- June 8, 2022

- admin

- 0

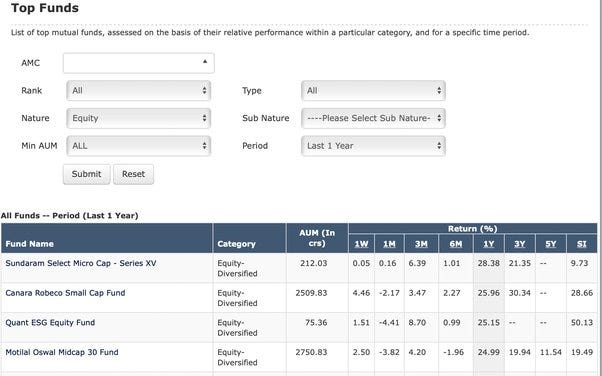

When it comes to investing, most beginners who want to get started with stock market investing opt for mutual funds. But do you know how many mutual funds there are in India? There are as many as 44 AMFI (Association of Mutual Funds in India) registered fund houses in India which together offer more than 2,500 mutual fund schemes.

How does a normal retail investor like you and me decide which one to invest from these 2500 mutual funds? It’s a tough task, but most of us would simply find which is the best fund based on its recent performance. We simply check which mutual fund has given the highest returns in the last 1 year or 3 years or 5 years and invest in it.

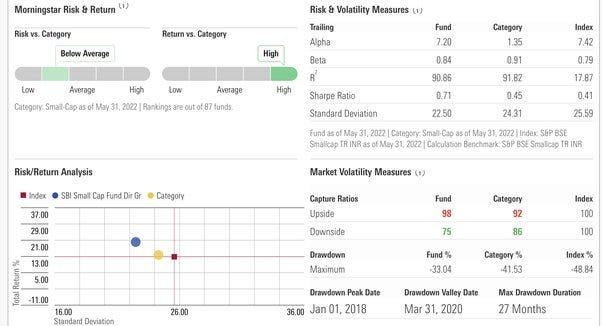

In addition to the returns we need to check the respective fund’s risk as well. How much downside we might need to witness before enjoying such high returns? Will you be able to handle the high drawdowns from these small cap mutual funds ? If you observe closely, you will see that most of the high returns generated from mutual funds are from Midcap /small cap funds. But if we check the risk measures of these funds, the standard deviation is as high as 30%.

For instance SBI small cap mutual funds which generated 22% CAGR has given such higher returns with max drawdown of -33% with max drawdown duration of 27 months, which means you would see zero returns in this 27 months, as a long term investor you need to sail through such rough phases in addition to the high expense ratio.

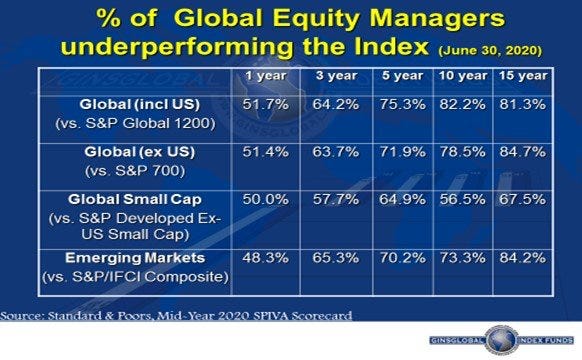

We always compare our portfolio very frequently with indexes to see how it’s performing. Not every fund can beat the benchmark index every year. That’s highly impossible, there will always be some funds which underperform for a prolonged year since most of the small cap mid cap stocks are cyclical in nature, so if these mutual funds hold such cyclical stocks in their portfolio it tends to affect their returns.

In the long run more than 85% of fund managers fail to beat the index returns. So the odds are completely against retail investors like us who rely on mutual fund managers for our investments. We should be extremely lucky to pick those 15% of fund managers who beat the index in the long run. And that’s really hard.

When we pick a mutual fund today, we are committed to invest in it for 15–20 years, are we sure about the fund manager sticking to the same fund house for such a long period? He might change his job in between, after all he too wanted a raise in salary. So when we pick a mutual fund, we are getting into a marriage relationship with the fund manager trusting him to provide higher returns. But that’s not certain.

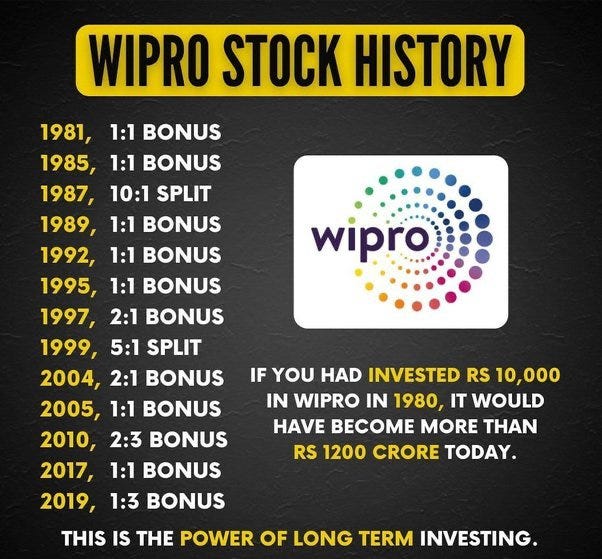

Even if we wanted to be our own fund managers by doing all the research and analysis by ourselves, is it possible for us to beat index returns in the long run? Remember all those Wipro, Infosys, MRF, Bajaj Finance stories where if you had invested 10K, You would be worth 1000’s of crores today.

