.

Most of the trader’s worst enemy when it comes to trading is Drawdown. Why does it play a significant role in trader’s life? Most of the traders either look for ways to increase their returns or keep on looking for ways to avoid drawdowns. But in the end they end up with curve fitted system. Is it really possible to avoid drawdowns completely? Definitely not, but there are better ways to deal with the drawdowns. First let us explain what is a drawdown?

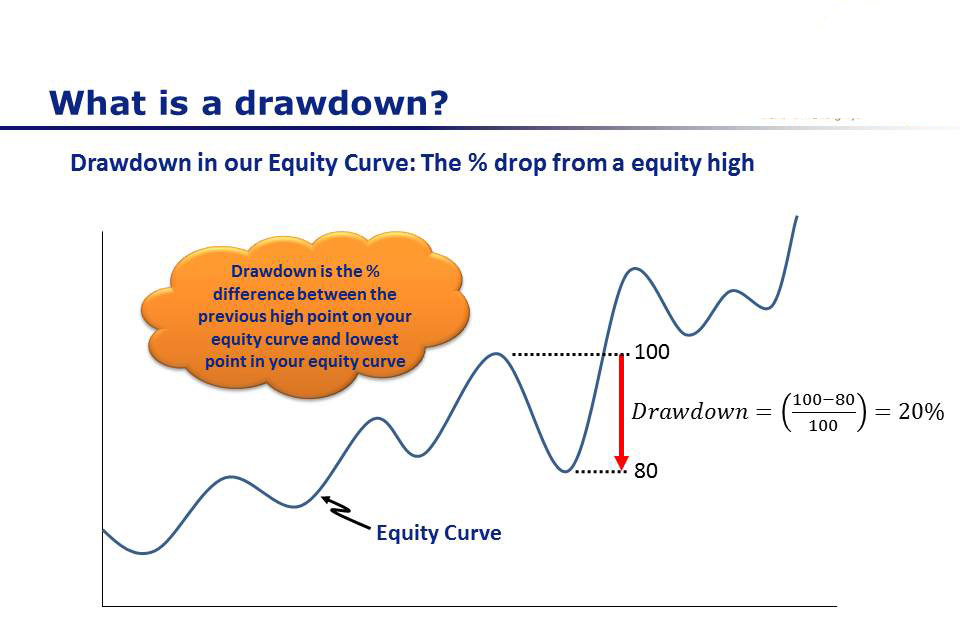

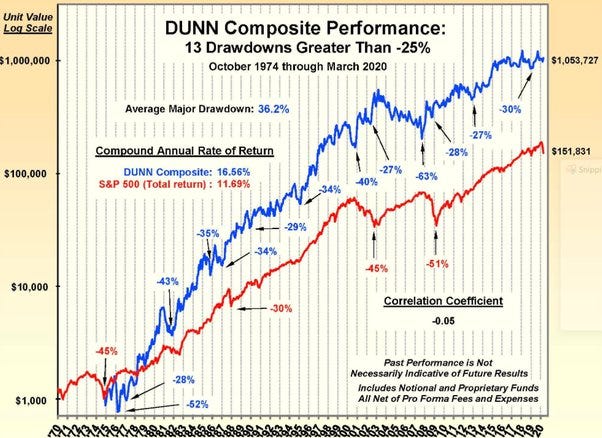

A drawdown refers to how much an investment or trading account is down from the peak before it recovers back to the peak. Consider your trading system has made 100% returns, then due to streaks of losses, if returns comes down to 80%, then your drawdown is 20%.

More than the returns of your trading system, it is the drawdown of the trading system decides the fate of the trader, because when things are not going as planned, when we face streaks of losses, suddenly we start doubting the system or start blaming the markets that things have changed. Warren Buffer once said

“Unless you can watch your stock holding decline by 50

% without becoming panic-stricken, you should not be in the

stock market.” –Warren Buffett

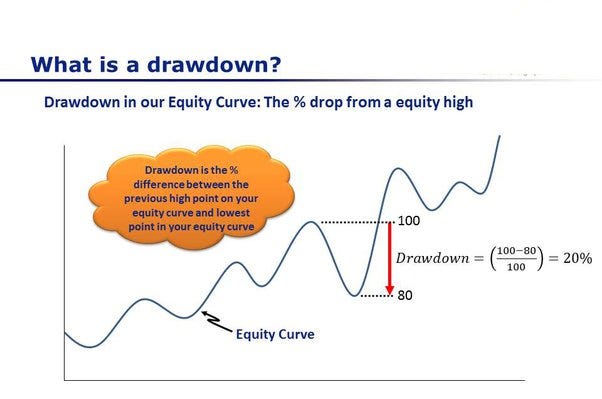

Forget 50%, when your trading system says 30% drawdown, but in real time if it hits 15%, just half of your backtest drawdown, we tend to panic, we start reanalyzing the trading system to ensure everything is correct, we start reaching out to other system experts to get their opinions, the real restless starts when hit the rough patch. But let me show you the actual equity curve of famous hedge fund manager Bill Dunn, who has been trading a trend following system with their fund since 1970’s, its most 40+ years of live trading track record.

