- April 11, 2023

- admin

- 3

In the last three weeks, I have attended three different option conventions back to back meeting 100s of option sellers. I was astonished with the number of option sellers and the kind of money people manage with option selling systems. Whoever I met, they are into option selling. And most of them started in the last two years. I was like

It’s really huge, on one hand, I was really happy for people who are able to manage 100s of crores and also able to make consistent returns. But on the other hand, it made me really anxious. What happens if something goes wrong, will it create systematic risk, any chance of black swan event that could wipe us out? I started researching more on this topic once I came to my place.

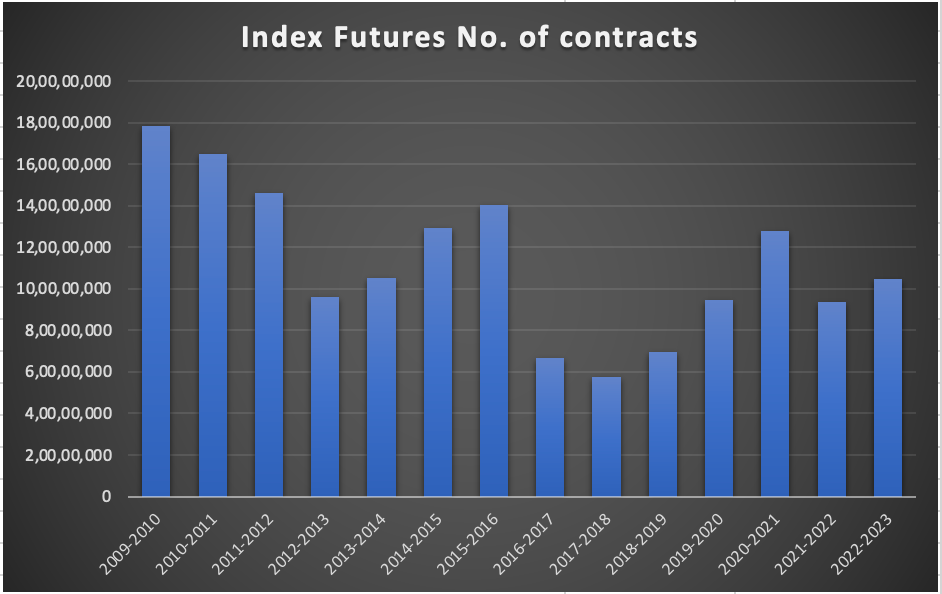

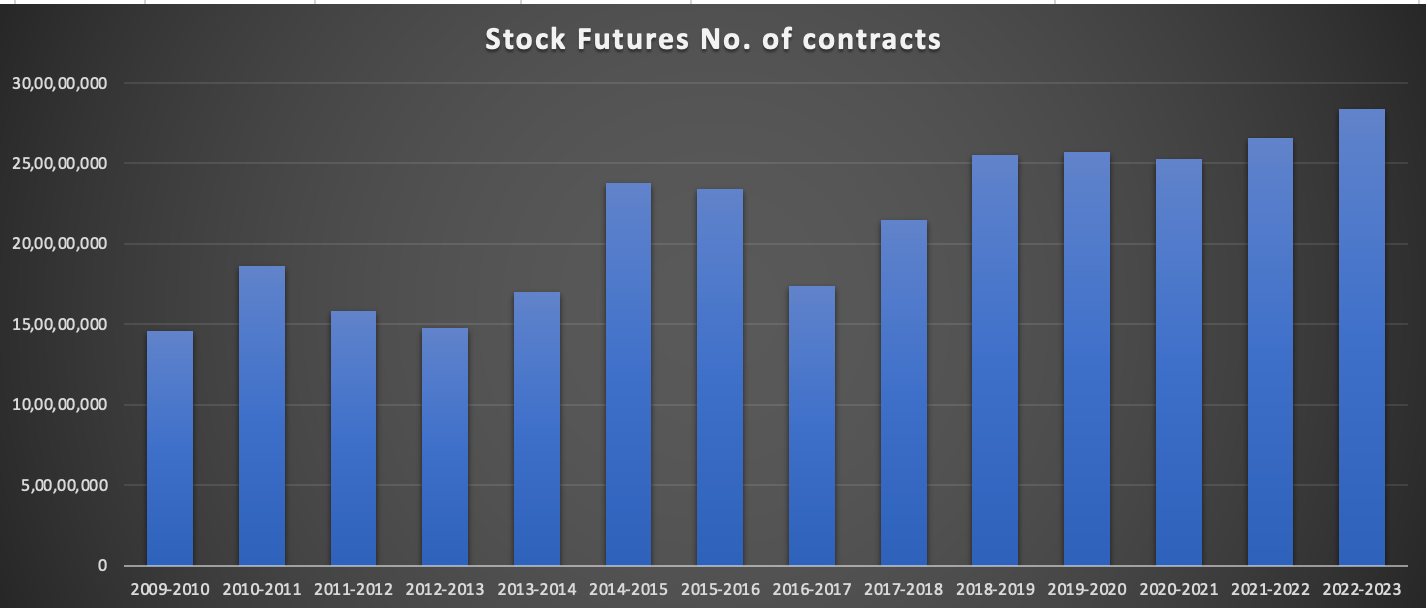

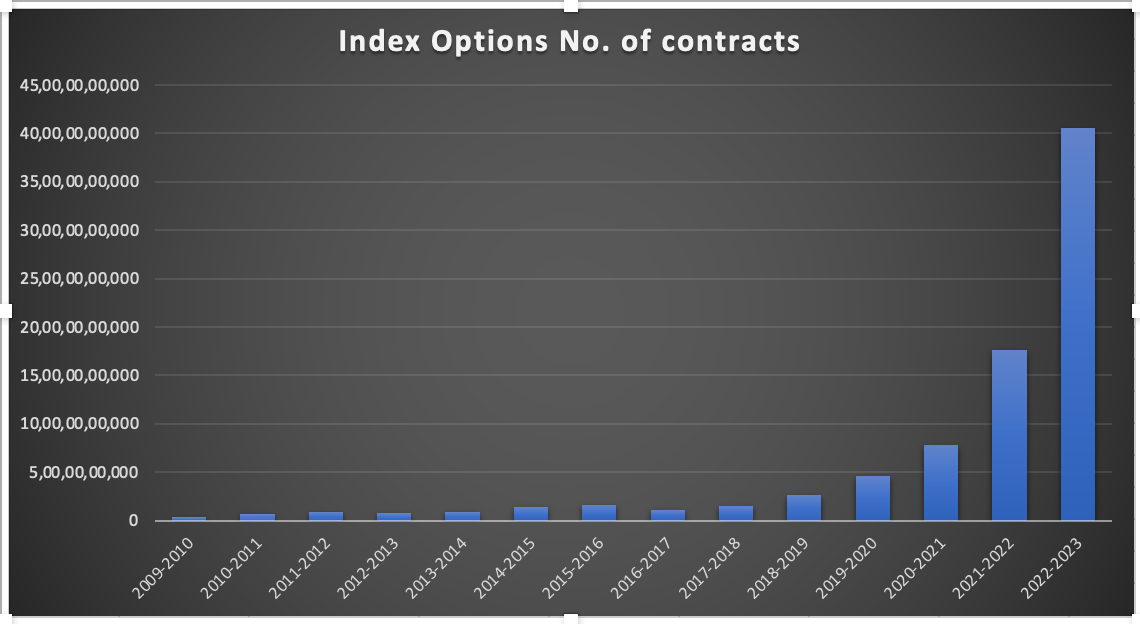

Is the option selling crowd really increasing or is it happening only with a few sets of traders? Just because I met a few people over option convention who do option selling, I cannot conclude that everybody is into option trading. So I tracked the NSE data to figure out the number of contracts traded in the last 10+ years with Index futures, Stock futures and Index options.

Here’s the chart of no of contracts traded with Index futures, it has been steadily declining.

With stock futures, the number of contracts traded has been stagnant, neither an increase in contracts traded nor any decrease witnessed.

But look at the no of contracts traded with Index options, from 2010 to 2022, the no of contracts traded has increased more than 11776%, almost 118 times increase. That’s so huge.

Weekly options with Bank Nifty were introduced by June 2016 and Nifty weekly options were introduced from Feb 2019. Since then option volumes have skyrocketed.

