- April 20, 2023

- admin

- 8

People say when they trade manually its hard to control their emotions, that’s why they started algo trading. But Algo Trading removes emotions is a myth, there’s no way we can avoid emotions in trading but there’s some ways you can control it which can improve your over all trading performance.

Each Trade is unique:

We always regret about the past or worry about our future. That’s human nature. We hardly live in the present, but when it comes to trading, we live way too much in the present, We worry too much about the present trade. How this trade is going to end? Will it end up in profits? Will it help me recover all my past losses? Will this trade blow up my capital?

You really don’t need to worry too much about an existing trade. Focus on the bigger picture, law of large number always kicks in when it comes to trading. The outcome of the current trade is no way going to affect your next trade.

What will happen tomorrow?

Say you are going for a walk in the park, If a person comes to you and say what’s going to happen in your life tomorrow exactly at 10 am with precise details about the event, will you believe in it? 99% chance that you would ignore him because you know very well that no one predict what’s going to happen to you tomorrow, or next month or even for years to come.

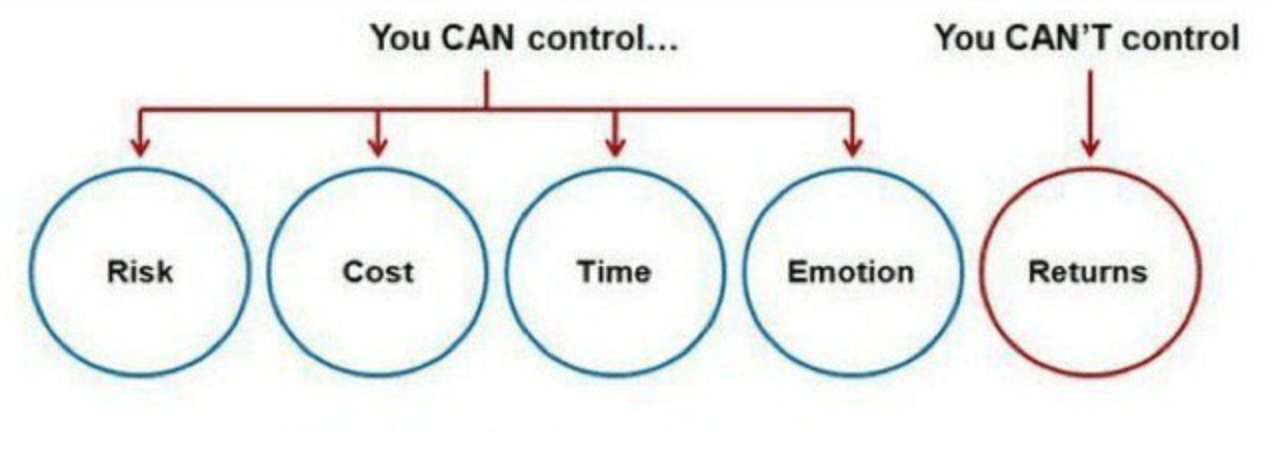

But then why do we believe the so called experts who says whats going to happen with the markets tomorrow? We can only react to market movements, place the trades based on whats currently happening. We cant take trades based on prediction of whats going to happen tomorrow. You can only control whats you can control.

When you cant control the trading outcome, why to worry about it? There used to be days, where after taking an overnight put options, i keep checking whats happening in the world. I wake up in the night to see where US market closed, then after waking up in the morning i use to check how Japan, Shangai, China and SGX Nifty are trading and then eagerly will wait for our markets to open.

Once the positions is taken, there is no control in our hands. Despite that we keep checking what’s happening around the world, main reason for that is too much money is at stake. We did not realize how much is too much and trading with higher lot size. I always say the correction position sizing rule is very simple. Trade with the no of lots which lets you sleep comfortably without worrying too much about whats going to happen over night.

Ego:

Right & Wrong, Success & Failure, A grade and F grade, all these are wired in our minds since childhood. When we get A grade in school we tend to think we are the smartest and when we get F, we tend to think we are a loser. We relate our success & failures to what we are capable of. But if you trade with the same mindset we are screwed.

A winning trade doesn’t mean am smarter than the rest

A losing trade doesn’t mean am dumber than the rest

In general in life, we don’t want to wrong. Being wrong makes you a loser as per soceity. But trading is the only profession where you can make money being wrong. Only when we are ready to take losses, we will be able to make profits.

