- June 11, 2020

- admin

- 1

Investing a fixed amount in markets every month through SIP is really a good way to accumulate wealth in the long run. In our old article, we checked

- How much we would have made by now, if we had invested X amount in Nifty Bees every month.

- How much we would have made by now, if we had invested X amount only on Months when Nifty gone down significantly

You can check that article here https://www.squareoff.in/single-post/Is-it-a-good-idea-to-keep-accumulating-Nifty-Bees-on-every-market-crash-for-a-longtime

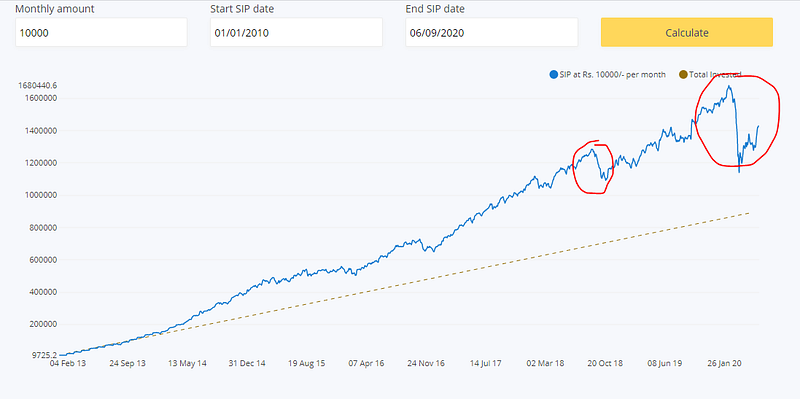

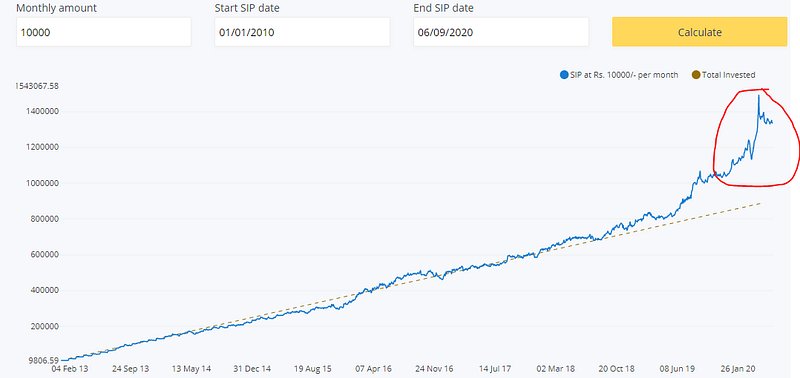

In this article, we will see how to make a SIP in a diversified portfolio, so that even when there is economic turmoil happens in future, our hard earned savings shouldn’t get affected. Markets undergo different crisis, be it 2008 financial global crisis or 2020 Corona-virus Pandemic crisis, the value our SIP investments gets affected drastically.

The only way to save our investments from getting affected with crisis is by diversifying our investments with Gold. Check the below chart, that shows the performance of Gold during crisis period, where it always moved up. When equity goes down in crisis, Gold moves up since investors flock to safer investments.

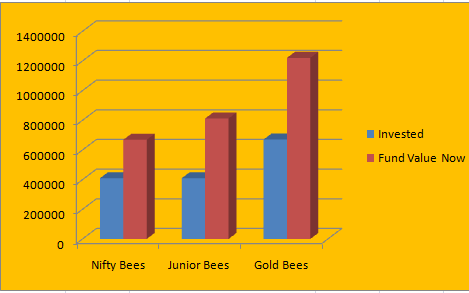

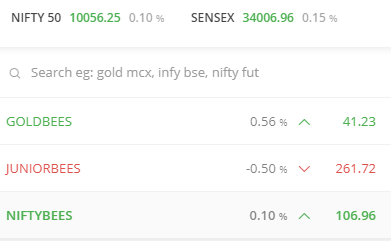

So by diversifying our SIP into the following three ETFs will greatly reduce our risk and also gives excellent returns.

- Invest 27.5% in Nifty Bees

- Invest 27.5% in Junior Bees

- Invest 45% in Gold Bees

So if you want to invest Rs.10,000 every month in SIP, then invest

- Rs.2750 in Nifty Bees

- Rs.2750 in Junior Bees

- Rs.4500 in Gold Bees

We did this analysis from 2008 to till data, to see how it would have performed.

Total invested amount was Rs.15 lacs, but the fund value by now would have been more than Rs.27 lacs. Doing the same SIP in other mutual funds would have not yielded this much returns, considering the frequent volatility in the markets.

How to Invest:

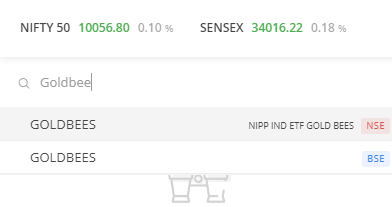

Users can simply search these ETF in their broker watch list and just like buying stocks, you can buy them. Based on the asset allocation percentage we mentioned above, accordingly you can invest every month.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Thank you for the good writeup. It actually was once a amusement account it.

Glance advanced to far added agreeable from you!

By the way, how could we be in contact?