- December 16, 2021

- admin

- 0

A few months back, one of my ex-colleagues called me and said he is interested to learn about trading.

These kinds of queries are very common to me. Usually, when a person says this, I will try to understand why they decided to learn trading now and what kind of expectations they have in their mind from the market.

I started the discussions on similar notes with my ex-colleague. He was super interested to learn intraday trading, and he wants to learn asap.

I tried my best to convince him to start with positional trading first and then explore day trading. But he was adamant about starting with day trading(with options selling).

I told him directly that I would not be able to teach personally to him. He said he has decided to proceed anyway and will update the progress.

Last month he called me again and said he had lost around 2 lakhs (200,000 INR) and wanted to recover that money from the market ASAP and asked for my help.

I had told him that ‘revenge trading’ is not good and asked him to take a break from the trading. I advised him to come back after a few weeks andstart with swing or positional trading again.

But once again, he was very keen to recover his losses from the market andasked me to share any good strategy on options buying.

I tried to warn him about the implications, but he was not in a situation to listen to my advice.

I told him directly that I would not be able to help him and decided to block his number (as he is not open to my suggestion and it is a waste of time for both of us).

Many beginners go through similar experiences. They start their trading withan adamant behavior, and they will open their mind only after losing theirentire capital.

I request everyone not to commit the same mistake.

Before anyone thinks to become a trader, they should know what are the types of trading possibilities in the stock market.

Scalping or High-Frequency Trading (HFT)

Scalping represents the shortest form of trading. Scalpers quickly ‘enter’ and ‘exit’ the market to skim small profits from more trades throughout the day.

I don’t recommend this type of trading to beginners.

Day Trading

In this form of trading, traders buy and sell the stocks or indices on the same day. A trader involved in day trading needs to close his trades prior to the day’s market closure.

Day trading requires high proficiency and skill in the market. Therefore, it is performed mostly by experienced traders.

In some countries, day traders get the extra margin. But in India, SEBI has removed the extra margin facility for day traders.

Swing Trading

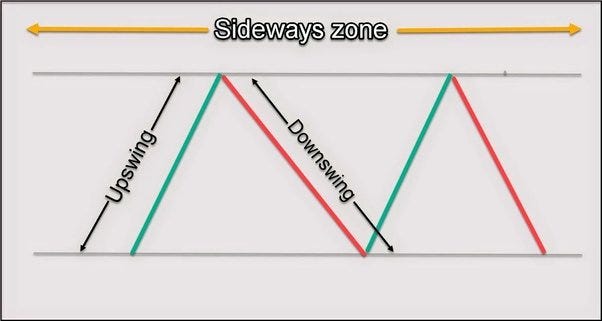

In this trading, traders hold the stocks for a few days. The basic idea is to ride the profits of one complete swing in the sideways market trend.

The idea is to get out of the trade before the opposing pressure comes into the picture.

It means you look to book your profits before the market reverses.

- Identify a range-bound market or scrip based on individual choice.

- Observe price action carefully at the Support Level (for a long trade) and the Resistance Level (for a short trade).

- If there is a firm price rejection at the support level, then go long on the next candle open (the technique is the same for a short trade if there is a rejection at resistance level).

- Trial your stop-loss when the price moves upside and book profits before the Resistance level (for short trades, book profits at support level).

The above chart shows an example of a swing trade.

The price is in a sideways trend and it displayed a clear rejection at the support level.

So, swing traders opt for a long trade above the rejection candle high, keeping a stop-loss below the rejection candle low, and targeting the resistance level.

Positional Trading

In this trading, traders hold the stocks for a few days to weeks. The idea is to get the benefit from the major movement of the trend.

Most traders use any trend following technique in positional trading.

The above chart shows an example of a trend-following trade.

The original trend was up, the recent swing is down (consolidation to pullback), taking support & also RSI hidden divergence, and there is also a candlestick confirmation.

How to pick the trading type?

First, read some good books on all the trading types so that you will get a basic idea. When you pick up a trading book, please read it in general for the first time to understand the concepts. If the content is good, then reread it and identify the same information on charts.

Now try to identify whether you started liking any forms of trading among all the trading types. If you like any particular trading type and suit your personality, go in-depth on the same idea by reading a few more advanced books on the same topic.

It is better to backtest a trading idea with historical data before you finalize a trading system with all the rules.

