- January 14, 2023

- admin

- 0

Many of us have this thought that high risk will always end up in high returns. Is it really true? If you are running a trading system and making average returns with minimal risk, now thinking of increasing the risk to make higher returns? Then this article might help you.

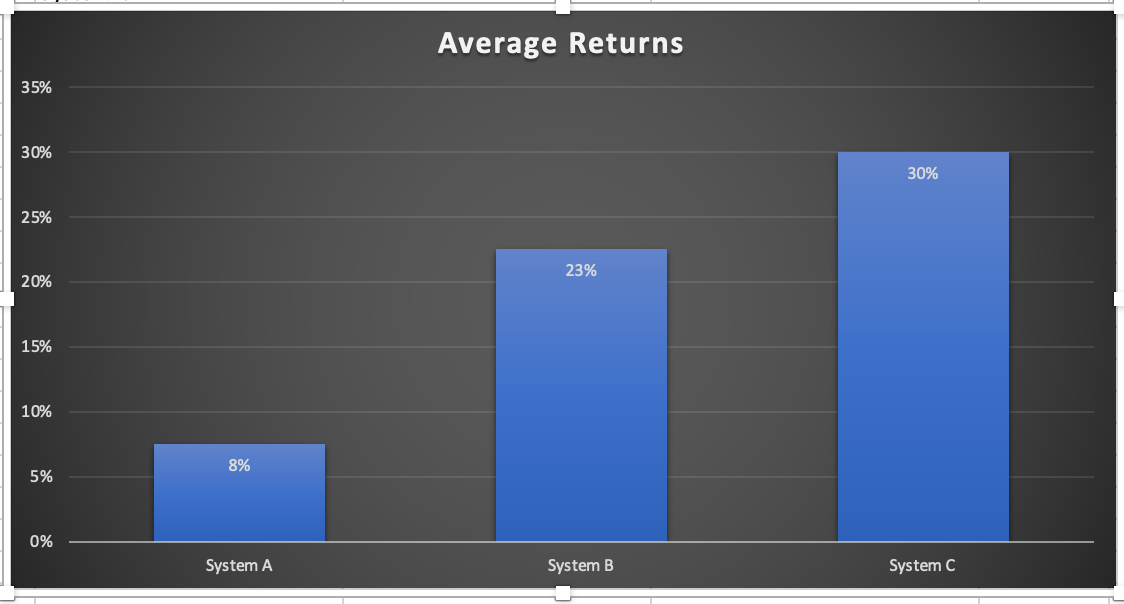

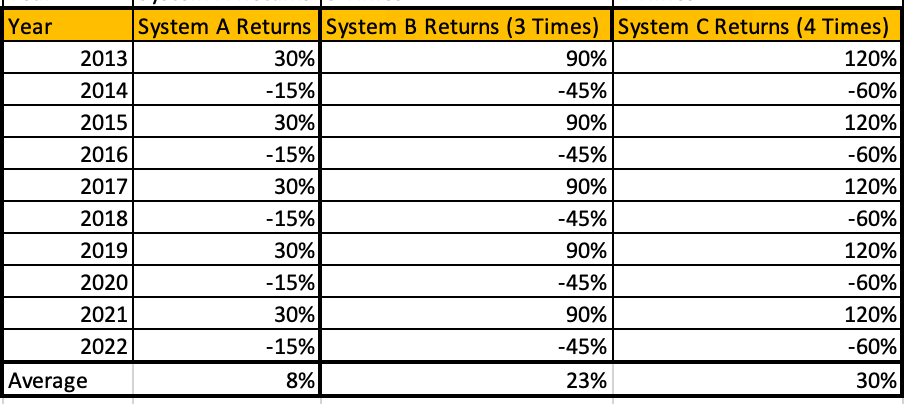

Let’s assume three different trading systems. As we always tend to check what is the average returns a mutual fund gives, the average returns a trading system gives or any PMS. We always give importance to average returns made over the years. The below table shows average returns of three trading systems for the last 10 years. Which one would you go for? Most will opt for System C obviously.

