- October 24, 2019

- admin

- 0

A strong fundamental company like DHFL falling more than 40% in a day is really a very big thing. Such drastic fall in companies that are part of Futures & Options are not normal, we could see stocks falling down and getting locked in lower circuits like 20% are normal. But a panic sell off that we witnessed on Friday in Indian Stock market is huge.

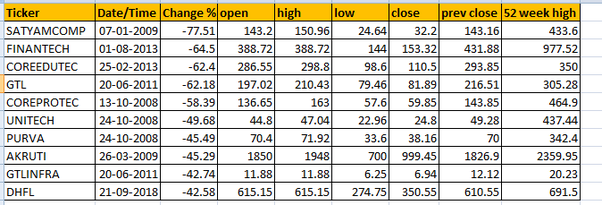

Before We analyze about DHFL, lets see the historical data and find out what are the other stocks that has fallen huge in just one day which were once fundamentally strong company, listed below are the top stocks that has fallen more in one day.

The top spot belongs to Satyam computers, the crash in Satyam was due to the founder Ramalinga Raju confession. Such a big crash for stock like Satyam was really a big deal, i have explained about it in my other answer.

Let’s see what happened to other stocks that has fallen big. Financial Technologies — The stock crashed more than 65% in just one day in the year 2013, the stock could never bounce back and touch it previous high levels. The stock is dead.

Look at Core Education, if you are an experienced trader/investor, everybody would have remember the companies like Educomp, Core Education etc, where media was literally saying that these companies are distrupting the indian education sector, this is the future, blah..blah..blah.. The stock corrected more than 62% in one day. And this is also dead now.

Here’s another company called GTL, after a huge fall in one day, the stock eventually declined further and has become a penny stock now

The 4 years of gain that this stock made was lost in just one day. That’s how the retail traders gets killed.

We know that other Stocks like Unitech, Purva, Akruti crashed badly during the realty sector crash in 2008.

Now coming to DHFL chart, whatever the gain it has made in last 3.5 years was gone in fraction of seconds.

Market crash that we witnessed yesterday is a serious cause of concern, this is what happens when liquidity issues arises, all big funds would sell their holdings in open market causing the stocks to crash, before even we realize about it and decides to exit, the stock would have already crashed more than 50%. This is what happened with DHFL.

Now the retail investors have seen their years of profits evaporated in fraction of seconds, by looking at all the historical data, it seems going forward, people would try to get out for every up move they see in DHFL. The Markets gonna have tough time to come back to it previous high levels going forward. We could end up catching a falling knife, Its better to stay away from DHFL for now,