- July 10, 2020

- admin

- 5

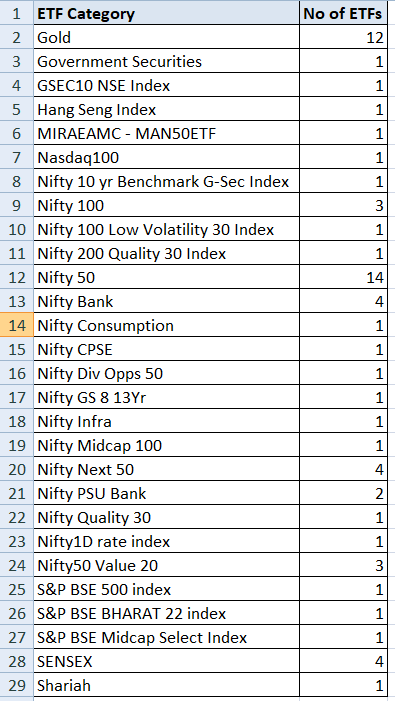

There are in total 28 different categories/sectors where ETFs are available, just like how you can buy a TCS stock, Reliance stock, ETFs also work on similar structure, you just have to enter the ETF name in your broker’s watch list and buy it.

Why investing in ETFs are better?

ETFs or Exchange Traded Funds are a type of pooled investment funds which invest in diversified securities. An ETF passively tracks an index like the Sensex or Nifty by holding securities in the same weights as the Nifty/Sensex.

Since an Exchange Traded Fund tracks an Index, it does not rely on active investment calls provided by a fund manager.

ETFs in India track diverse products like the Nifty, Gold, Nifty Next 50, Nifty Low Vol 20 Index and several others. You may not find active mutual funds tracking all these products

These are the different ETFs category available for investment

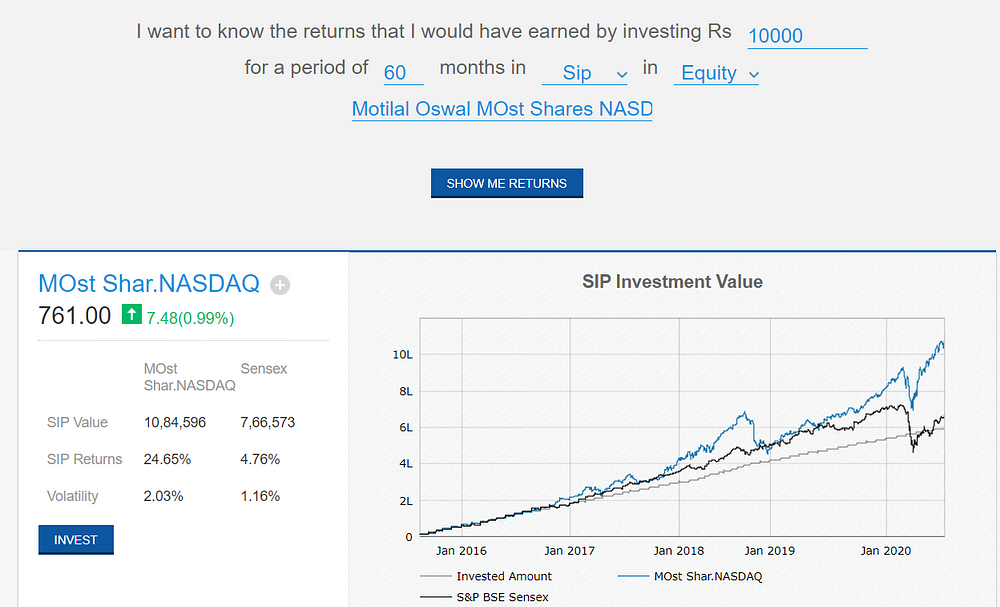

There are 12 ETFs available in India, if one wish to invest in Gold, there are 14 different ETFs available if one wish to invest in Nifty 50, since we cannot invest in all 50 Nifty stocks, just buying Nifty 50 ETFs will replicate the same performance of Nifty index. Like wise for each Category, we have ETFs. In this article, we shall check what are ETFs one can consider for SIP investment, where you simply allocate a fixed amount to these ETFs and also we shall check how it would have performed by now, if we had invested in them for last 5–10 years.

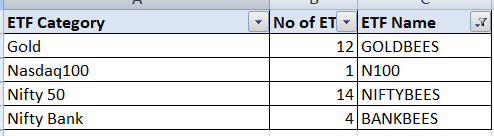

Out of 28 different category, we consider only 4 ETFs, considering only these 4 different ETF will help investors to diversify their risk. We shall check how regularly investing Rs.10,000 every month in these ETFs for last 5 years would have performed.

