- September 10, 2019

- admin

- 2

How about a trading system that gives you just two or three trades in a year, but ends up giving phenomenal returns. This is one such trading strategy with plain simple rules, even a 10th Grade student can follow it.

As we know that Market gets into trending phase 30% of the time and stay in range bound rest of the time. If we are able to design a trading strategy which could capture most of the trending moves and keep as away during side way movements, then we can be assured that most of the year we could stay profitable.

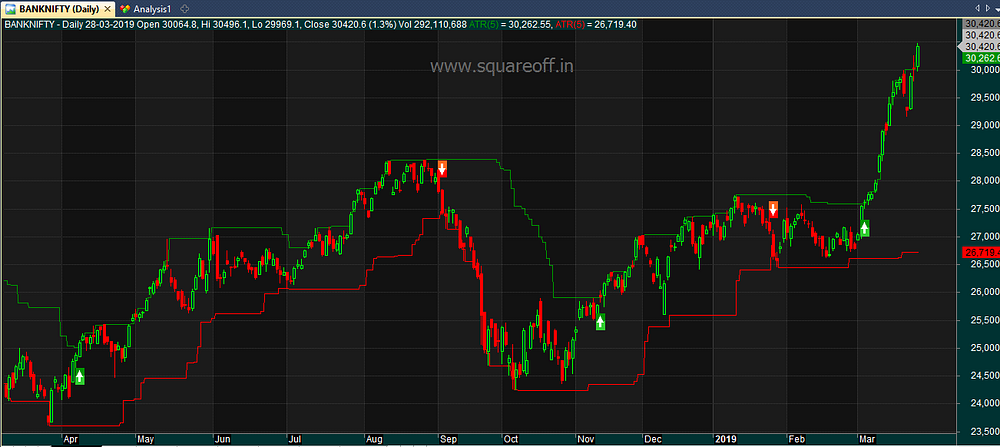

Here’s the rules of the game:

Buy when the stock closes above last 20 days high price

buy=c>Ref(HHV(H,20),-1)

Sell when the stock goes below last 20 days low price.

sell=c<L1=Ref(LLV(L,20),-1)

Its almost similar to the famous Turtle Trading Strategy. Traders can add more condition to it to reduce the over all drawdown, however even with such plain rules, the strategy has given best returns.

As markets always go higher in the longer run, most of the positional trading system would do well if we stick to trade only the Long and ignore the short. If you are following a positional strategy, you can check your strategy results, am sure, the profits from Long trades will be always higher than the Short trades. And some times, even the trades from Short would have resulted in loss.

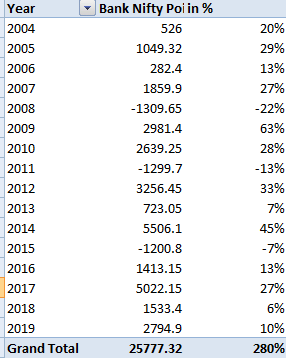

The strategy has given more than 25000 Bank nifty points when tested with historical data. The bull year like 2017 was phenomenon, where it returned 5000 points.

Here’s the link to download historical backtest report of Nifty and Bank Nifty, along with the AFL.

https://drive.google.com/file/d/1TXaxz-2CuATp0ZLTYhmFXGs717tSu_lh/view?usp=sharing

Follow our Telegram channel for more information related to Trading Systems.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Do we have backtest or forward test result of 2020 and 2021 also ?

Hello… I plotted this on Chartink and started looking at the data for this month so understand the capital requirement…. by taking each and every order that came in this alert for the first 10-15 days and arriving the quantity by taking maximum SL as 2500 Inr, the capital utilised is already 7L+++… with not much decent returns…. how can this be streamlined further ?