- March 31, 2020

- admin

- 5

There are tons of stocks which are available for retail investors to choose from when it comes to long term investing. Most investors choose a industry and try to invest on specific industry leaders. In this article, we shall explain about what are important factors one should consider for long term investing and how one can follow a simple rule based approach to pick top stocks from every sector.

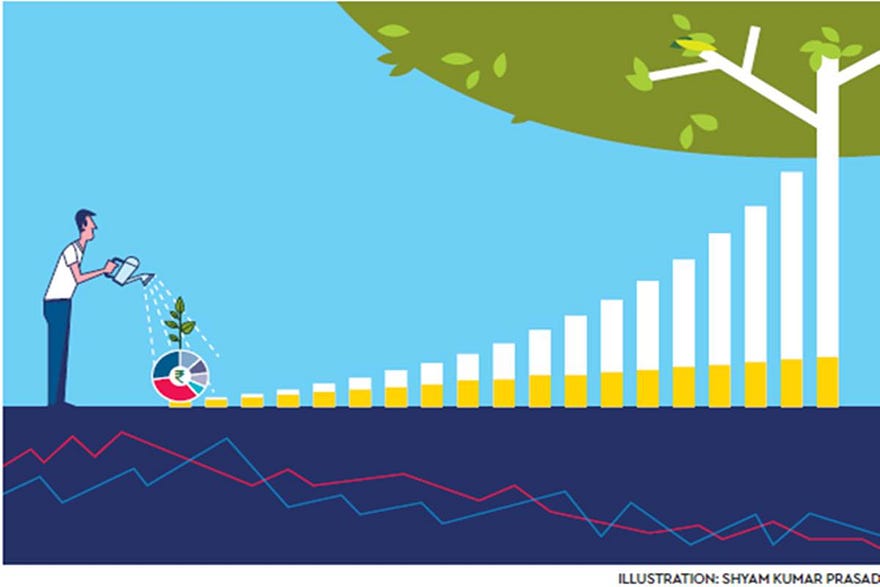

If we check NSE 500, there are 18 different sectors with multiple companies belongs to each of this sectors

Financial Services sector alone consists of 69 different companies, followed by Consumer Good sector.

When it comes to building a long term portfolio, our aim is not to make to higher returns, because when we aim for higher returns, we need to face higher volatility as well. Which means, when you want to make 20% returns with your long term investments, you might see a draw down phase, where your total investment can go down -50% or more than that. Returns comes with specific risk, and this is where most of the investors lose confidence after seeing their capital getting wiped out during tough times.

So our aim should be look for companies that provides reasonable returns with risk not crossing our average returns. If your returns is 20%, we should not face risk of more than 20 to 30% to achieve this 20% returns, how much we are risking to make our returns matters the most. To find that, we follow a simply ratio,

- find the last 10 years average yearly returns of all stocks in each sector,

- then find the standard deviation of the yearly returns.

- Now divide the average yearly returns with yearly standard deviation,

- You get a ratio, higher the ratio better the stocks are.

We shall find what are the top 3 stocks to invest in every sector.

Automobile:

Listed below are the top 5 stocks, where the standard deviation is not much higher than the yearly returns. Bala Krishna Industries is top stock where average yearly returns for last 10 years was 36%, in order to achieve this 36% returns, the risk involved was 46%. So usually, the expected returns going forward can be average + 1SD (36%+46%) on a positive side and negative side average — 1SD (36%-46%) which is -10%

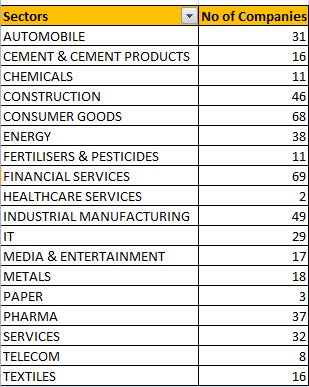

Cement Sector:

These are the top 3 stocks in Cement sector, the ratio in this sector is not really good, your risk is double that of your returns, which is not so good. Better to avoid.

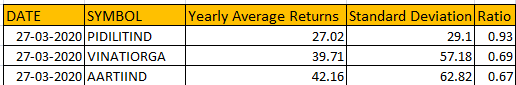

Chemical Sector:

These are the top 3 stocks in Chemical sector, the ratio is really good for Pidilite Industries stock, your risk is almost equal to that of your returns, which is good. Good pick for long term investing. Even if you consider present scenario, when Nifty and other mid cap companies were severely affected, Pidilite did not fall much.

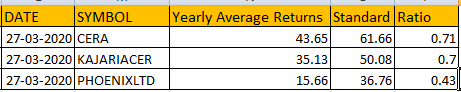

Construction:

These are the top 3 stocks in Construction sector, the ratio in this sector is ok, where Cera and Kajaria Ceramics are better, your risk is almost 0.7 times that of your returns, which is average.