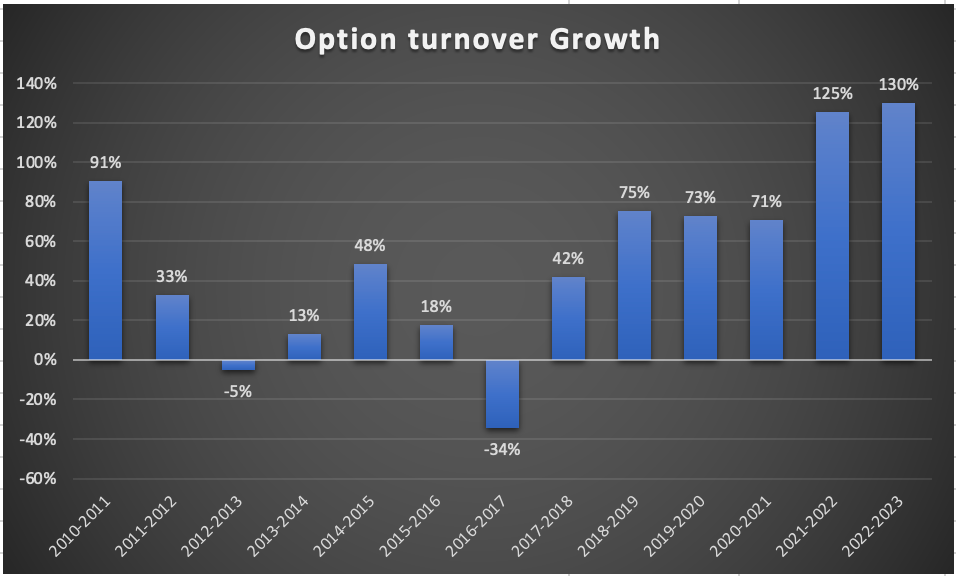

Look at the year on year option volume growth, last two years it’s growing at a record speed of more than 100%. Only during 2016–17 we saw a dip in option trading volume, might be due to demonitization.

