- September 28, 2020

- admin

- 8

Here’s a simple Trend following strategy based on weekly time frame, that has performed well across 12+ years of historical data. Why weekly time frame is better than daily time frame when it comes to positional/swing trading system? Because, the noise is higher when we deal with daily time frame, however on weekly time there is enough time for the trend to get established, noise are lesser and so false breakouts are also lesser.

Moreover, no of trades becomes lot lesser, thus it helps in reducing over all transaction cost and slippages. Let’s get into the rules of this weekly trading system.

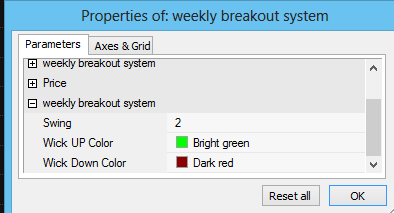

- Buy when weekly close is above the last two weeks high price

- Short when weekly close is below last two weeks low price

As simple as that, its an SAR system, means stop and reverse trading system, so the position is always open, either on long side or short side. Those who want to trade this system on equity cash segment, can stick to only long trades and those who want to trade on index like Bank Nifty, can trade on both long and short sides.

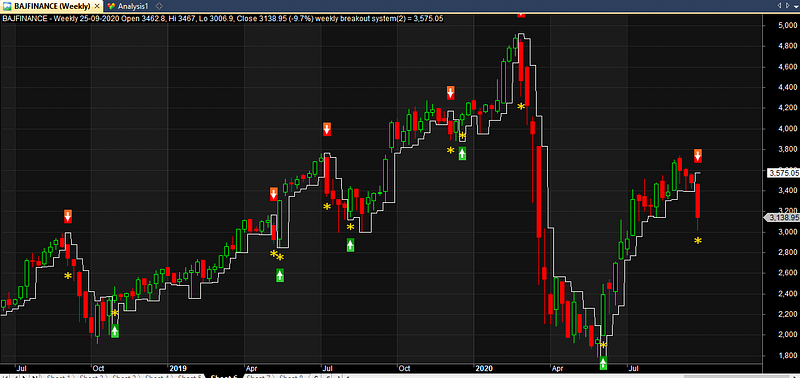

The strategy is able to capture trend reversals clearly, for example just before the crash happened in March 2020, it gave short signal in Bajaj finance and also by June 2020 the reversal in Bajaj finance started, and it clearly gave the buy signal.

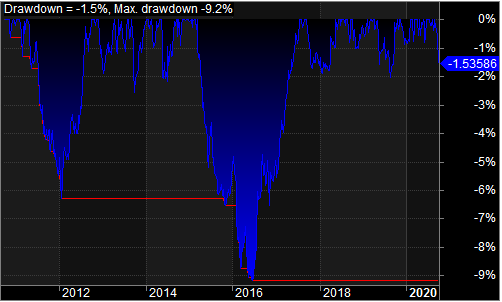

It has generated good returns with lesser drawdown

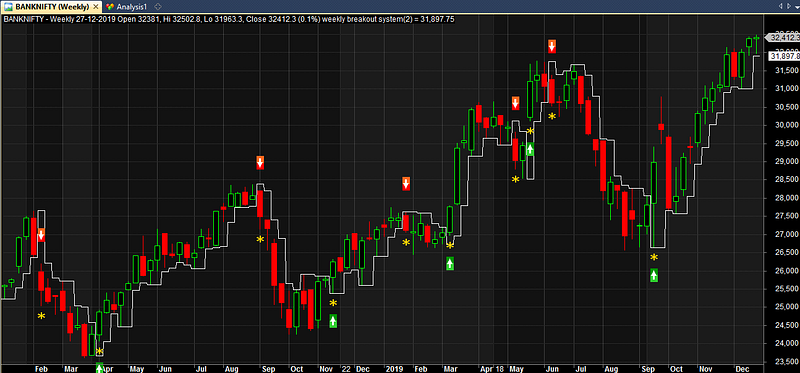

Even with Bank Nifty, the weekly breakout system has performed well, with just less than 100 trades in last 10 years, it has generated 22750 points with Bank Nifty.

As long as the instrument we trade is more volatile and trending in nature, such breakout system would end up providing positive returns. However, applying the same on non trending instruments like USDINR, Currency pair, commodity might not return good results. Anyone who has filter mechanism in place to short list stocks and looking to apply trending following rules, can implement this weekly breakout trading strategy with it.

Please note that the above results considered are just a random trending instruments, there could be lot many stocks like ITC which has never moved at all for years, applying any kind of trending following strategy in such stocks would fail miserably. With trend following strategy, your 80% of over all profits comes from less than 20% of trades, so it is important to apply the trend following rules with basket of stocks or multiple instruments, so that one or the other will capture the big moves.

I have added the AFL along with this article, so users can download it and add in their own parameters like changing weekly breakout levels from two weeks to three weeks or more, add own stop loss or target levels and explore more.

You can download the same with this link. If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

what is stop loss?

The Two week Low…

Read again. everything is explained clearly.

What about adding Stop and reentry. For example SL -0.5% – 1% and Reentry on 2Weeks H or L

As the trading is based on weekly close, we have to either go long/short only on Mondays & no actionto be taken duringother . Am I correct

As the trading is based on weekly close, we have to either go long/short only on Mondays & no actionto be taken during other days . Am I correct

Unable to open link in Google drive.please email to my email id saket1seth@gmail.com

can we apply it in zerodha