- January 18, 2022

- admin

- 4

Someone in twitter recommended this book a month ago, I checked Amazon reviews and found that many people find it interesting as this book covers great wisdom from some of the legendary investors in the world like Sir John Templeton to Charlie Munger, Jack Bogle to Ed Thorp, Will Danoff to Mohnish Pabrai, Bill Miller to Laura Geritz, Joel Greenblatt to Howard Marks. The best investors can teach us not only how to become rich, but how to improve the way we think, reach decisions, assess risk, avoid costly errors, build resilience, and turn uncertainty to our advantage.

I really loved this book, instead of making it as simple Q n A book like Market Wizards, it covered many aspects from each of the investors. I firmly believe that being disciplined with your trading/investing is utmost important to become successful and the same has been emphasized by all these legendary traders throughout this book, but remember discipline doesn’t simply come between 9am to 3pm during market hours, its how you behave outside the market hours determines how disciplined you are going to be during market hours. Richer, Wiser and Happier would definitely teach you lot of insights about markets, how these investors made it big without any big background.

Let me quote some of profound thoughts shared by few investors in this book which i find really interesting.

You get a lot of A’s and B’s in school. In stock market, you get a lot of F’s. You will be proven wrong tons of times, but people don’t want to be wrong, that’s why so many investors really find it hard to make money in markets. Being right is not the key to success.

We know that stock market is all about probabilities, we really need to figure out the odds in order to win big. Peter Lynch once said

“Learning to play poker or learning to play bridge, anything that reaches you to play probabilities would be better than all the books on the stock market”

Ed Thorp, famous mathematician who cracked wall street much earlier through his quantitative approach shared his journey in this book. He mentioned

Just because a lot of people say something is true, that doesn’t carry any particular weight with me. You need to do some independent thinking, trust but verify.

This is really true, during my initial days when I started trading I blindly believe what experts say, if they say something is working i would directly jump in trade it only to suffer loss later, then i started digging more into data analysis and tested every logic myself. Then onward, I would only believe such things if its backed by data.

Mohnish Pabrai is also one the investor who was interviewed in this book, he has high regard for Warren Buffett and admits that his investment style is copied from Buffett. But it all started randomly one day when he first read the book One Up On Wall Street by Peter Lynch. In this chapter, Pabrai shared lot of insights on value investing and why he firmly believes in Warren Buffett investing philosophy. He was able to successfully replicate Buffett’s investing principle in markets and able to make a fortune.

No Wonder why Warren Buffett is considered to be most successful investor of all time, the below incident is one tiny example of how Warren Buffett handles investments.

Staying in cash when everyone is buying, when everyone is selling then that’s the time to deploy all those cash.

These days people are crazy about IPO, there was a mad rush from retail investors to apply for every single IPO last year until Paytm debacle happened. Many are completely new to markets who wanted to make quick returns through listing gains. Here’s a great wisdom shared by Templeton on how he handled IPOs during dot com bubble.

Howard Marks is another legendary investors covered in this book, I really loved his book “The Most Important Thing: Uncommon Sense for The Thoughtful Investor” He explained why predicting doesn’t work in stock market. Why many so called experts waste their time in predicting the outcome every year?

“You can’t know the future but it helps to know the past. We have to recognize the market for what is, accept it, and act accordingly”

Great performance comes from holding not from buying/selling often. – Howard Marks

I came across a investor who is 109 years old called Irving Kahn. This is the first time am hearing about this name, but what he has shared in his chapter is pure wisdom. In his long investing career, he has witnessed lot of setbacks in markets like great depression, Black Monday crash of 1987, Dot-com bubble of 1999, Financial crisis of 2008 etc. Nobody in the investing world has survived so many crashes. Irving Kahn closely worked with value investor pioneer Benjamin Graham. When asked what the most important thing he learned, he said

“Investing is about preserving more than anything. That must be your first thought,not looking for large gains. If you achieve only reasonable returns and suffer minimal losses, you will become a wealthy man.”

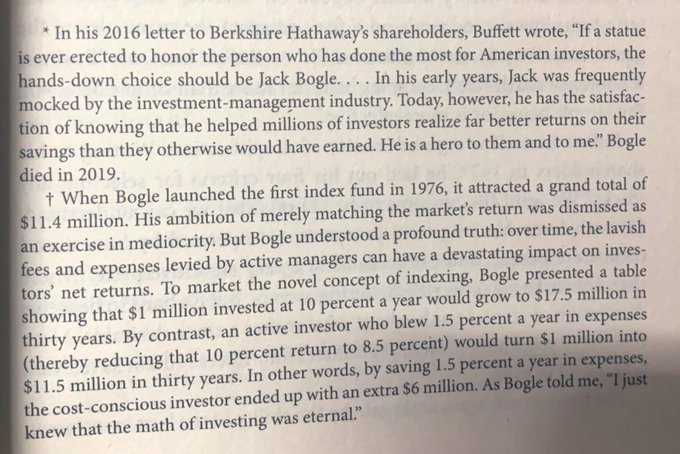

When it comes to Investing, many legendary investors made a fortune for themselves. But there is one man out there who avoided becoming billionaire by avoiding any high management fee so that his investors can become millionaire. Jack Bogle founder Vangaurd, if you and me talk about Index funds often its only possible because of this one man. Buffett, long an admirer of Bogle because of their shared interest in sensible long-term investing, wrote this about Bogle in his annual letter to shareholders in 2016:

“If a statue is ever erected to honor the person who has done the most for American investors, the hands down choice should be Jack Bogle.”