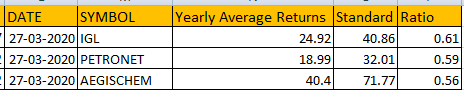

Energy:

Energy sector is not really doing well, and these are top 3 stocks if one wants to invest in this industry. The risk to reward ratio is not so good in this sector.

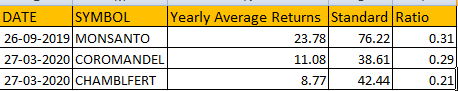

Fertilizer:

This sector is really bad, look at the ratio, its way lower than other industry you end up risking more to make a decent returns. Its better to avoid investing in this sector.

Financial Sector:

When it comes to finance sector, there is no doubt KOTAK BANK is the best of all. The returns to risk ratio is really good, and that’s why even when Bank Nifty and other dozens of top banks corrected significally during this Corona Virus crisis, only Kotak Bank did not fall much. Listed below are the top 3 companies in finance sector one can consider investing for long term.

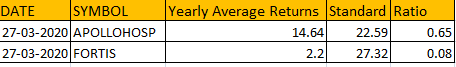

Healthcare:

Healthcare sector consists of only two stocks, Apollo Hospital and Fortis. Apollo Hospital has provided decent returns over the long term with little bit higher deviation/risk.

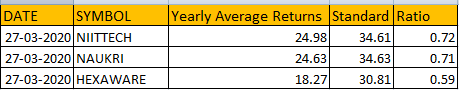

IT Sector

After financial sector, IT sector consists of many favorite stocks among investors, but only these 3 tops the list that provides better risk adjusted returns over the long term.

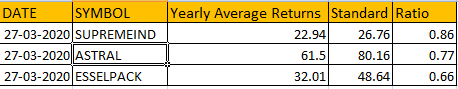

Manufacturing:

Even though manufacturing index stocks aren’t performing well, these stocks are exceptional that has provided better returns for the last 10 years with least risk. Supreme Industries is really a good pick in this.

Media:

Just like fertilizer sector, even this sector haven’t produced a better risk adjusted returns, where the deviation is considerably high. If you do not want to have higher fluctuations in your portfolio, better to avoid this sector.

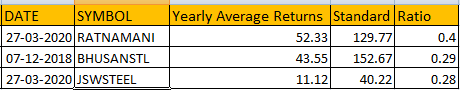

Metals:

Metal industry is another sector which is safe to avoid considering their higher risk, the standard deviation is so high for these stocks, which would have a higher impact on your portfolio if you invest in them.

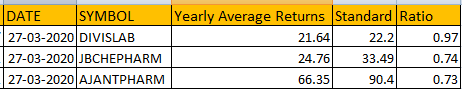

Pharma:

Though many investor’s favourite are stocks like Sun Pharma, Auro Pharma , both of these stocks are not in top list. Divis Lab tops the list with lowest standard deviation and this is also a perfect example during the recent sell off happened in Indian Stock market, where Divis Lab is the least affected. Definitely one can consider this stock from Pharma sector for long term investing.

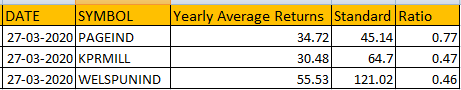

Textiles:

Out of dozen other textile companies, Page Industries is the only stock that given better risk adjusted returns than all other stocks.

Sectors like Paper, Telecom and Services doesn’t not have any good stocks to consider for long term investing. Its better to avoid any stocks in these sectors.

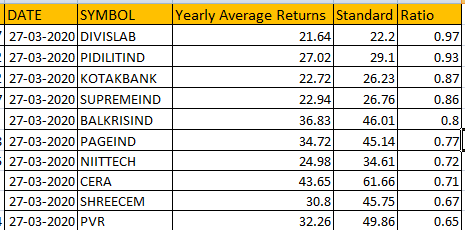

Out of all these above mentioned sectors, we checked what are the top 10 stocks one can consider investing for long term in each of these sectors. These are the top 10.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Dear sir

Help us with a small case with all potential stocks for one year time frame sir. As this is start of financial year kindly help us with a small case where we can invest in sip mode sir please

For SIP, you can check our QSIP service where we recommend to invest 5 stocks every month. https://squareoff.in/graph/qsip/

Thank you for sharing this,

This is very interesting,

What standard deviation have you used 1 sd or 2 sd.?

The rational I can think of is good returns , with low sd , will give us better ratio .

So returns , with less price fluctuation. Will be good .

Also dose any sector have a range of such ratio to be favorable or unfavorable.

Thanks again

Can this be automated on screener website, so that we can see regular updated status?

yes you can do that