- August 13, 2020

- admin

- 0

Fundamental analysis of Eicher Motors Limited (EML)

Business segments

(1) Royal Enfield

Eicher Motors Limited (EML) is the owner of the iconic Royal Enfield brand.

Royal Enfield is the World’s oldest motorcycle brand in continuous production since 1901 and it is mainly focused on mid-size motorcycles (250 cc-750 cc). Their products are sold in India and 50 countries globally through exclusive stores and dealers.

Royal Enfield with its motorcycle combines modern-day elements with the brand’s heritage, garners immense enthusiasm amongst global motorcyclists.

Portfolio

Motorcycles — Bullet, Classic, Thunderbird, Himalayan, Interceptor 650, Continental GT 650

(2) VE (Volvo group and Eicher motors) commercial Vehicles

VE Commercial Vehicles (VECV) designs, manufactures and markets reliable, fuel-efficient trucks and buses. EML’s joint venture VE Commercial Vehicles (VECV) with Sweden’s AB Volvo has pioneered the modernization of commercial vehicles in India and other developing countries.

Portfolio

Eicher branded 3.5–4.9 tonnes, Light Medium Duty Trucks (5–15 tonnes), Heavy Duty Trucks (16- 49 tonnes) and buses, Volvo trucks

Competitive strength

- Eicher Motors is known for its cult motorcycle brand — Royal Enfield Bullet. Royal Enfield is the global brand in the mid-sized motorcycle segment

- Eicher Motors Limited (EML) occupies 95% share in the mid-size motorcycle segment and 29.4% market share in domestic Light to Medium Duty (LMD) segment

- Eicher Motors has low debt and zero promoter pledge

- Eicher Motors has 915 exclusive stores in India

- There are 42 exclusive Royal Enfield stores across UK, Colombia, USA, Mexico, UAE, France, Spain, Indonesia, Thailand, Philippines, Australia, New Zealand, Portugal, Malaysia, Brazil, Vietnam, and Argentina

- The company has an effective low-cost supply chain and distribution

Weakness

- The company faces domestic competition from its top competitors Bajaj Auto, Hero Motocorp, Jawa motorcycles, Ashok Leyland and Mahindra & Mahindra

- The company is also facing competition from new international entrants like Harley Davidson, Benelli

- There is a major fall in Trailing Twelve Months (TTM) profit due to economic slowdown and pandemic

Management

Eicher Motors Limited (EML) has seen robust management over the decades. Mr. Siddhartha Lal is the Managing Director of Eicher Motors. He also has been the Chief Executive Officer (CEO) of Royal Enfield and the chairman of VE commercial vehicles, a joint venture between Volvo Group and Eicher Motors. He was the one who helped revive the company’s fortune and strengthened stakeholders’ interest and involvement with the brand.

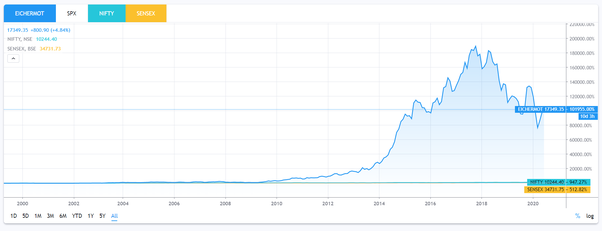

Share price levels of Eicher Motors

Screenshot source: “Trading view”

From the above graph, we can see that the stock has outperformed both the indices (Sensex and Nifty) since the company has been listed in NSE and BSE.

Lifetime high of Eicher Motors: Rs. 32617

52 week high of Eicher Motors: Rs. 23450

52 week low of Eicher Motors: Rs. 12450

Market capitalization: Rs. 56473 crores

Currently, Eicher Motors is trading at 21500 levels.

However, in the last three years, Eicher motors have been in the downtrend. Eicher Motors was trading at Rs.12000 on April 3, 2020. From that level, it is showing strength now.

Reasons for the fall in share price in the last three years

- Poor quarterly results in 2019

- New competition from Jawa motorcycles

- Fall in demand led down by a slowdown in the economy

- Not only Eicher motors, but the whole automobile sector have also been in a downtrend over the last few years

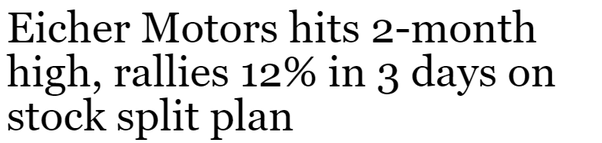

Recent news

screenshot source: “Business standard”

The company announced and approved a stock split plan to increase liquidity and to make the shares more affordable to retail investors. Eicher motors board approved 10 for 1 stock split. The company will split each share of Rs. 10 into 10 equity shares of the face value of Rs. 1 each.

