- March 7, 2020

- admin

- 3

I wanted to create my own long term investing strategy which doesn’t focus on fundamentals at all. So how can one pick up stocks for long term without focusing on fundamentals? When it comes to long term investing, everybody wants small cap returns with large cap drawdown

What does it mean? The average risk/drawdown with index like Nifty will be around 15%, and returns is also will be similar 12–15%. Whereas with Nifty small cap or mid cap index, the returns is relatively larger, can be around 20–25% and at times even more than that, but to get that returns investors in such small cap stocks have to face huge risk, since many stocks can fluctuate hugely.

What if we can come with a strategy that can generate returns like small cap stocks but with a risk like Nifty index? That’s what this artcile is about.

Years before I was reading a book like The Unusual Billionaires , where the author was explaining about fundamental factors like Return on capital, return on equity etc, the prime focus was to look for companies that are generating ROCE > 10% — 15% every year for last 10 years. And as per his analysis, only 15 companies passed this simple filter.

In the similar lines, I wanted to look for average returns of all stocks from its listing date to till date, and find their standard deviation, then I generate SD ratio which is average returns/Standard deviation, and there are good companies which are listed only few years before and there are companies which are there for decades. So based on how many number of years a particular company is listed, i created another final ratio, where i simply multiple SD ratio (which we calculated in previous step) and no of years the stock is listed.

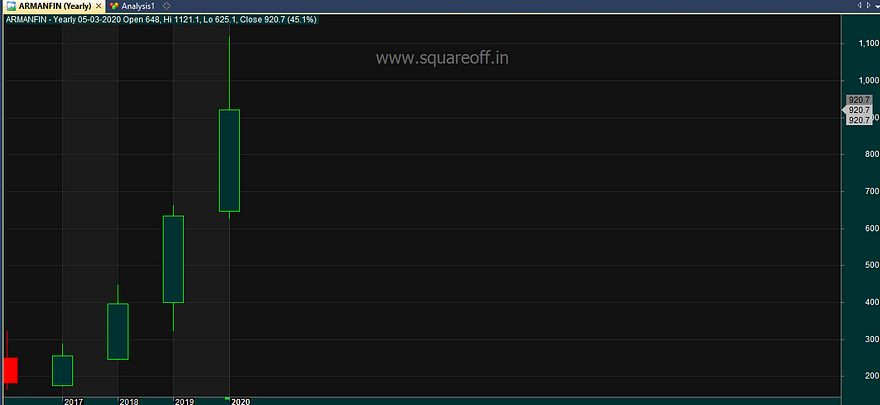

Once am done with the above analysis, the first company that tops the list is Arman Financial Services Ltd which was listed only 4 years before, with average yearly returns of 50.18% and with a standard deviation of only 8.8%.

I have never heard of this company before,only after i ran this analysis came to know about such a company which generates great returns with least volatility.

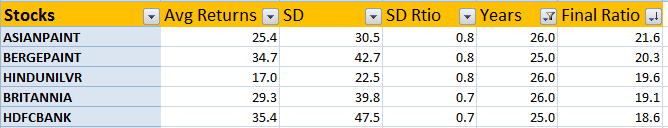

But since 4 years of performance of a company cannot be considered, i wanted to run the ratio analysis for companies which are there for more than 20 years. Then the result was clear and obvious, ASIAN PAINTS emerged at the top spot. And listed below are the top 5 companies that generates yearly average returns of more than 20%, for almost last 25 years, with least volatility.

If someone wanted to invest in a concentrated portfolio, then the listed below 5 stocks are best of the best.

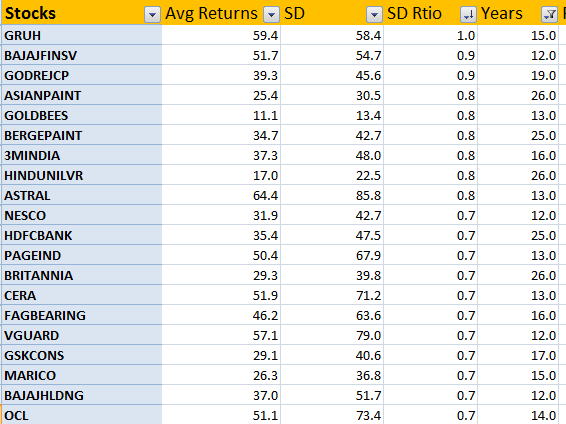

There are also some of the best performing companies which are listed 10 years before as well, so I wanted to check list of best performing companies that generates superior returns with least risk, so based on standard deviation, i found the listed below top 20 companies one can invest for long term.

If someone wanted to invest in a well diversified portfolio, then the listed below 20 stocks are best that generates great returns with least risk.

Investors who wanted to analyse further, can download the full report here.

https://drive.google.com/file/d/1zKXaAckiZp131vezmMtyQbnGQmKfiKua/view?usp=sharing

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Good Analysis thank you. However What are the key indicators we should look for todards investing- I mean whether its the final ratio or SD Ratio. Basically how to read the numbers and interpret for trading in that stock. Please guide

thank you

Yes, look for SD ratio and make your investment.

What is best SD ratio to invest.

How you have calculated final ratio. It seems that you normalised the figure on the basis of company existence.