- August 10, 2020

- admin

- 2

Fevicol ! Fevistik ! Fevikwik !

I hope one would have heard and used all these products multiple times. It is very difficult for a person to say if asked about the competitors or alternatives for all the above-mentioned products. This is the brand equity of Pidilite industries.

Everything great starts small and Pidilite is no exception. In 1953, the company was started in Mumbai with only one factory that produced only one product, Fevicol. In 1990, the name Pidilite Industries was incorporated thus making the first step towards brand recognition. Pidilite became an adhesive monopoly and has reinvested the capital from that to also become a monopoly in India’s waterproofing business also.

Pidilite is loved for its iconic advertising, marketing and superior quality.

Products of Pidilite Industries

Few of the top brands of Pidilite are

Fevicol, Fevistik, Fevikwik, Fevicryl, Fevigum, Terminator, M-seal, Dr.Fixit, Hobby ideas

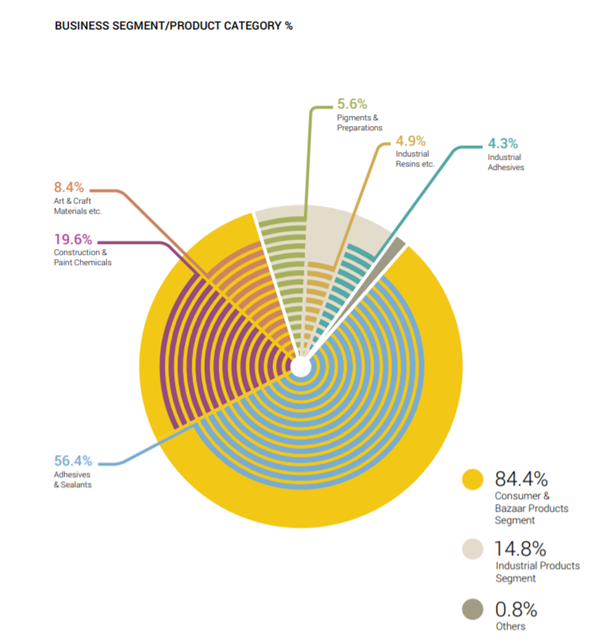

Pidilite Industries top portfolio consists of

- 56.4% — Adhesives and sealants

- 19.6% — Construction and paint chemicals

- 8.4% — Art and craft materials

Competitive strength

- Pidilite is very strong in marketing and advertising. Almost all of its advertisements are massive and viral hit

- Pidilite has presence in 71 countries across the World

- The Company is rich in networks and has an extensive channel of distribution across the country which helps it reach out to customers aggressively

- Strong Research and Development centers across the globe

- Loyal customers — Fevicol has become synonyms with adhesives

- Various products of Pidilite have only very less competition and this will definitely help in boasting the growth of companies

Weakness

- Pidilite is over dependent on M-seal and Fevicol for revenue generation which results in reduced investments on other products and brands

- Pidilite industries is a cyclical stock and is largely dependent on real estate sector and crude oil prices

- Company faces competition from its top competitors (BASF, Arrow Magnolia, MAESTRIA, Tata chemicals)

Management

Pidilite has seen robust management over the decades. Mr. Madhukar B. Parekh is the chairman and his journey with Pidilite was commenced in 1972. He converted an unexciting product into one of the country’s famous and top brand product — Fevicol. He was the one who steered the company to become market leader in adhesives and sealants segment in India. Mr. Bharat Puri is the Chief Executive Officer and he joined Pidilite in 2015.

Auditor: Deloitte Haskins and Sells

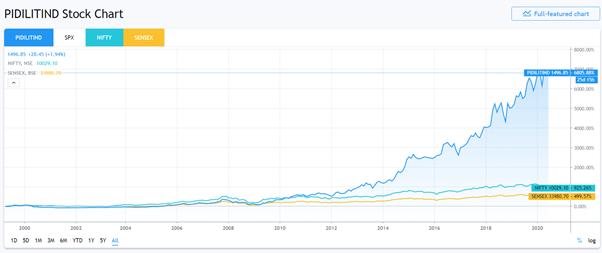

Share Price levels of Pidilite Industries

Pidilite has been in uptrend since it is listed. Th below chart shows the comparison of Pidilite stock return and NSE & BSE indices.

Source: “Tradingview”

From the above graph, we can see that Pidilite has outperformed both indices return.

Currently, Pidilite is trading at 1400 levels.

