- September 10, 2019

- admin

- 1

I have come across many posts in Facebook and other trading forums about a specific strategy that many people are attracted to, which they call it as

Hero or Zero

Buying huge quantities of OTM options just before the expiry day, expecting for massive gain if the markets moved exponentially on expiry day.

7000% returns in Bank Nifty weekly option.

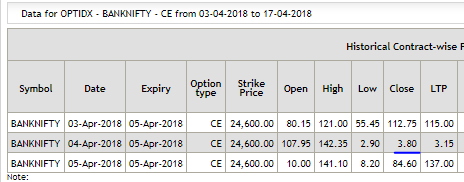

Example:

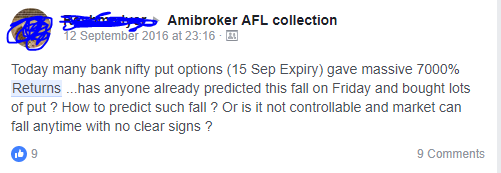

Date: 04–04–2018

Spot: 24129

Strike: 2% * spot = 24611 — round off = 24600 CE

So the strike price we need to buy is 24600 CE April 5th 2018 expiry.

Index:

Option data:

So we would have bought the 24600 CE around 3.8 Rs. But the next day, the price went up as high as 3600%.

That’s a stellar returns in just one day. Very low investment and huge reward, and people get interested towards such option buying strategy and they tend to repeat it for next couple of expiry expecting to make such huge returns but the options end up expiring worthless. Becomes Zero, not a Hero.

But is it really possible to make such returns if you buy OTM options a day before every expiry ? I did the research on it with Historical data, checked the data from inception of Bank Nifty weekly options.

For testing purpose, I considered OTM options which are 2% away from Spot price.

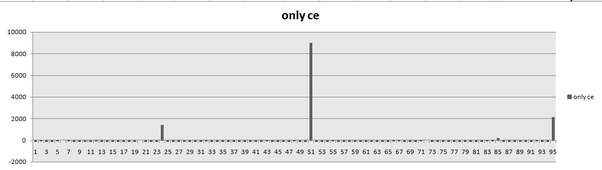

If some has bought OTM CE (strikes that 2% from spot) Bank Nifty weekly option, every Wednesday (day before expiry) from June 2016 to April 5th 2018.

Returns in %:

You just see 3 big spikes right? Yeah, those are the stellar returns that you get in buying OTM options. Just 3 out of 95 trades.

These are three dates where the huge returns happened.

10–11–2016 1411%

25–05–2017 8992%

05–04–2018 2126%

All other trades ended up with loss. Full deployed capital wipes out. But still whats the total sum of all returns? Its is 4283%, so even though 97% of all your trades are failure, you still end up making positive returns.

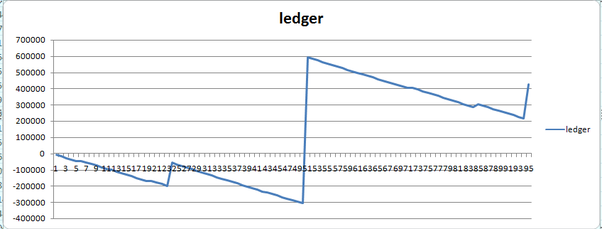

You cannot put all your capital in one trade and expect to make 1000% returns, if it goes against, you end up losing al. so what I considered was, say I put in 10k in this kind of trade for every expiry, the this how cumulative Profit & Loss looks like!

My Total Investment: 10k every expiry — in total 95 expiry. So total investment was 9.5 Lakhs.

Returns: Rs. 428325

That’s almost 45% returns. That’s all.

Crazy! Isn’t it. But that’s how this Hero or Zero strategy works! Losing 97% of the time to make just one big profit. Even though its over all a profitable strategy, very hard to follow.

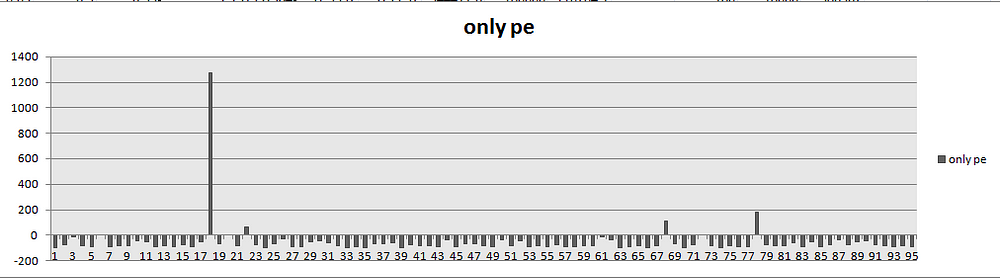

Edit: Many readers have asked me, what would have been the result, if only PE was chosen or if both CE & PE (Long Strangle) was chosen.

I have calculated that as well. When only PE options is considered, instead of CE, the P&L distribution is like the below.

Only one trade resulted in huge profit which was the day surgical strike happened i.e. 29–9–2016, all other trades resulted in loss. Total sum of returns was -5113%.

Both CE & PE: — Long Strangle on the day before expiry. If we consider buying both CE & PE, still only 3 or 4 trades resulted in good profits and all other trades ended up in full loss. Total sum of returns was -3900%.

Follow us at our Telegram Channel to get more such updates.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Interesting approach but in your first example 9.5L is not investment, its expenditure.

In the end the returns won’t be 4.2L + 9.5L

It will be 4.2L – 9.5L

Which is almost -45% returns and hence not overall profitable, isn’t it?