Now let us dig deep further.

System A: Up 30% one year, down -15% the next, repeated for ten years

System B: Up 90% one year, down -45% the next, repeated for ten years

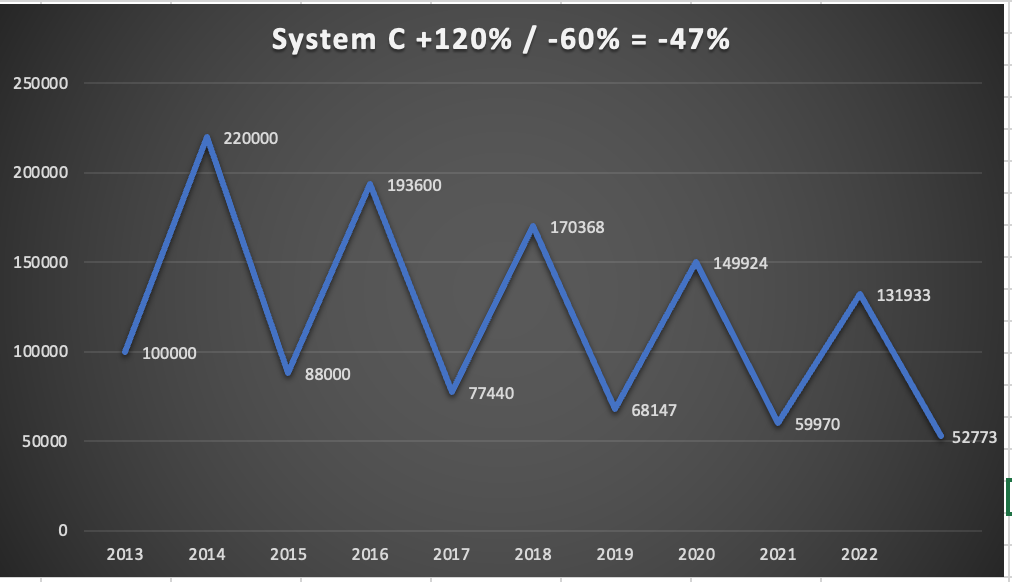

System C: Up 120% one year, down -60% the next, repeated for ten years

The average returns for System C looks much better.

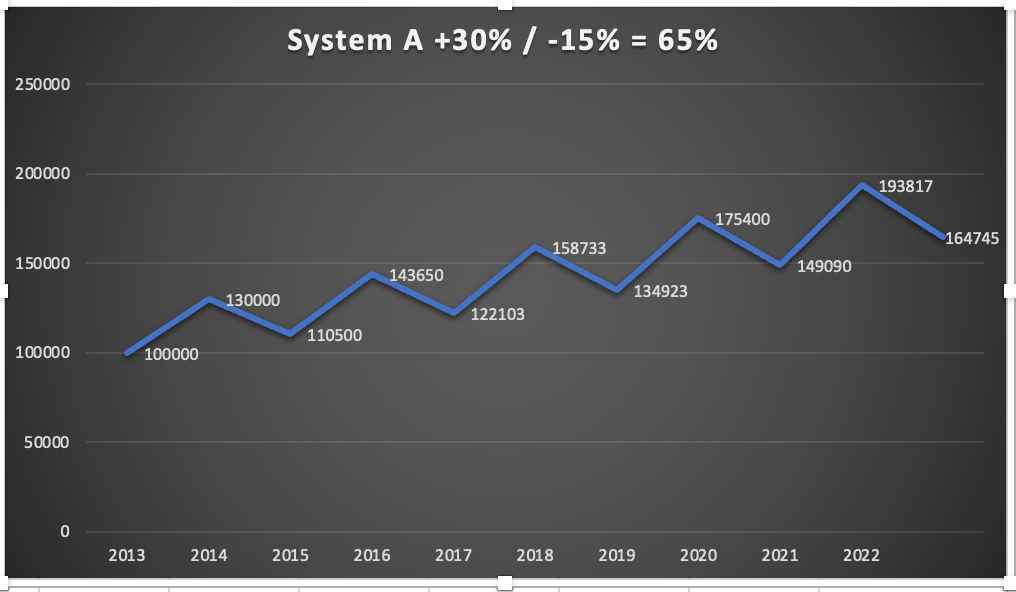

If you have invested Rs.1 lacs with this system in 2013 with System A and continued for next 10 years, your 1 lac would have grown to Rs. 1,64,745.