Gold bees:

Investing in Gold will not only diversify our risk, it can amplify our returns to greater extent when economy is not going well. In fact, Gold Investment has out performed sensex investment in last couple of years.

Investing Rs.10,000 every month for the last 5 years in Gold Bees, would have given much higher returns than Sensex. You would have invested 600000 Lacs INR, but the SIP investment value would have been more than 9 lacs INR by now.

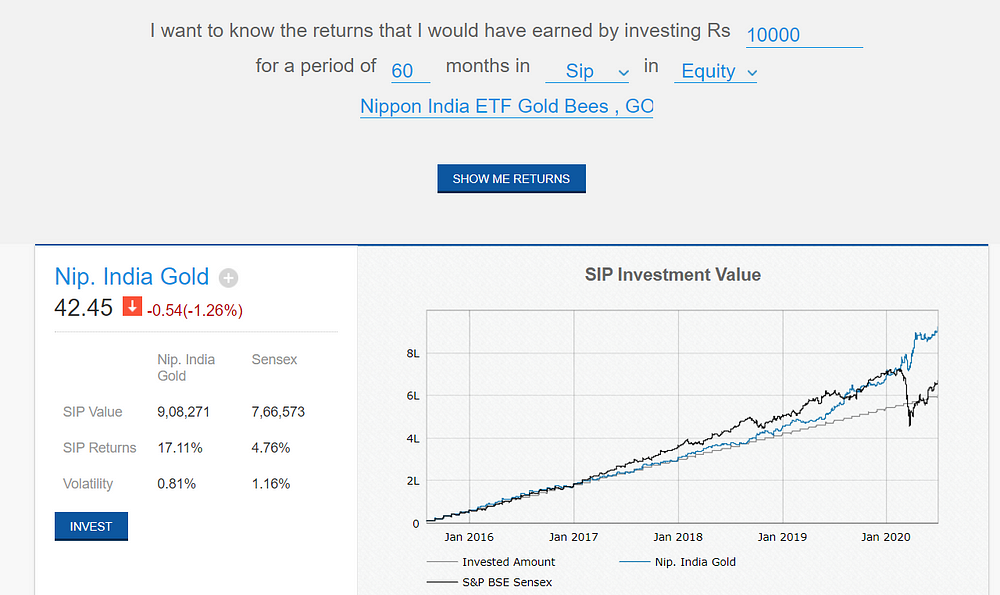

N100:

This ETF invest in NASDAQ 100 stocks, that offer investors in India an opportunity to invest in US stocks, The Nasdaq 100 majorly constitutes the big tech players from the USA like, Facebook, Google, Netflix etc. This makes it a very technology sector specific index.

Investing Rs.10,000 every month for the last 5 years in N100 (NASDAQ ETF), would have given much higher returns than any other index in India. You would have invested 600000 Lacs INR, but the SIP investment value would have been more than 10.8 lacs INR by now.

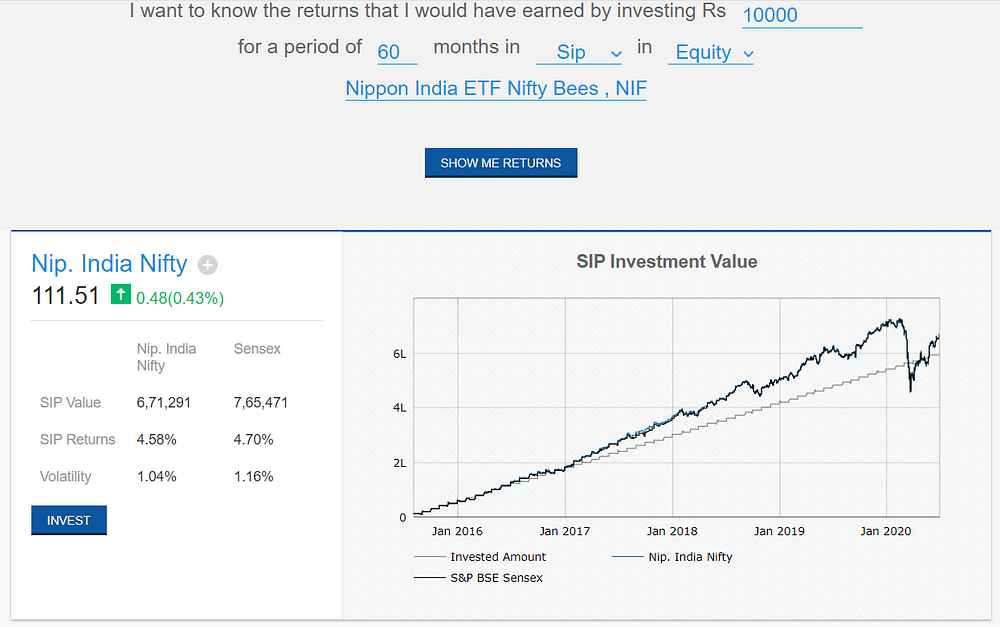

Nifty Bees:

This ETF is mainly for investors who want to invest in Nifty 50 stocks, those who are looking to replicate index performance, can consider this ETF. Investing in Nifty bees alone for last the 5 years haven’t given any exceptional returns.

Investing Rs.10,000 every month for the last 5 years in Nifty bees, You would have invested 600000 Lacs INR, but the SIP investment value would have been 6.7 lacs by now. A mere 70,000 Rs. profit for the last 5 years.

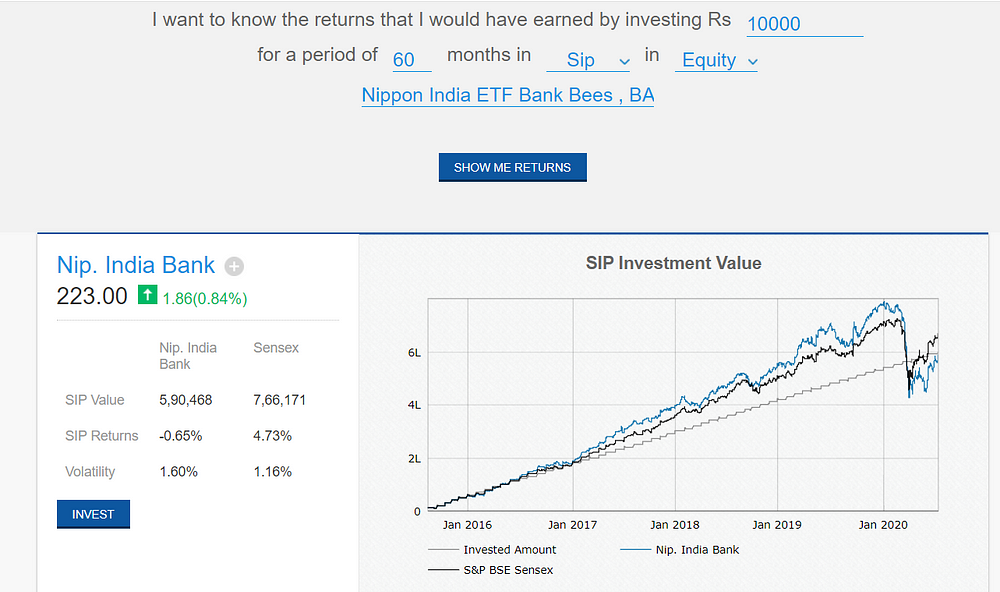

Bank Bees:

This ETF consists of Banking sectors stocks, investors who primarily want to bet on Bank stocks can consider investing this stock, we know Banks play a vital role towards economy, so Banking stocks can outperform when the economy of a country is expected to do well, but if there is an economic turmoil happens, then this is the first sector to get affected badly.

Investing Rs.10,000 every month for the last 5 years in Bank Bees, You would have invested 600000 Lacs INR, but the SIP investment value would have been lesser than what you have invested, the fund value by now would be 5.9 lacs, Rs.10,000 loss in-spite of making SIP investment for the last 5 years.

Conclusion:

Investors who have invested in many Mutual funds SIPs for the last 3–5 years, would have not seen much capital appreciation since most of the stocks tanked due to recent Coronavirus market correction. Mutual funds is not the only option if one wants to do SIP, from above example we can see investing in Gold and Nasdaq ETF has given outstanding returns than investing in Indian Equity markets.

There are periods like this where your investment could under perform, so instead of investing in Mutual funds, one can consider investing in ETFs like Gold Bees, N100 (Nasdaq ETF) and Nifty bees. By combining and investing all three different ETFs, your investment is well diversified with Gold, international equity and Indian equity markets. This way, you can easily beat any mutual funds returns.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

I will add 5th ETF: LiquidBees

Awesome evaluation

Is there any etf available if i want specifically invest in IT sector?

Thematic funds are available, but liquid ETFs aren’t available yet for IT sector

ITBEES