When Jack Bogle launched the first index fund in 1976, not many believed him. Nobody wanted average returns, everyone wanted outsized returns, only it started with $11.4 million AUM later people realized the importance of Index fund, now total AUM under Vanguard is more than $7 trillion that’s more than the GDP of France, UK and India together.

“Buying funds based purely on their past performance is one of the stupidest things an investor can do.”

Joel Greenblatt is another investor covered in this book. Greenblatt’s book The Little Book that Beats the Market introduced the investment strategy of “magic formula investing”, a method for determining which stocks to buy: “cheap and good companies” with a high earnings yield and a high return on invested capital. He shared many important insights about rule based investing approach, why average investor doesn’t do well in markets, why mixing discretionary with rule based approach will give disaster results and why we should avoid the news, he stats news is noise. This four simple lessons from Greenblatt makes a lot of sense

No strategy works all the time. There will always be period of under performance. Many traders get this doubt when their strategy is out of sync with the markets for a while. We tend to doubt our strategy if it stopped working. When Investing is simple everyone would have become millionaire. What separates the successful from unsuccessful is “How one reacts during the under performance period”

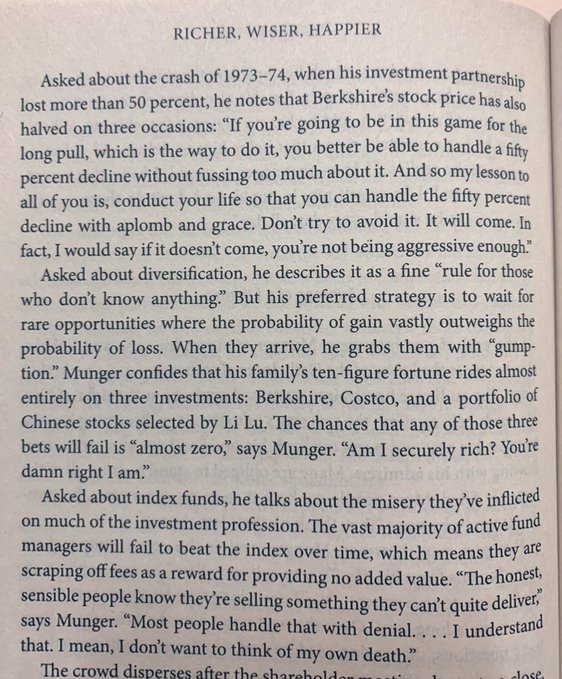

The last two chapters covers Charlie Munger and Van Den Berg. The author William Green was able to get appointment to meet Charlie only for few minutes, but what we captured in that few minutes from legendary investor Charlie Munger is out standing. Even Charlie emphazied about importance of index funds and why its really important to withstand the large downsides that happens in the market once in a while. If you truly want to get the outsized returns in the long run, then we should be ready to witness our portfolio going down 50% in the short run.

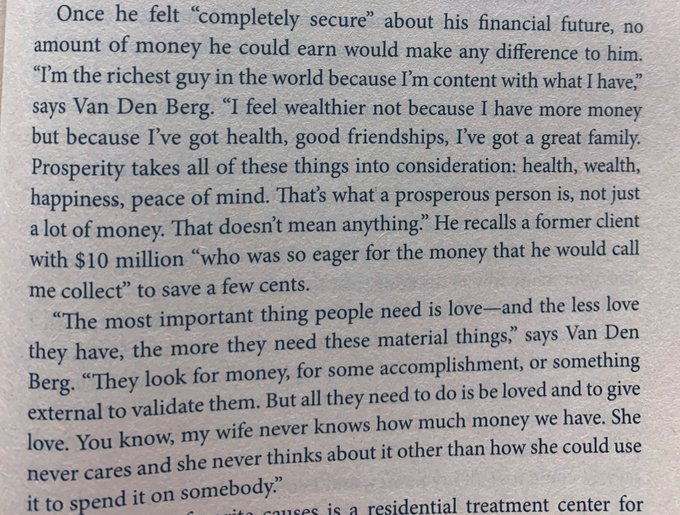

Finally the book ends with a chapter on investor named Van Den Berg. This was the first time am hearing this name, initially started reading his chapter without much expectations but by the I finished reading about him, it was amazing, truly inspirational. Of all the investors out there, Van Den Berg simply tops the list not because of he achieved out standing or consistent returns, its mainly because of what he has gone through at his early age. And how he fought back with poverty and the wisdom he shared about markets, life in general is truly mesmerizing.

Overall Richer, Wiser, Happier is definitely a no nonsense book. Doesn’t beat around the bush, with just few hundred spent the wisdom you gain from this book is enormous. Highly recommended.

Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Super sir

Thanks for refer

Thanks sir

superb snapshot of the book and a real eyeopener for us