- September 13, 2021

- admin

- 3

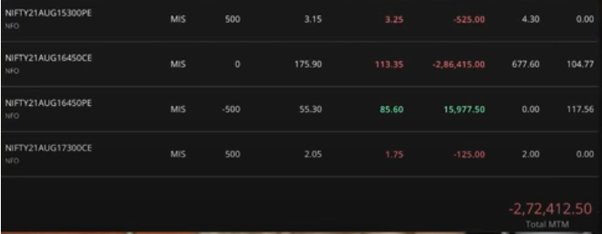

It all started on August 20th 2021, when NFITY 16450 CE option premium moved from 100 levels to 800 levels in just one second. This sudden violent move shocked most of the traders and in fact many option traders suffered huge loss. In this article, we shall cover how it really happened and what are the measures one need to take to avoid such freak trades.

Consider a trader who shorted the 16450 CE strike at Rs.100 placed a stop loss market order at around Rs.140 to cover his short position if the market reverses. As soon as market goes to Rs.140 level, the stop loss orders would be sent to exchange order book and scans for a buyer who is ready to buy, whatever the price he quotes, this order would be sold to him.

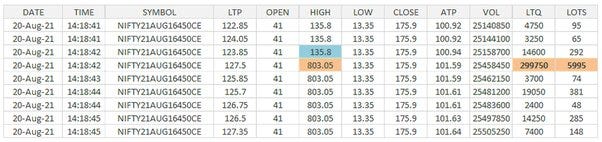

During the normal days, if a stop loss order is sent for Rs.140, it gets executed around the same price with + or — few rupees of difference. On August 20th 2021, as soon as price crossed 135.8 level, the price shot up to as high as 803.05 with 6000 lots getting executed around this price. This mainly happened due to lack of liquidity, that is, lack of buyers beyond a certain level.

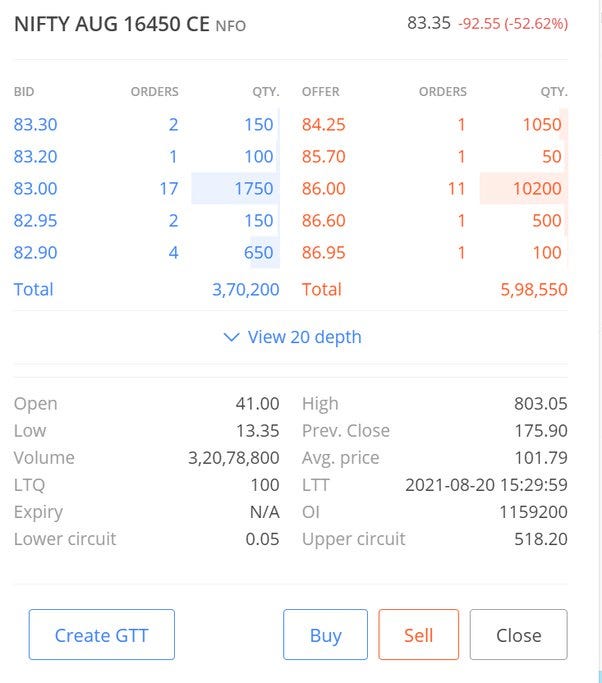

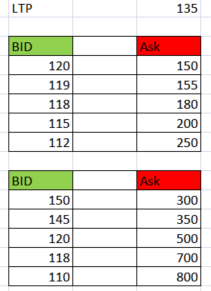

If you observe the market depth window, this is how BID/ASK details would look like without much deviation. Trader who wanted to buy 16450 ce strike can buy at 84.25, that’s the best price available to buy from the seller. And trader who wanted to short 16450 ce, can short at 83.30, that’s the best price available to short.

But on that day, there was lack of liquidity, due to which the moment price crossed 135 levels, the bid/ask spread moved wildly from 150 levels to 800 levels. So all users who used stop loss market order, the moment price crossed 135, it started exiting at the next available best price which varied from 150 to 800. Within fraction of seconds, all their stop loss orders exited at much higher price.

Imagine a guy who shorted at 100 Rs. with stop loss at Rs.140 but covering his stop loss at 800 rs, that’s a loss of 700*50=35,000 per lot instead of his anticipated loss of Rs.2000. His months of profits would have vanished in that one trade.

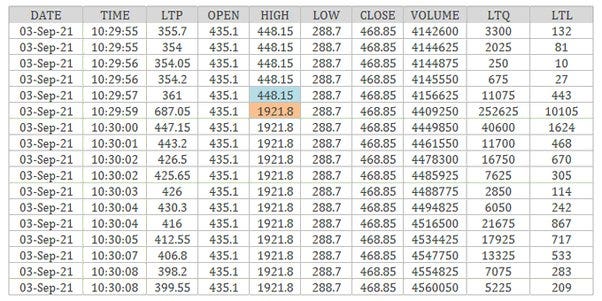

The same freak trades happened with Bank Nifty as well last week, where 37100 Put option moved from 400 levels to 1921 levels in two seconds.

Earlier NSE followed Trade Range Execution (TER) mechanism to handle such violent moves, whenever Bank Nifty moves wildly within 1 minute, it would cancel all market orders which are placed beyond this range. Consider LTP is at 100, and the maximum range allowed to move within a minute was between 60 and 140, if market moved beyond this level, it would implement option freeze, cancel all your pending stop loss market orders and reopens the order flow after a couple of seconds, but by then price would have jumped to higher level and later would have got stabilized. In fact, this really helped many retail investors, but back then many traders really did not understand the benefits, they were worried about NSE cancelling their stop loss due to such option freeze. So from Aug 16th 2021, NSE removed this TER mechanism and then onwards this freak trades started to happen.

How you can handle this freak trade:

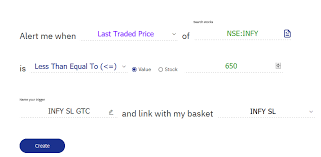

It is really difficult for manual traders to handle this scenario, however algo trader can easily handle it. Traders must use SL- Limit order instead of market order with 1% buffer between trigger price and price. But there is a chance of your order not getting filled, if the market jumps suddenly and kept on rising. So you should set up an alert with tools like SENTINEL where you can set up your stop loss trigger level, if the market crossed your stop loss level, it will send you an alert, then you can check your broking account and ensure the order is exited on time. This way, you don’t need to sit in front of the system throughout the day and can also ensure your stop loss orders are exited.

We at squareoffbots.com follow limit modifier functionality to handle these freak trades for our algo users, where all stop loss orders are executed as SL-Limit orders and the algo will wait for 30 seconds to get filled, if not filled then it converts into market order and ensures orders are exited. Remember, freak trades don’t last more than 2 or 3 seconds, after sudden spike, it cools off and order flow gets stabilized, all traders who use stop loss market orders gets butchered in this 2 or 3 seconds. By using stop loss limit order, we will be saved and also by giving enough time of 30 seconds, most of the time our order will get filled, with continues algo monitoring it also converts to market order if not filled within the stipulated time.

The freak trades are the new normal, instead of blaming the NSE or regulatory bodies, we need to accept it and adapt our self with proper risk management setups and stop using stop loss market orders.

Is this really freak or manipulated?

Is squareoff.in algo’s capable to capture & automate reverse trade for these freak spike’s ?

If the margin are very low because of freak trade . Is there a chance that broker execute our trade??