As a system trader most of us would think, the risk is only -15% with this system A, if I could increase the risk 3 or 4 times, then I could make huge returns.

But one important factor that we fail to understand is High Risk is not equal to high returns.

A +50% returns followed by -50% loss is not equal to 0%.

You have 1 lac capital, you made 50% returns. Now your capital is Rs.1,50,000.

Now you made -50% loss on Rs.1,50,000, so you will end up with Rs.75,000.

So by making +50% and -50% you are actually losing -25% of your capital. That’s why Volatility is very important factor we need to consider when developing a trading system. Many of us comprise on the volatility to make higher returns.

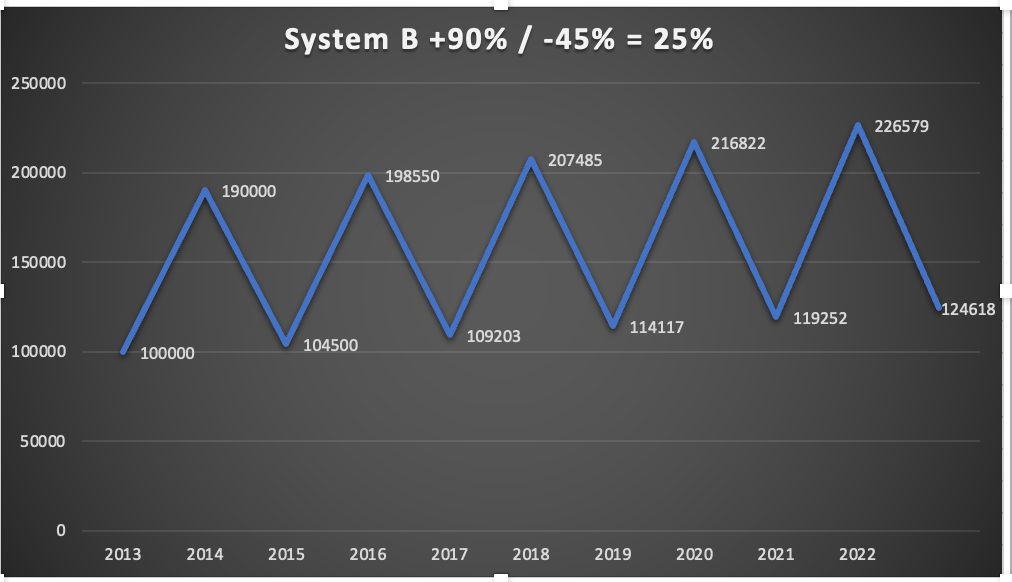

Considering this, if you have increased the risk three times and traded System A, after 10 years the average returns might be 23%, where your 1 lac initial capital will end up with Rs.1,24,618.

Similarly if you have increased the risk four times, then System C average returns over 10 years might look attractive, but your actual returns will be negative, where your 1 lac initial capital will end up with Rs.52,773. Where almost 50% of your capital wiped out, inspite of making higher average returns.

Volatility Drag:

Deciding which mutual funds to invest or which trading system based on average returns will give us wrong picture.

- System A, with minimal returns and risk, performs best in the long run.

- System B, with average returns higher than System A was not able to generate higher returns than System A.

- System C loses money.

This phenomenon is known as volatility drag.

So higher the risk will not always end with higher returns. If you are a system trader and trying to increase your risk in order to generate higher returns, you need to be careful.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.