- November 27, 2019

- admin

- 7

Let’s analyze two scenarios.

- How much we would have made by now, if we had invested X amount in Nifty bees every month.

- How much we would have made by now, if we had invested X amount only on Months when Nifty gone down significantly

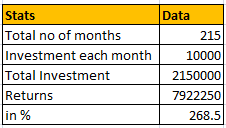

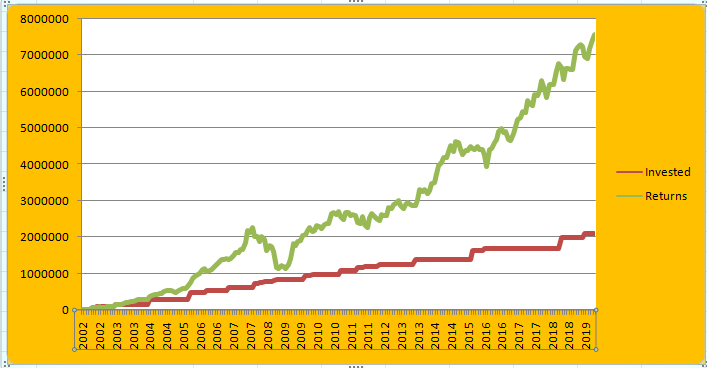

From Year 2002 to 2019, Nifty bees moved from 100 levels to 1300 levels. Consider we have invested Rs.10000 every month from year 2002 to till now. Then our total investment value would be Rs.21.5 lacs and our returns is Rs.79.2 Lacs, that’s around 268% over all.

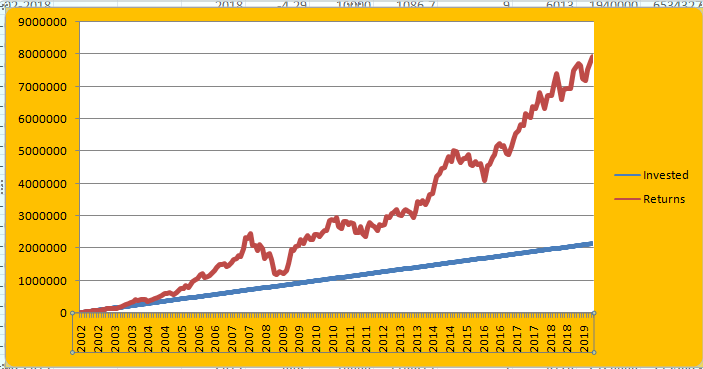

This is how your investment would have grown over the years.

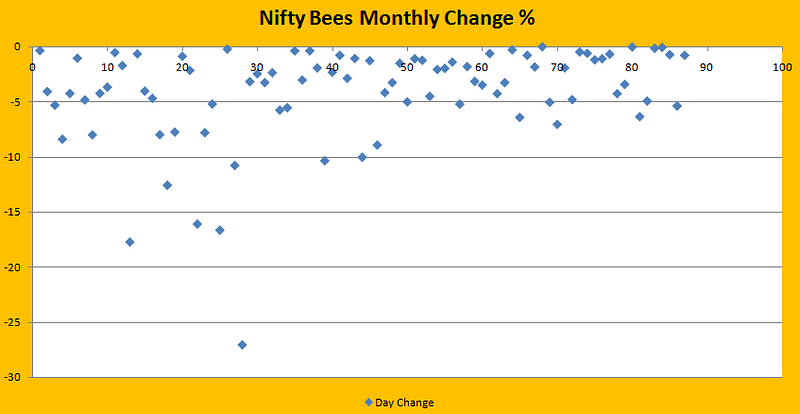

Now lets consider we shall invest only when markets have gone down,not on other months. Here’s the scatter plot of Nifty, as per chart it is evident market usually drops 0 to 5% often, greater than 5% are usually rare occurrence, so will consider investing in it only market drops >-5%.

If markets did not go below this point, we will not invest , we shall keep accumulating cash and wait for such correction to invest.

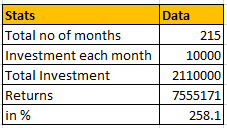

This is how your investments returns would have been, if you invested only when market tanks

As you can see, there were only 25 times markets corrected significantly in a month and years like 2017, markets kept on moving higher without any corrrections

The above analysis indicates, though investing only during correction times has given you good returns, still it did not beat the regular monthly investments. In the long term, equity always tend to move up, and when market enters the all time high territory, the volatility usually gets reduced drastically and you hardly see any fall in index. So its wise to stick to regular repeated fixed monthly investment, instead of timing the market.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

As you have taken a chart of 21 years its significantly very high time frame,what abt if we have a time frame of 10 years? Please provide analysis for 10 years time frame

The conclusion is DO NOT TIME THE MARKET, just keep accumulating Nifty bees every month instead of waiting for crash

1. In the second scenario, have you considered interest (assume FD return- risk free) on the accumulated cash till the time you invest?

2. Combine above approach and 3% correction (instead of 5) – and see what you get.

How about buying Nifty Bees every month, say Rs.10,000 (X amt), and also Invest 3X or 5X your usual monthly investment when nifty corrects more than 5% a month ??

It would be great if you could help us run an optimization, which would help us allocate the right amount during correction and help in achieving higher returns.

Thanks.

Is it better to invest in mutual fund or nifty bees ( for long term say 20 years )

Instead of investing in large cap mutual funds, better to go for Nifty bees.

Nifty beez