- October 20, 2021

- admin

- 14

We often hear this term F&O ban, where certain list of stocks are banned by NSE exchange. During the ban period, traders wont be able to trade on futures & options segment for the list of stocks which are in ban. If you have open positions, you can exit from it but you cannot create any new positions with the stocks which are in F&O ban period.

All stocks traded in the F&O segment, the exchanges set an MWPL(Market-wide positions limits), this is the maximum number of contracts that can be open at any time(Open Interest), If the open interest of any stock crosses 95% of the MWPL(All futures and options contracts of that stock), all F&O contracts of that stock enter a ban period. The ban is reversed only if the open interest falls below 80%.

Say if a stock continuously declines, there could be more short sellers who could short this stock through futures/options segment which in turn can hammer down the stock price. But if the stock crosses the 95% position limit and goes into ban, what will happen? All traders would tend to buy back their position, since no new positions are allowed and you are only allowed to exit your position. This scenario can create buying pressure, which can move up the stock price eventually.

So to find

“What happens if we buy a stock that gets added to F&O ban list and sell that stock once it comes of F&O ban list.”

I wanted to backtest this F&O Ban trading strategy with the below rules

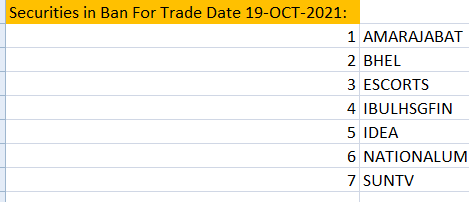

- From this link we get list of stocks that gets added to F&O Ban, changing the last date parameter gives historical data info. https://www1.nseindia.com/archives/fo/sec_ban/fo_secban_11102021.csv

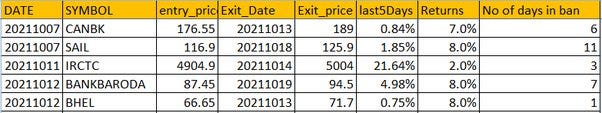

- For example: BANKBARODA was added to ban list on 12th Oct 2021, so we buy this stock next day at open price, On 13th 2021. Then we keep checking for BANKBARODA stock every day in the fno ban list. On 19th oct 2021, this stock name was removed from the ban list. So next day on 20th open price, we exit this stock.

- We need to scan for stocks in fno ban list

- Buy next day when stock gets added to ban list

- Exit the stock next day once it is removed from ban list

I ran this analysis from 2016 to 2021, that pulled up detailed info like on which date stock was added to F&O ban list and which day it was removed from Ban, when we exited from the stock, at what price we entered , what price we exited , returns we made and total number of days the stock was in ban.

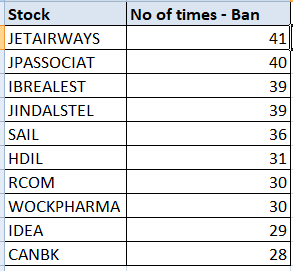

The listed below are top 10 stocks which were added to the ban list very often, Jet Airways tops the list with maximum number of FnO ban.

Maximum returns came from the below 10 stocks, Adani Power tops the list with maximum returns gained during the ban period, able to achive this returns by buying the stock in cash market when it was added to FnO ban and exited once the stock was removed from ban period.

Over all there were 974 trades in last 5 years, with total returns of -296% which signifies that overall trend is negative when the stock is locked in ban period. So I added a filter here, find the trend of the stock before it was added to the FnO ban list, was the trend positive or negative?

- If last 5 days Rate of Change for the stock is < 0, calculate the total returns, which was -312% with total no of trades 433 , with average returns per trade was -0.7%

- If last 5 days Rate of Change is > 0, calculate the total returns, which was flat 3% with total no of trades 539.

Conclusion:

The maximum number of times, the trend remains negative after the stock goes into ban. We cannot capitalize this negative trend, since we are not allowed to take any new positions in FnO segment and obviously we cannot short through cash segment as well. Taking long position in cash segment also did not yield good returns. Above results gives us the interpretation that, just trading based on FnO ban alone doesn’t give any significant trading edge.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

If one is holding banned shares then that can be sold!

Yes

Ban is applicable to creation of f&o and option . The holding can be sold in cash market on delivery basis.

Fab!

Loved the bck test result analysis

If we can short (cash market, intraday) every day until the ban release then returns will be good.

Let me know your thoughts

Yes, good idea

Great research buddy!

Nice analysis

Enjoyed reading it through.

Nice Analysis. Good that you explained it with an example . . .

Any observation on stock price, during the ban. Does it always decrease everyday during the ban? Or any other pattern?

Did u check other stocks which are beta related to these stocks ?

Naah, It does not cover all aspects.. Cash market goes down also and Premium goes down also , when a stock is put in ban list.. It is not always the case that , cash market price will go up and eventually the premium.. When cash market is operated by option call sellers too.. They can drag the cash market down by not buying at all and Infact doing short selling Which creates panic in option market too and sellers in the option market buy their position back for square off by offering much lower premium to the option buyers….