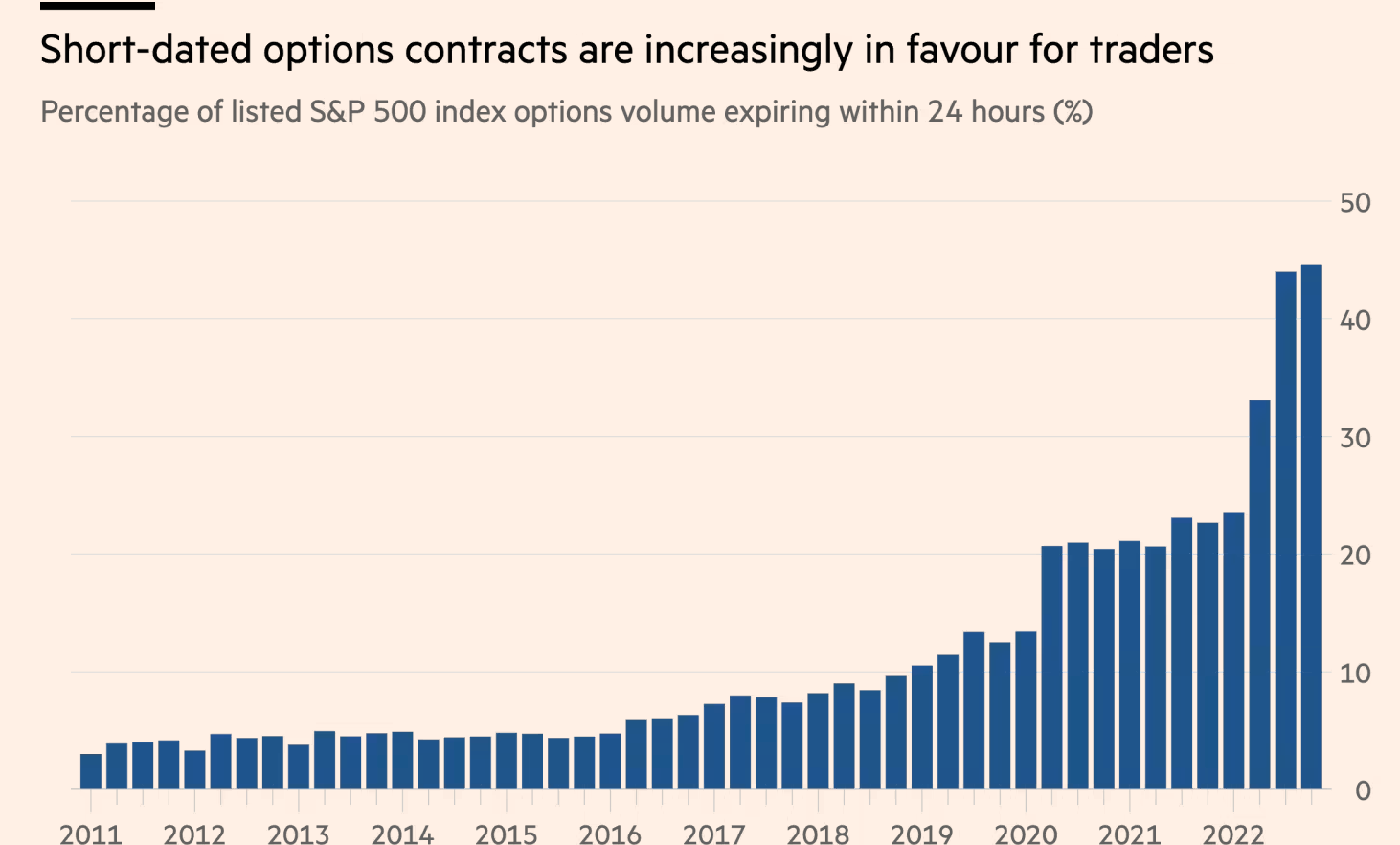

When I googled further, I realized not only India, even in the US market people who trade with options have increased a lot. In fact, there is a concentrated option selling happening on expiry days which lead to many vol spike and gamma moves on expiry days.

