- June 13, 2021

- admin

- 3

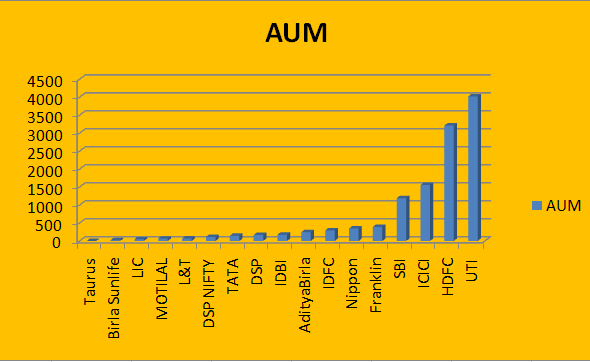

Nifty 50 is one of the widely tracked index, since many Mutual fund houses closely track 50 for to maintain their portfolio balance index funds, all stocks that are being included in Nifty 50 or excluded from Index will have an impact towards the stock returns to the next one year. There are many large fund houses like UTI, HDFC, SBI etc who invest more than 12,000 crores in these Nifty 50 stocks.

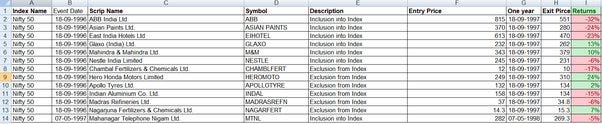

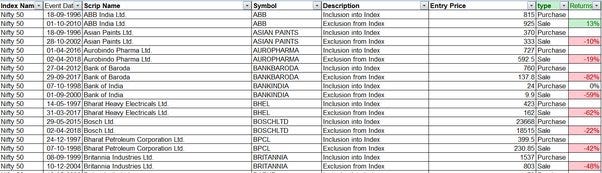

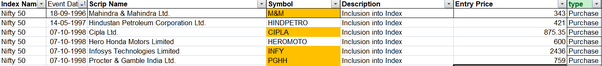

So I ran an analysis to check what are the list of stocks that are added to Nifty 50 index and what is the returns of such stocks for next one year. Similarly, checked the list of stocks that are excluded from Nifty 50 and how it performed in next one year.

NSE based on Individual company’s performance, market cap and other methodologies regularly track all Nifty 50 companies, if any of stock fails to meet the criteria, it gets removed from the index. In 2008, companies like RCOM, DLF were part of Nifty 50, eventually these companies were moved out of index. From 1994 to till date, you can find what are the list of stocks excluded and included in Nifty 50 from this link https://www1.nseindia.com/content/indices/IndexInclExcl.xls

We can get the historical price of any NSE stocks from this link https://www1.nseindia.com/products/content/equities/equities/eq_security.htm

using which we can calculate the entry price and exit price after one year, to calculate the returns and check if we can make profits with the stocks that are added to Index buying them and holding it for one year from the date it is added to the index.