The red line is the S&P 500 index, similar to our Nifty and the blue line denotes the equity curve of Dunn Composite, Bill’s fund. As you can see, there are years Bill made profits and there years his system went into drawdown. Even famous hedge funds who manages billions of dollars has to go through drawdowns, there were 13 drawdowns greater than -25% and every time he not only recovered from drawdowns but also his equity curve starts making new high. Despite such drawdowns, Bill Dunn out performed the index for 40 years. That’s the power of staying disciplined with your trading system.

Drawdowns are the reason traders quit:

- We tend to think that is the system stopped working? You hesitate and stop live trading and move back to paper trading just to ensure system is working fine or not.

- You might think market has changed and this could be beginning of a larger drawdown? You are unsure and stop trading the system.

- You start doubting yourself, Did I do something wrong? You pause the strategy and optimize the variables before resuming (with a new strategy)

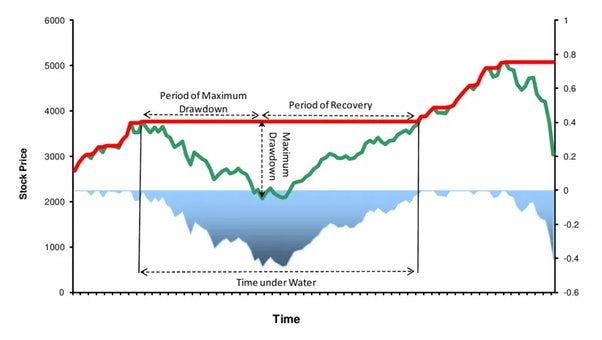

Even though we know about the drawdowns through backtest why it is really hard for a trader to sail through drawdown phase? Because when the real money is at stake, all sorts of behavioral mistakes happens. We keep asking if this drawdown is temporary or system stopped working permanently. A prolonged Drawdown damages your conviction and confidence. That’s why we should give importance to time drawdown.

You should know how long does your trading strategy stays underwater when market regime changes. For instance, in the year 2017 most of the intraday trend followers sufferd prolonged drawdown, mainly due to historical low volatility. And even with our Golden ratio trading strategy with Bank Nifty, it was underwater from Feb 2017 to Aug 2017, almost six months with zero returns. Most of the traders who followed this system stopped using it during this period, but in the year 2018 volatility started picking up and most of the intraday traders made stellar returns again.

So when you are designing a trading system, do not just look at returns only, you should check its drawdown and time drawdown. Both are essential, if the backtest says 15% drawdown, you should be ready to face 2 times of that, i.e 30% drawdown when you start trading live, also check how many instances the equity remained under water for longer duration.

Follow this ten most important rules to become a successful system trader:

- To be a long term successful trader, you should be okay being a short term loser. Learn to accept the losses.

- You cant be a winner always, instead of fighting against drawdown, make peace with it, learn to live with it.

- Always remember every trading out come is random in nature, most traders at times think “I faced three continuous winning trades, fourth can be a losing trade, hence am not taking the fourth trade” No, don’t do that. You can never be sure about the outcome of your next trade.

- Never over ride your trading system. Trading System always win in the longer run, let it do its job, do not interfere with it.

- There are traders on Twitter who always makes profit, without any drawdowns. Don’t fool yourself, its better to unfollow such handles.

- Failures/Setbacks are part of life, we are able live with it and we know only when we deal with such setbacks, we can come up in life, similarly Drawdowns are inevitable, only when you learn to handle it and deal with it, you can hit the new equity high.

- Always doubt your trading system before implementing it not after going live. If a trading system is with small or insignificant drawdowns is more likely a result of chance, randomness, or curve fitting.

- Always trade small when you start trading a system, get used to its daily fluctuations and gradually increase your stake in it.

- No matter how high the returns looks like, don’t fall for it. Always check how much risk you need to take in order to achieve that returns. If returns to drawdown ratio is very small, you can avoid it or reduce the leverage and trade it.

- Above all, always assume “Your biggest drawdown is always in the future” So risk smaller with each trade, if you want to strive in this business for long term.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Informative

If you are only refering to system based trading and direct equity investment strategies of Fund houses, then your article seems justifiable. But when referring to discretionary trading, I strongly believe that one can trade markets with zero drawdowns. But here, the annual returns will be around 1% to 2% only. It’s possible to take positions (especially on indices,say Nifty) with complete downside protection (means zero downside risk) and with manageable upside risk.

When we get risk free returns of 5% to 7% from FD, why bother about 2% returns from Nifty.

Do you provide option strategies to commodity and forex?

No

How do we measure risk taken to achieve a particular return? It is the drawdown that occurred only, right? Or do we consider the worst case scenario that could have happened?

My bad. It’s 1 to 2% monthly return. Typo error. 12 to 24% annual return.

Nice and Enlightening Thread.

Appreciate Your Efforts. Best Wishes.