- May 4, 2021

- admin

- 4

If you really want to improve your trading result, follow this one simple approach which can immediately show you the reason why you weren’t able to make profits in the stock market. Go to your broker’s backend portal and try to retrieve you last six months’ trade PnL report and check the results trade wise.

You could observe there are some trades you made profits and there are some days you made loss. That’s normal for every trader, but if you dig deep you can see the following observations.

-

- There are few traders who are always quick to book profits when the trades go in their favor, but wait for a longer time to come out of loss making trades. They hold on to their losing trades a little longer with a hope that the stock might come back to their purchase price, so that they can exit at breakeven, instead it does more damage, as the stock might continue to move in their opposite direction. All the little profits you made would have been wiped out by this one or two losing trades. Eventually the net result is negative.

-

- There are other type of traders who are good at riding the trends, they trail their profits and hold onto their positions until trend ends and capture larger profits in few trades, however with the trades which are not going in their favor they get out as soon as stop loss is hit. But this type of trader often faces emotional imbalance because they often go wrong, as they have to cut short their losses, they would see more red days than green days. Most of the time they will be in drawdown, but still the net results would be positive for them because when they are right they make it big and when they are wrong, they lose little.

And this is the case with most of the successful trend following traders. They aren’t bothered much about each trading outcome, they believe in the law of large numbers, so they keep taking every trade as per their system. Even if there is a continues losing streaks, they won’t be bothered about it, even though their profit/loss is not evenly distributed, they don’t lose big. They continue to bet small expecting to win big. Those big winners come once in a while, but that will make up their entire profits.

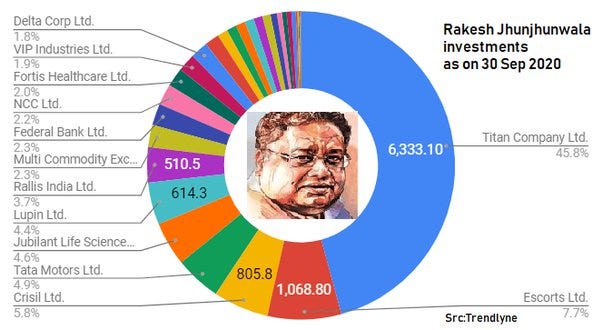

Let’s look at the most successful Indian Stock market Billionaire investor Rakesh Jhunjhunwala’s portfolio, even though he holds many stocks, Titan and Escorts contributes 80% of the wealth he generated.

Even if we look at the Nifty 50 stocks, listed below 10 stocks decides the movement of Nifty, the rest of the 40 stocks doesn’t play any vital role. However only these 20% of the entire Nifty 50 decides where Nifty should move. So the 80% of Indian Stock market movement is decided by 20% of stocks.

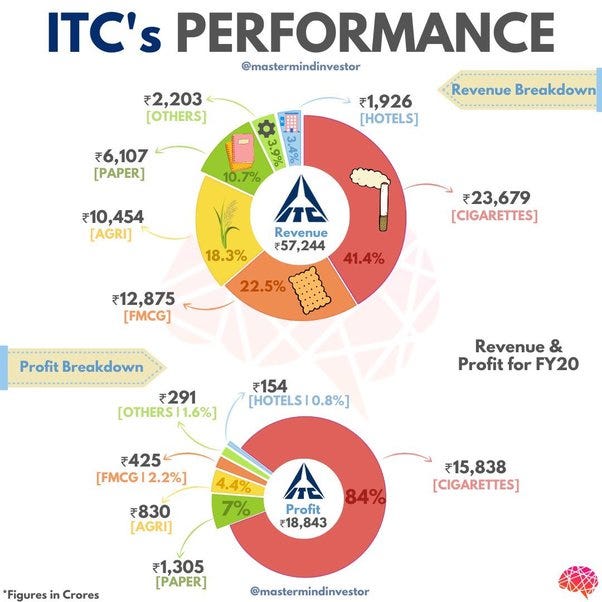

This is what you call it as Pareto principle, that is being applied vastly in many businesses. Consider ITC, where does major revenue come from? In cigarettes, their 80% of the revenue comes from less than 20% of their business.

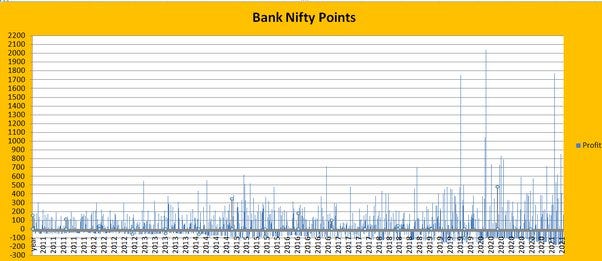

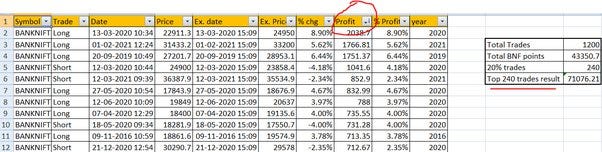

Let me explain with real time example, Golden Ratio Bank Nifty strategy which is one of the top performing Square offtrading bots that made 240%+ returns so far in last one year. The outlook may look smooth and easy, but if we dig deep we will know the real picture behind such outstanding returns.

The outlook may look smooth and easy, but if we dig deep we will know the real picture behind such outstanding returns.

The Golden Ratio strategy has been tested with last 10 years data, this is how the PnL looks like in terms of Bank Nifty points. As you can see, the max loss was between -100 to -300, but the profit points it made was from 100 points to as high as 2000 points. As we discussed earlier, this is the perfect example of cutting your losses and riding your winners. If you keep a fixed target and trade a trend following or breakout trading system you are not going to make large wins and those large wins are essential to compensate for the regular small losses we make. That’s why we never recommend fixed targets.

If I try to sort the results based on profits, I can know what are the list of trades which has made huge gains. The Highest profits came during last year due to corona pandemic crash, followed by a list of other huge gains. In the last ten years, this strategy has generated 1200 trades with total BNF points of 43,350. Now if I calculate how much profit was generated from this top 20% trades, its whopping 71,000 points. If we remove this top 20% results, we will end up in net loss.

But is there a way to capture only those top 20% trades? No way, we can never know what’s going to happen with our next trade. Predicting the trading outcome is a waste of time, no one can predict stock market movement.

The only way is to accept that each trading outcome is random in nature, as per the Pareto principle once you follow a trend following or breakout trading system or even if its long term investing, once in a while you are going to make very big profits, but in order to make such big profits we should be ready to take every single trade without worrying too much about the outcome. Eventually over the long run you are going to be profitable.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Hi

Very good write-up.

This 80/20 rule is applicable in all walks of life…

What a brilliant article … superb

Awesome 👍