- March 12, 2020

- admin

- 1

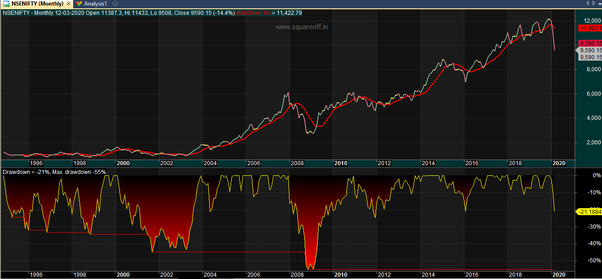

The crash that happened in 2008 occurred over 10 months period, from Jan 2008 to Oct 2008, markets were steadily declining. Let’s check the last 25 years historical price movement of Nifty.

During 2000 dot com crisis, Nifty corrected -45% over the period of two years, during 2008 global financial crisis markets went through -55% correction over a period of 10 months, and now Nifty corrected -21% from its recent peak in less than two months.

This is fastest bear market ever, similar to 2008, markets across the world are crashing. It just took 19 days for Dow Jones to reach bear market.

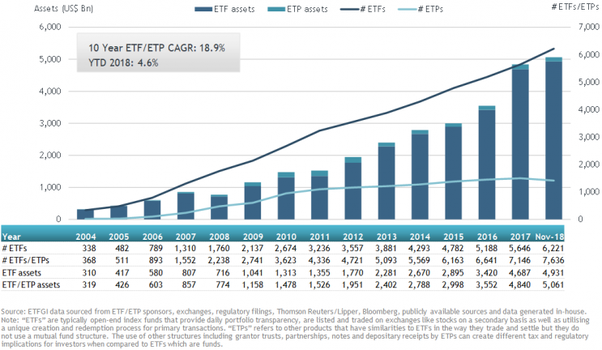

The amount of money inflow into the markets via ETF is so high, it has gone up almost 500% from 2008 levels. So buying and selling billions of transactions are made easy now through ETF, so any large institutions who wanted to exit from market just sell their ETF and come out of markets quickly which creates steep fall in markets globally.

This is a bullish-bearish indicator created by Squareoff based on simple analytics that checks how strong the market is, to check if the market is in buy zone or sell zone. Usually when it is above zero, it indicates uptrend and if its below zero, its downtrend.

When it stays above +5% we are considered to be in strong uptrend market, buy on every dip and when it stays below -5%, we are considered to be in strong down trend market, sell on every rise.

We have gone past all the corrections that has happened in last 10 years, with such steep fall, more pain is expected.

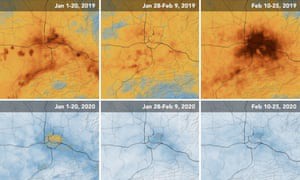

And China being a $13 Trillion dollar economy, dominates supply chain for most of the countries in the world, when it goes down it brings along other countries with it. Here’s the satellite image of China 2019 vs 2020 Jan, the image shows the NO2 emission coming out of industries in China, which indicates, the productions were at full swing in the year 2019, however the the image for 2020 shows, there were no industrial pollution, which means there are clearly no productions happening in China since Jan 2020. So none of the companies in India or other country which depend on China for raw material is going to get goods, which in turn going to affect their sales.

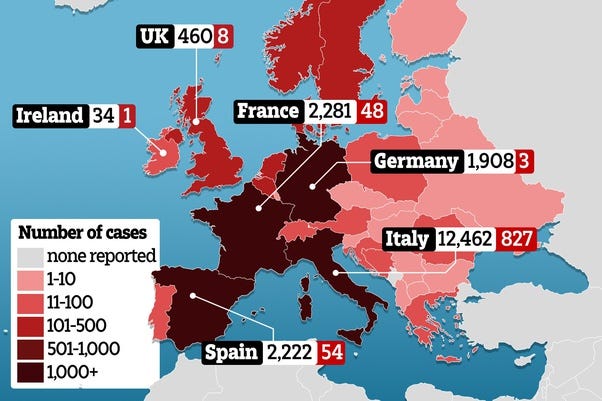

Now imagine, the entire world getting locked down one by one, what would be the impact on the world economy? So this fear has spread so much across the world, which results in world markets crashing significantly.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Can we test strategy of usdinr