52 weeks High: Rupees 1,709.90

52 weeks low: Rupees 1,168.10

Market cap: Rupees 76,046 crores

Now, let us look into the financials of the company based on four aspects namely growth, liquidity, cash flow and profitability

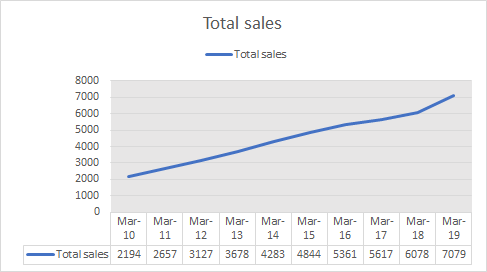

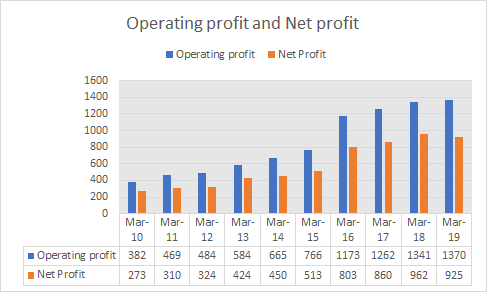

Growth

- Total sales of the company have seen a continuous increase of around 14% CAGR over last 10 years

- Operating profit has increased by around 15% CAGR over the last 10 years

- Net profit of the company has increased by 14.52% CAGR over the last 10 years

Pidilite Industries had a good growth history!

Liquidity

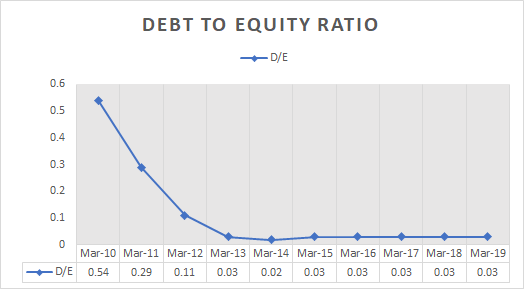

- The debt to equity ratio of the company was at 0.54 in 2010 and now the company’s debt to equity ratio is just 0.03 which tells us that the company id mostly financed by equity capital

- Pidilite Industries is virtually a debt free company

- The current ratio of the company is 2.55 which shows that the current assets are sufficient enough to meet the short term obligations of the company

Cash flow

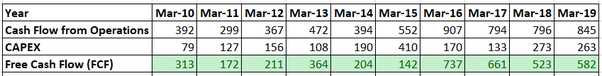

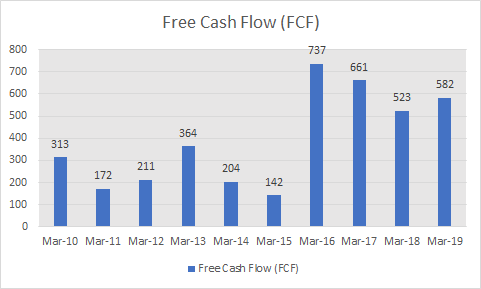

Eventhough Pidilite Industries have been investing in various segments to diversify their business, they are maintaining positive cash flows over the years

Thus, Cash flow of Pidilite Industries is strong!

Profitability

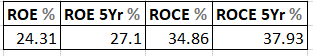

Profitability of a company is measured by two ratios

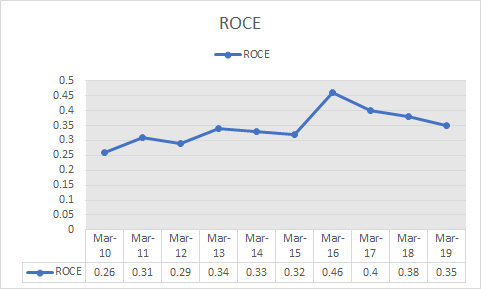

(1) Return on Equity

(2) Return on Capital Employed

Company has good ROE and ROCE record. Currently, ROCE of the company is 35%

So, Pidilite Industries have been profitable for shareholders!

Price valuation

- The Price to Earnings of the industry is 9.22 and Pidilite is trading well above the industry average. The 5 years P/E of pidilite is 41.69

- Stock is trading at 17.5 times its book value

- The current P/E of the stock is 61 which is greater than its median level 42.4. This shows that Pidilite is trading at overvalued levels. Since, the share is trading at overvalued values, it is suggested to invest in Pidilite only at dip

So, overall Pidilite is a financially and fundamentally strong stock for long term investments with good economic moat around it. If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Author

simple article, easy to read and understand,

Very simple & easy to understand even for a lay man very well presented