Watching your MTM:

Once the trade is placed, all stop loss orders and target orders are there, does watching your MTM screen going to help anyway in increasing your profits? No way. But still we are addicted to watch our MTM every now and then. Be it manual trading or automated trading, we keep staring our screens. Sometimes people monitor their order book to ensure there are no execution errors, that’s fine but still that can also be automated.

Watching your MTM screen will convince you to book your exits early. Somehow market will convince you that if you don’t close the position now, it will end up in loss. Due to fear of losing your profits, you tend to exit early most of the time. Watching MTM does more harm.

Pull backs:

If you are running a trend following/breakout system, then you would have noticed multiple times market reversing back from the peak and hititng your trailing stop loss and then again reverse from there and resumes it up move. With such system if you keep a very close trailing stop loss definitely it will kick you out much earlier, we always want to protect our profits, we dont want make the unrealized profits into realised loss, so to lock the profits we tend to come out early if we use such TSL method in trend following/ breakout system.

Recency Bias:

Don’t bring the emotions from one trade to another. Say you were trading a market neutral option selling system last expiry, suddenly after 2:30 pm market moved one side, because of that your profitable position turned into a loss. The whole week you tend to think about it. When you trade next expiry, you tend to expect the same behaviour from market, so before 2:30 pm you will close your positions. But that day market would have reacted normal and if you had held onto the positions as per system you would have made much more profits. Because of the recency bias, because of the pain you have gone through recently, your subconscious mind wants to save you from that pain again, so you exited the trade early. As mentioned earlier, each trades are independent.

Dont let your previous trading outcome dicdate what you should do with your next trade.

Pain decides your Plan:

Trading is all about handling the pain. Why do some traders let their losses run? Why do they cut short their profits, but they wait for their losing trades to turn profitable?

“People will do more to avoid pain than they will do to gain”

By nature, Humans wants to avoid pain at any cost. So in trading they are reluctant to book the loss, because once the trade is closed, it becomes a realised loss, and it causes pain. They want to avoid pain as long as they can. Basically they just keep postponing the pain by not taking that loss.

And this is also the same reason where amateurs are quick book profits. Because they dont want to turn the profitable trades into a losing trade. They want to avoid pain.

When you are on winning streak, you tend to reduce your risk. People tend to assume this winning streak wont last long, so they don’t want to lose more. And again that causes pain, so avoid that pain they reduce their risk.

Similary when you are on a losing streak, you tend to increase your risk. Why? Because you are already suffering from pain of losing. You want to get rid of this pain, so by increasing your risk you are planning to recover all your loss in one trade, but again this will end up in disaster.

My target is hit for the day, am done for the day. You might have seen many traders winding up for the day, the moment they see a small profits. Even though they say they are done for the trade, they will continue to watch the markets. But they wont place the trades, because of the fear that they might lose what they earned. So to avoid the pain of losing what they earned, they stop trading and just watch market after their target is hit.

So as a trader most of our decisions are solely based on our own emotions. We dont need to learn more about markets, instead if we learn more about ourself we tend to do well. The one who controls the emotions becomes a disicplined trader and eventually becomes a successful trader.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Thank You Kirubhai for sharing such words on Psychology.

There is lot to learn from this guy….

Quite interesting, but only facts have been discussed rather solution has not been shared . . . So it’s a normal topic

Bahot Badhiya..!! 🙂

So as a trader most of our decisions are solely based on our own emotions. We dont need to learn more about markets, instead if we learn more about ourself we tend to do well. The one who controls the emotions becomes a disicplined trader and eventually becomes a successful trader.

Great Information, Trading is all about handling the pain, its life. so Trade simply offering you complete Algo Mechanism with our Robo-Tech Algo trading platform.

On our system we have tried to solve complex part of technical analysis, by offering very simplified indicators and tools for price analysis and best part about our indicators are its predefined on our system so you do not have to bother for making diverse selection every time. Our set of indicators gives you opportunity to analyse different market types on a click of a button be it short/ medium- or long-term trends. On our system you stay focused with managing your trades and we take care of technical analysis, and you stay away from tech jargon in live market.

Thank you this blog post, it cleary mentiones how algo,trading help the traders and overcome the psychological challenges.

Thank you this blog post, it cleary mentiones how algo trading help the traders and overcome the psychological challenges.