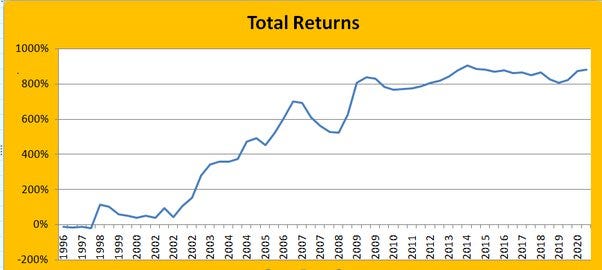

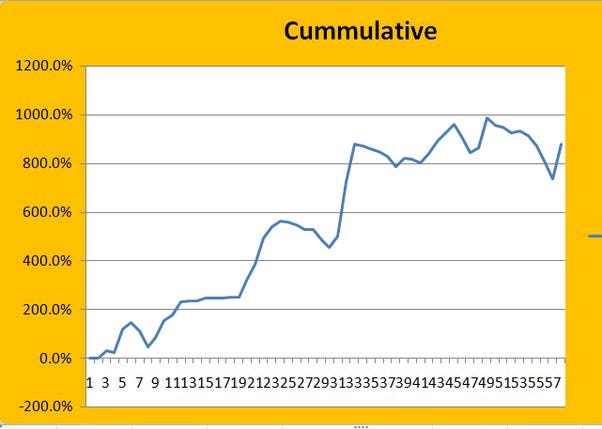

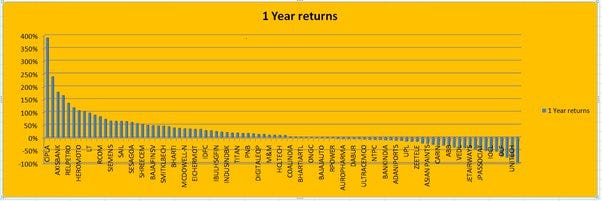

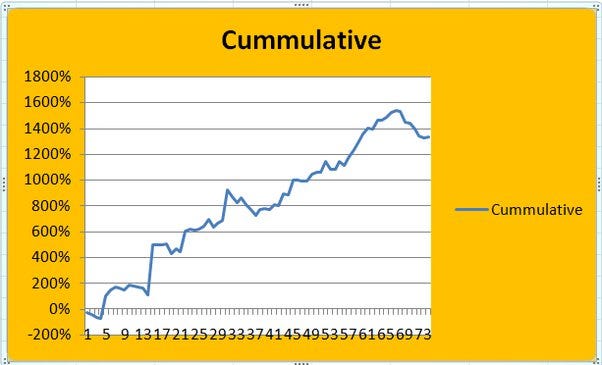

From 1994 to till date, there are 196 instances where stocks were included/excluded to Nifty 50. Every time a stock is added to the index we buy them and hold it for one year, if we did that from 1994 to till date, these are profit/loss distribution looks like for each stock symbol. Total returns were 882%, average returns was 15%

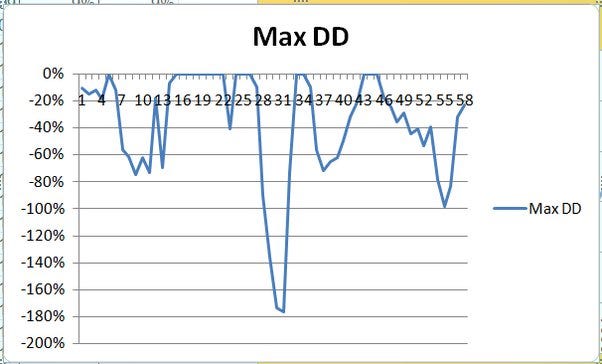

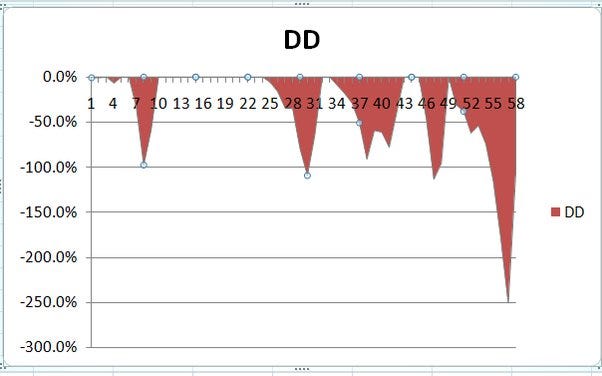

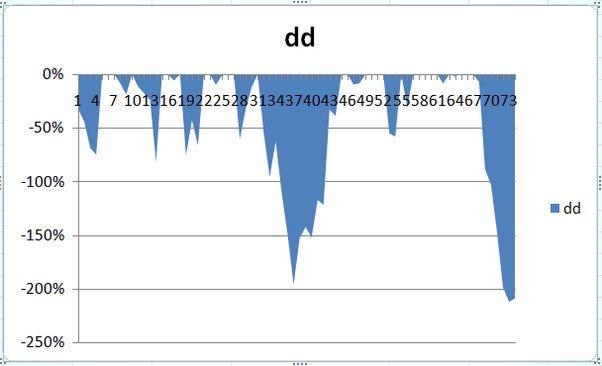

But the maximum drawdown is very high, it shows we can blow up the account, as there were multiple instances where stocks like RCOM,UNITECH,IDEA which were added to the index tanked more than 90%. So this puts one into higher risk, if he thinks buying the stock, just because it was added to the index is a good bullish sign.

The cumulative returns from 1994 to till data for list of stocks that are excluded from Nifty 50 also shows signs of positive returns, where it made 820%

But again if we check the drawdowns, its -250% which means that if we try to buy the stocks that are excluded from Nifty 50, it can at times provide positive returns, but taking every trade when stocks excluded from Nifty 50 might put us in trouble since the max dd is extremely higher. We reduce the leverage, consider you have 5 lacs, but trade only with one lac with this type of strategy, then your overall returns will be 160% with max dd 50% and with average returns of only 5%, which makes this strategy bad.

Listed below are returns made from each of the stocks

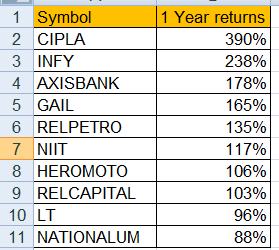

Maximum returns came from these top 10 stocks

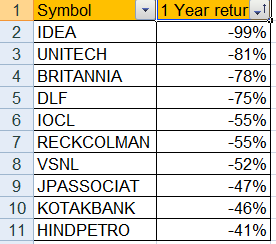

Maximum loss came from below top 10 stocks

I checked further to see, what would be the returns, if we consider only the stocks that are added to Nifty 50 for the first time, for instance stocks like GRASIM, IDEA, RCOM were added and removed from Index multiple times, so we will consider only the first time it was added and calculate what would be the returns.