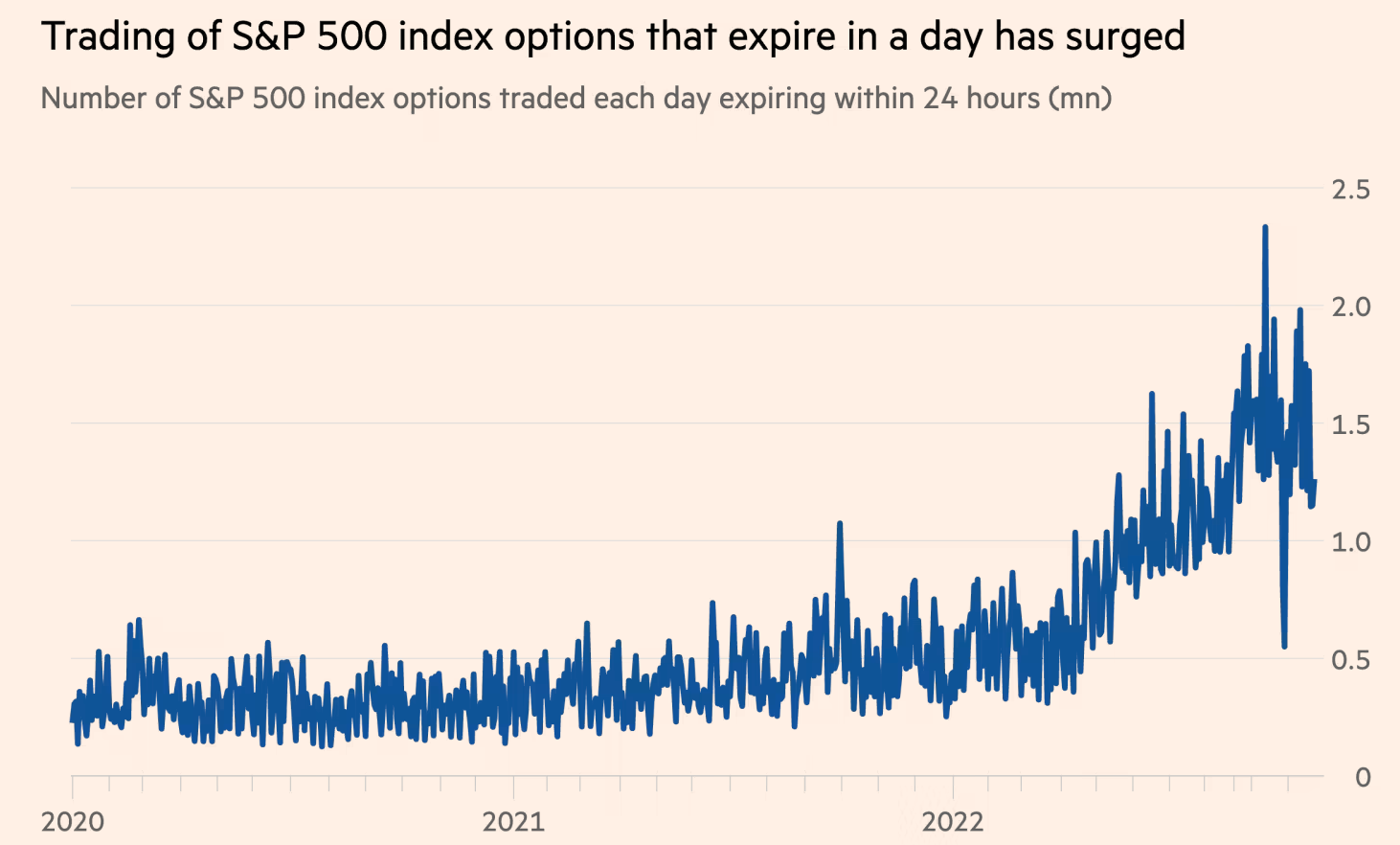

Record numbers of so-called zero-day options that track the S&P 500 stock index are changing hands — with volumes of about 1.5mn a day in November — more than double the levels in January and almost four times those at the start of 2020, according to OptionMetrics.