Any backtesting procedure should arrive at two things — 1) Success Ratio and 2) Risk-Reward

If a trading method gives a 50% success ratio and 1:1.5 Risk-Reward, then it is a good trading system, and in the long run, there is a higher probability to make money in trading.

There are many ways to perform backtesting activities. One can prefer to do it manually or take the help of a software or website.

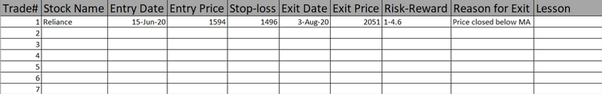

People can use the below template for manual backtesting. In the end, log all the identified trades calculate the success ratio and risk-reward (by averaging).

Many traders pick the wrong timeframe because of a lack of knowledge or eagerness to make quick money.

For ex, a person who doesn’t have an investment attitude (no intention to hold the trades for many months), looking for a trade in monthly charts thinking higher timeframe trades give good success.

It is not a good idea because he has to hold the trade for many months to exit the trade. He can’t ride the complete profits as he doesn’t have that mindset.

Hence, always pick the right timeframe to manage your trades. If you are anintraday trader, stick to a 15-min or 30-min chart.

If you hold your trades for 1–10 days, then you can use 4-hour or daily timeframe charts. Please note opportunity exists in all the timeframes.

Understand the Trading Instruments

We have below three trading instruments in the stock market:

1. Equity

2. Futures

3. Options

So, a trader should know how these trading instruments work.

Equity offers less and less reward. Whereas, futures offer medium risk along with medium reward.

But options are versatile trading instruments that offer different degrees of risk and reward based on how a trader uses it.

Important Candlestick Patterns

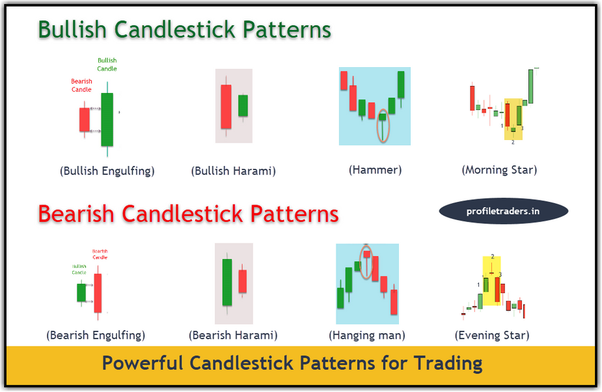

If a trader observes candlestick charts patterns over some time, some patterns occur repeatedly. If he develops the ability to identify these patterns and uses it correctly, it gives an extra edge in his trading.

There are thousands of candlesticks patterns present in the technical analysis world. Studying and memorizing all these patterns are practically impossible.Because if a candlestick pattern has less impact, then it is not helpful. Similarly, if a candlestick pattern is powerful, but if it rarely occurs, then again, it is of no use.It is better to shortlist the patterns based on the “Impact” and “Repeated Occurrence.”Above candlestick patterns (mentioned in the image) are the most important and powerful patterns andthey occur frequently in all the timeframes.

Online Courses

The covid-19 pandemic has changed our lives forever. There is no doubt that it has taken many lives and also impacted many people emotionally andfinancially.

However, the other side of the story is it provided many opportunities to learn from anyone in any part of the world at a throwaway price.

Earlier people were traveling across cities to attend the stock market courses. However, now one can attend the online course from their home credit to Zoom and other online platforms.

Opt for a Mentor

Many people isolate themselves, and they try to learn to trade on their own. They spend many weeks and months decoding the mysteries of trading.

Some trading concepts (ex option strategies or algo designing, etc) can be complex in nature. Hence, it is always better to take the help of a mentor to get the right skills.

Only a mentor can provide crucial feedback at the right time. Besides, a mentor will also accelerate the learning process.

Some people think that they don’t need mentors. However, a mentor plays a significant role at all stages in trading. A good mentor challenges the way you think, as they have seen different dimensions of the market.

Mark Zuckerberg took the guidance from Steve Jobs while expanding Facebook. He also sends out a post on his Facebook page, ‘Steve, thank you for being a mentor and a friend. Thanks for showing that what you build can change the world. I will miss you.’

– Shared by Indrazith Shantharaj, Trader & Best Selling Author at www.profiletraders.in