Total returns from 1995 to till date for such instances were 1333%, Even trading with one fifth of the capital doesn’t yield any good risk adjusted returns.

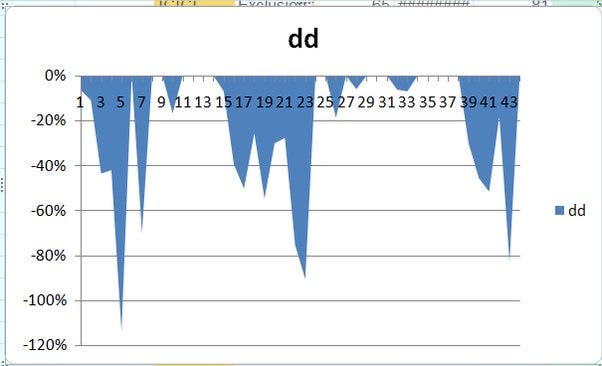

drawdown is still higher

If we consider the list of stocks excluded first time, total returns were 1246%

Again drawdown were 100% which means it can also blow us out

If you follow another approach of buy the stocks when it gets added to Nifty 50 and exit from the stock, if the stock is excluded from Nifty 50, then your returns will be negative most of the time. Because stocks that are not performing well tend to be removed from Index, so obviously returns would be negative.

But there are some stocks which gets added stays in the index and makes multifold returns, all the losses that happens from exits of underperforming stocks will be compensated with these outperforming stocks.

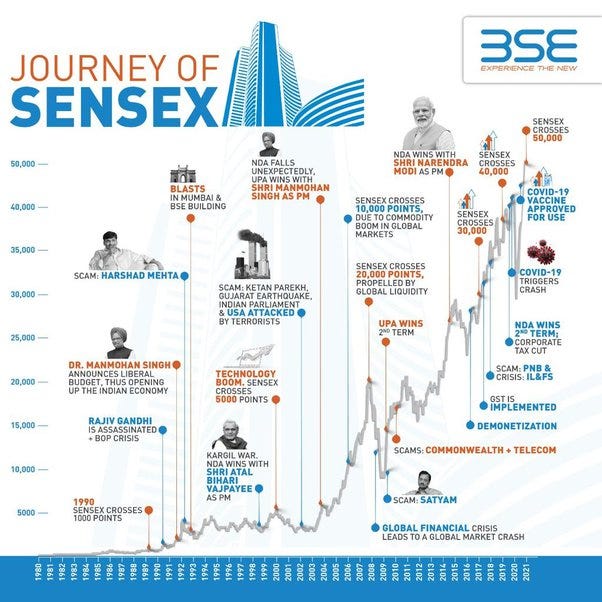

From 1995 to 2021 so many scams, disasters happened, no matter what happens to the economy, eventually it always moves higher. That’s why we see on the longer run, index always moves up, irrespective of any bad news.

Conclusion:

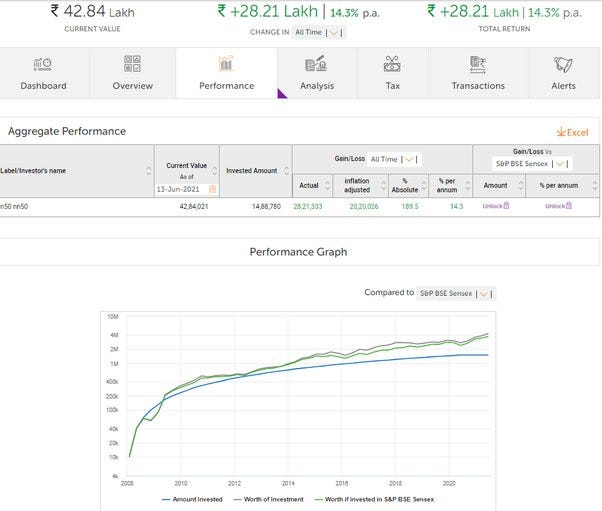

The better way to deal with index is to avoid any short term trades based on which stocks are included or excluded, its wise to make SIP with Index funds, Nifty 50 and Next Nifty 50 through ETFs. If you have invested just Rs.10,000 every month into index funds from 2008 to till date, your total investment amount would be Rs.14.8 lacs, but the fund value would have grown to 42.8 lacs.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.

Ty for everything

Thanks for giving us a wider perspective!

Thanks for sharing Article.