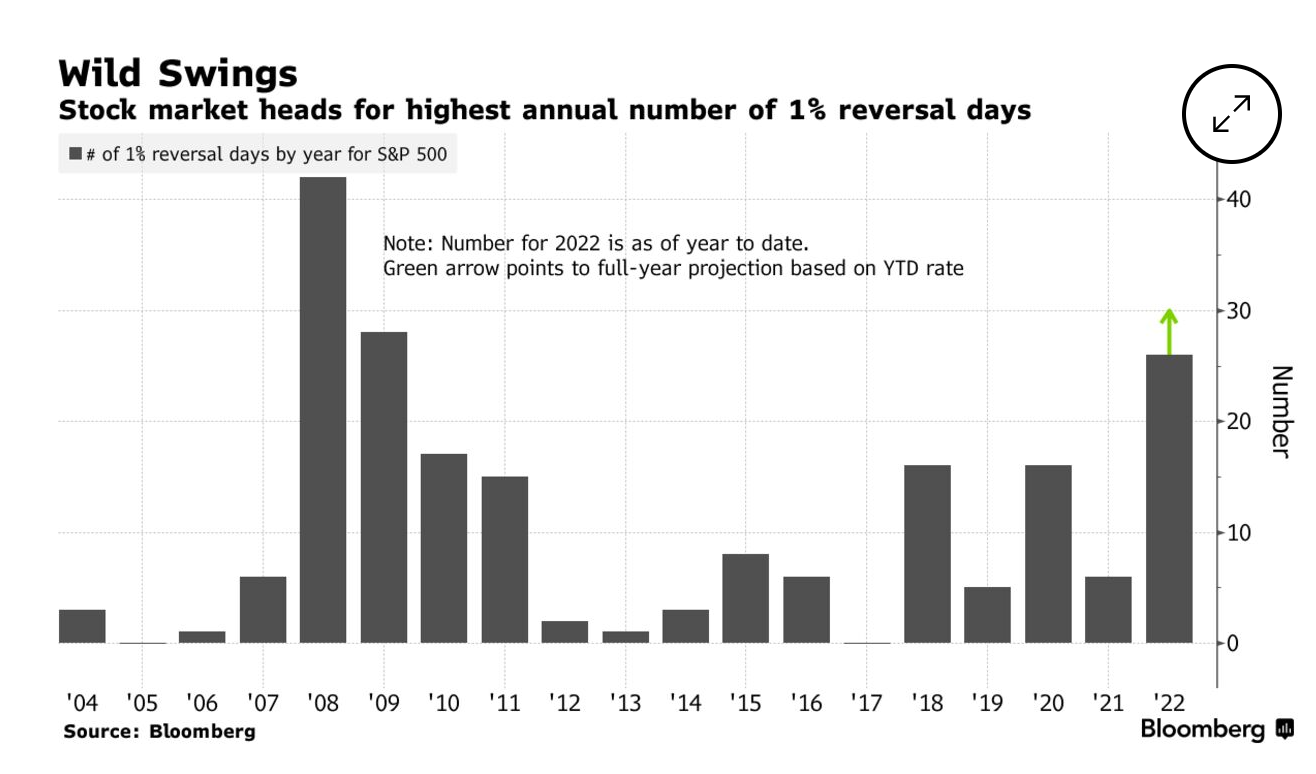

The number of reversals has gone up significantly in recent years. During our recent Goa meet up event, we traders were discussing market movement and Madan asked us “When was the last time the market made a greater than 1.5% intraday move?” We almost forgot when it happened, a big trending intraday move usually occurs frequently every month, but now such a significant move has gone down. Intraday trend followers must have suffered and would have not made good returns in recent years due to the rise in option sellers who arrested such big trending moves.

The following was extracted from a news article from bloomberg which exactly replicated whats running in my mind.

Take last Friday, when the S&P 500 jumped more than 2% to close above 3,900. Calls expiring that day with a strike at 3,850 surged to $45.80 from $2.90 — a stunning gain of 1,479%. On the other hand, puts maturing the next session with an exercise price of 3,750 tumbled 97% to 65 cents, after more than doubling to $24.27 during the previous day.

The explosion in short-dated contacts is concerning to Brent Kochuba, founder of SpotGamma. The flow, he says, can inflict large volatility on markets as it forces market makers to actively hedge these positions.

“This is a recipe for things to break and it elevates risk,”he said. “The risk, we feel, is that of a major headline or other data point that either catches this short-dated volume offsides, and/or triggers an overwhelming flood of directional volume.”

My biggest worry factor is related to the Indian market. Even though we could see many US traders are also worried about the rise of option sellers, I found the below data from the NSE site. Which shows how many no of Index option contracts are traded across the world. Do you know where we stand? At No 1. Yes, NSE is the largest derivatives exchange in the world. We are the largest, look at the difference between the number one player and number two player.

From 738 Million contracts traded in 2021, it has increased to 4375 Million contracts by Jan — 2023. The second largest exchange Korea and third largest exchange CBOE is nowhere near to India. This shows how concentrated our option selling market is.

Conclusion:

If you are an option seller, imagine what are the worst case scenarios and plan your risk management accordingly. What if in case the world’s largest exchange NSE itself goes down? Not just the broker, what if the whole exchange goes down? In fact, it has happened in the past. Feb 2021, NSE went down.

Back in 2017, a major technical glitch had hit the bourse, forcing trading halt across segments for hours. That incident, too, had resulted in similar chaos as was visible on the trading floors on Wednesday.

Imagine such a situation happening on an expiry day, all your pending stop loss kept at the exchange will get cancelled. If the exchange fails to resume trading due to any glitch, what if your intraday positions are carried forward because brokers were unable to Squareoff?

And the next day you are waking up with news that Russia is threatening a nuclear strike, all world markets will open gap down, what would happen to your intraday positions which was not squared off the previous day, it opens with huge loss.

Just because we use SL in the system doesn’t mean we are safe when volatility kicks in. It’s better to have some hedge in the system or add some option buying system that can offset some of your losses from your option selling system.

Risk is what we don’t see. It’s definitely coming, better be prepared.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

The authors concerns have no takers. These are hypothetical situations. Black swans happens rarely.. that too one can manage if have enough experience, also recover losses too.

Electronic carnage is equivalent to doomsday scinerio people do have hedges for the same.. so as to drfine the max risks. No doubt there daredevils in the market too and i am sure they are ready to accept the consequence.

As for the lack of one wat movement is due to global market sentiments… its not due to just option sellers.

Worth the read

Good article… Really an eye opener