What is a stock split?

When a company announces a stock split, the number of outstanding shares of the company increases but the market capitalization remains constant.

Shareholding pattern of Eicher Motors

Now let us look into the numbers of Eicher Motors based on four aspects namely growth, cash flow, liquidity, and profitability

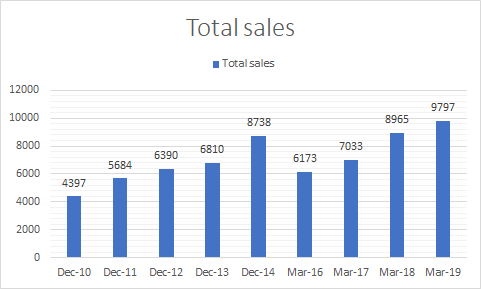

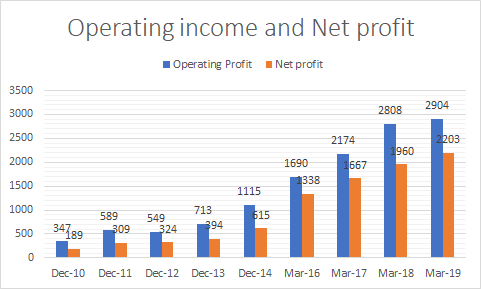

Growth

Inferences

- Total sales of the company have seen a continuous increase of 8.34% CAGR in the last 10 years

- Operating income has increased by 23% CAGR in the last 10 years

- Net profit has increased by 27.8% CAGR in the last 10 years

Eicher Motors had excellent growth history

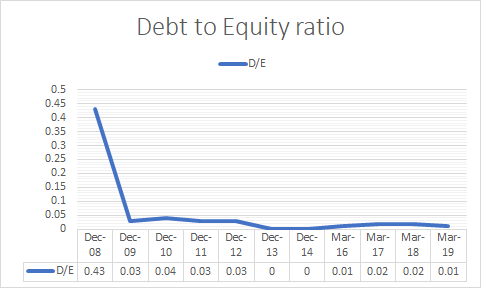

Liquidity

Eicher Motors is virtually a debt-free company

The debt to equity of the company was at 0.43 in 2008 and the current debt to equity ratio of the company is just 0.01. It shows us that the company has significantly reduced its debt level and it is financed by equity capital alone

The current ratio of the company is 3.15 which shows that the company has sufficient current assets to meet the short term obligations

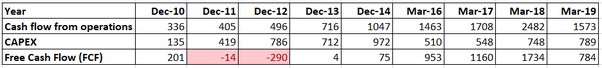

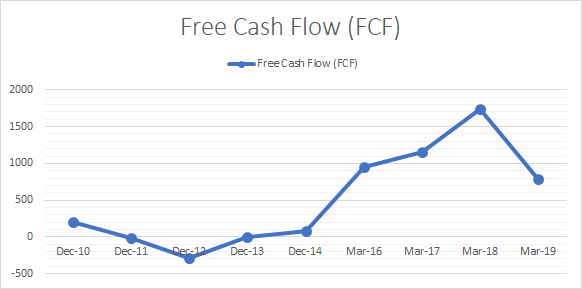

Cash flow

The company has been maintaining positive cash flows over the last 10 years (except 2011 and 2012).

Having a positive cash flow is a big plus for the company

Thus, Eicher motors had a strong cash flow

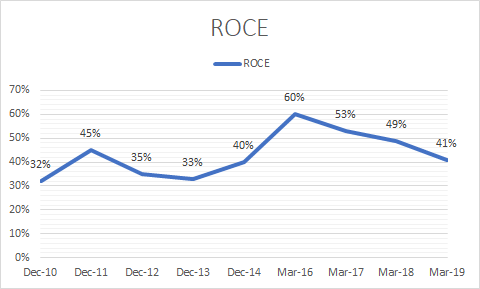

Profitability

The current Return on Equity (ROE) and Return On Capital Employed (ROCE) of the company is 27.63% and 40.59% respectively.

Also, the company has been maintaining a solid ROCE% of more than 30 over the last 10 years.

Thus, Eicher motors have been profitable for shareholders.

Price valuation

The current P/E ratio of the company is 25.2 which is below its all-time median level of 26.4, 5-year median level of 41.3, 3-year median level of 29.3

This shows that the company is trading at undervalued levels now

Overall, Eicher motors look like an undervalued company with strong fundamentals. Once the company begins its full operations, we can see an increase in sales and profit of the company and it is safe to buy and add Eicher motors at every dip If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Author