But the point is no one tells you what stocks should we invest now which can be the next Wipro, next Infosys. The truth is No one knows that. Just look back at your own life, every one of us will have a friend who falls in extreme cases, one who studies hard and will always be a topper and another one will always be a back bencher who doesn’t give a damn about anything. But back then everyone would have thought this bright student is the one who is going to shine in life, whereas we all know that’s not true.

Many of my own friends who were back benchers are extremely successful, running their own profitable startups earning 10x more income than the toppers in our school days.

Similarly it’s hard to predict which company will be successful, its not simply the kind of business the company is into decides the success or failure, it’s the person behind these company decides the future, Amazon is what it is not because of Jeff Bezos not because its into ecommerce industry, Microsoft is what it is now because of people like Bill Gates, for every successful story like Wipro or Infosys, we have failure story like DHFL or Yes Bank.

Only thing that is certain is that most of the stock market index around the world will go up in the long run. After all, the index itself is like momentum investing, good stocks stay in the index and bad stocks get removed from index periodically. So by investing in an index fund, we remove all the issues.

- We will never compare our investment with index, since we are directly investing in index itself

- Lower expenses since its index funds, hence higher returns

- Not relying on fund managers

- Need not worry about any individual companies which might go bankrupt like DHFL which was part of Nifty 50 once, was removed from index at one point of time. So bad stocks get removed automatically and we don’t need to worry about any such news.

Even someone did a SIP with Japanese Index, his returns would have positive inspite of the fact that Nikkeiindex took 30 years to cross its previous peak.

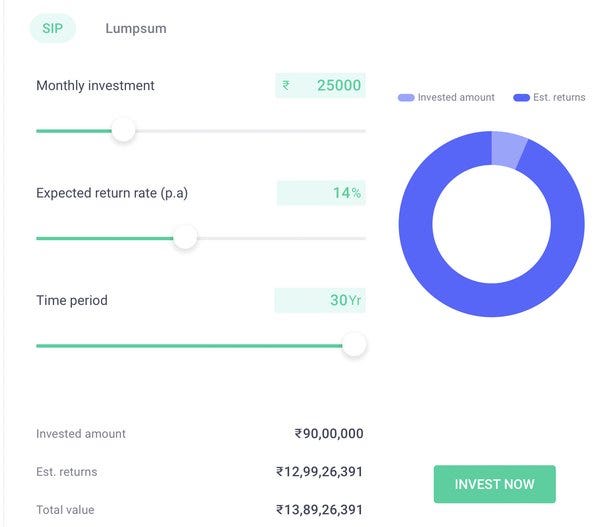

Index funds like Nifty 50 and Nifty next 50 generate on an average 14% returns, if you are investing just Rs 25,000 per month for next 30 years, you will end up with a huge corpus of Rs. 14 Crores.

This is without any research, any analysis, any mutual funds. Just a simple SIP on index funds could give you this returns of Rs. 14 crores after 30 years.

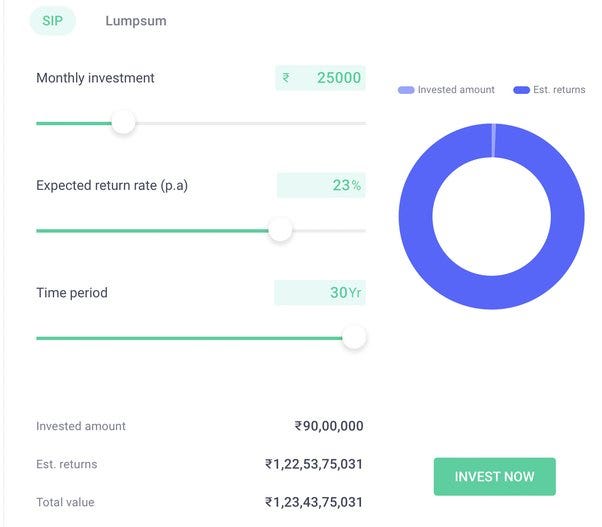

But you know what, if really can do the analysis, study the balance sheet of all companies and able to choose the right stocks, where if you can generate just 23% average returns instead of index returns of 14%, then do you know how much corpus you will have by investing only Rs. 25,000 per month for 30 years? Any wild guesses?

You will have more than Rs.120 crores! Yes, that’s true. That’s the power of long term investing, compounding works in your favour. The longer you hold, the higher the returns. You don’t need to focus on huge returns, just making 23% average returns is enough to make 100s of crores, but remember even that’s not so simple. But if we can do this, then nothing can beat stock market returns in the long run.

If you liked this article, please do share it (Whatsapp, Twitter) with other Traders/Investors.