- June 29, 2022

- admin

- 4

Every time after I make a SIP investment, market tends to go down in next couple of days. I always wondered I would have made higher returns with my SIP if I waited for market correction. Momentum traders always get into a trade when there is a uptrend and exit their trades when the downtrend starts, even they think their SIP returns would have been higher if they invested only during market uptrend and avoid SIP during market downtrend to avoid major drawdowns.

Every one of us would have thought about it, we always assume we might end up with higher SIP returns if we apply any specific strategy towards it.

Does making SIP only during market correction generates higher returns?

Let’s look at the historical chart of Nifty 50 for the last 16 years. Nifty has moved from 3000 odd levels in 2006 to 18000 levels by 2022. I have applied 10 month moving average to the chart, instead of using 200 day moving average I always prefer using 10 MA on monthly chart, because it greatly reduces the noise. When you use daily charts, there are lot of movements and tons of gaps that affects the over all trend when you apply a moving average chart into a daily charts, but once we move to monthly many of these noise are eliminated and shows a smooth graph which helps us to identify those bear markets.

When ever Nifty goes below 10 month moving average, we can consider the market has become weak and if goes above this 10 MA, then we can consider market has become strong. Let us consider different scenario for making our SIP investment on Index.

- Invest X amount only when market trades above 10 MA, if it close below 10MA on a monthly basis, then exit all our holdings. Wait for the index to close above 10 MA, once it does then invest all our investments again along with that will continue our monthly X SIP investment.

- Invest X amount when market trades below 10 MA, if it close below 10MA on a monthly basis, then ONLY we will start our SIP, if markets continues to trade above 10MA, then we will continue to accumulate cash and wait for market crash, the movement it goes below 10 MA, then we will invest lumpsum of all savings we accumulated so far and also continue to invest X amount every month as long as it trades below 10 MA. The moment it goes above 10 MA, we will stop our investments and continue to accumulate cash.

Basically one scenario is follow momentum / trend following approach, where we invest only when market keeps going up and avoid investing during bear markets. Another approach is the most interesting one as many of us want to invest only during crash, where we keep investing during down trend alone and stay out of market and keep accumulating cash to invest for next crash.

Let’s see how much each of these approach would have returned if we followed it since 2006 to till date.

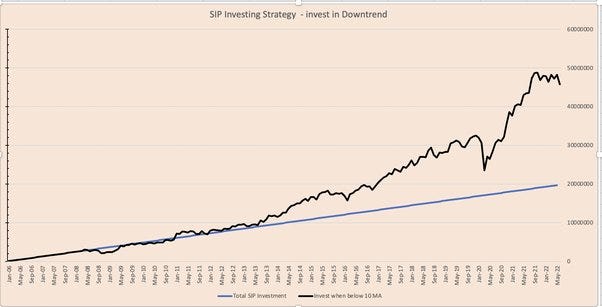

Invest only during crash:

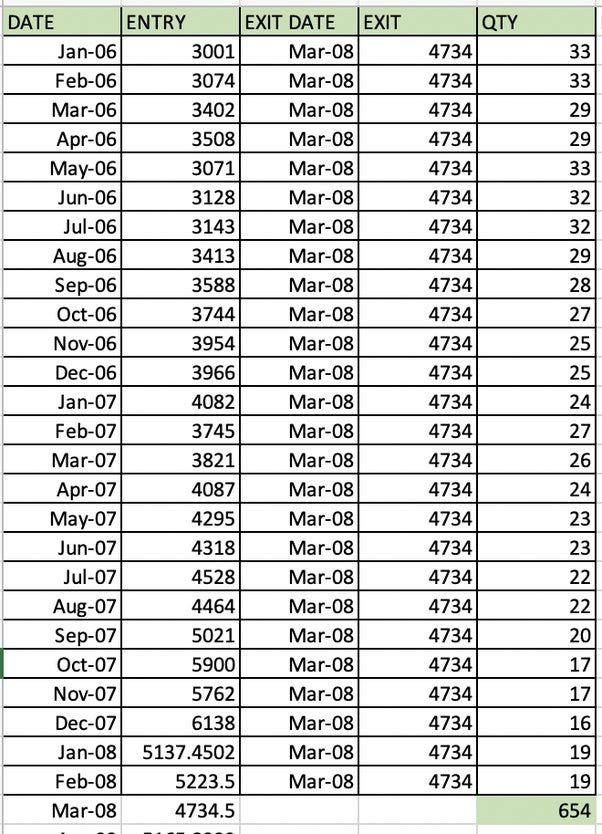

Let’s consider the third scenario first, what would be our returns if invested only when market close below 10 MA. In last 16 years, there are 6 to 7 instances where market corrected significantly. In 2008, due to global financial crisis, market corrected more than 60% and again in 2016 due to Brexit /demonetisation and other geo political events Index corrected more than 20%, similarly in 2020 due to Corona pandemic market corrected around 30%. Our investing during crash approach would have made use of all these correction period and invested in index.

From Jan 2006 to Feb 2008, we would have not invested a single penny in markets, since Nifty continued to trade above 10 MA, so during these period we would have kept on accumulating cash, so consider if we are planning SIP investment of 1 lac every month, then for 26 months we would have just accumulated cash and deployed all that cash of 26 lacs in March 2008 when market closed below 10 MA, then until it moved above 10 MA, we would have continued our 1 lac sip investment to index every month and continued till April 2009, during the prolonged down move where index corrected 60%, we would have accumulated 894 units of Nifty index.

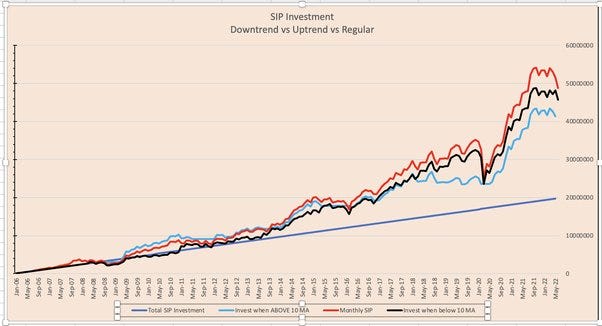

Like wise we replicate this from 2006 to 2022, with this approach we would have invested 1.98 crores so far and the fund value would be 4.57 Crores.

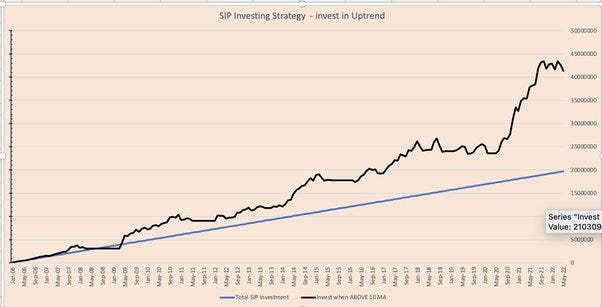

Invest during momentum:

In this second approach, we are investing same SIP 1 lac every month only when market trades above 10 month moving average. We are investing only during up move and book all profits when down trend starts, and then re invest again when the up move resumes.

From Jan 2006 to Feb 2008, we would have kept on investing every single month then booked all profits by march 2008 when market started its downtrend by closing below 10 MA.

With this approach we would have invested 26 lacs between jan 2006 to Feb 2009 and also made around 5 lacs profit since market also moved from 3000 to 6000 during this period. We will sell all our holdings in march 2008 when it closed below 10 month moving average. Then from march 2008 to April 2009 market was in heavy downtrend and it remained below 10 month moving average, so we would have not invested any single penny during this period but we would have accumulated cash every month by April 2009 it closed above 10 MA. So we will deploy all our accumulated cash + previous exited holdings value in April 2009 when index resumed its uptrend.

Like wise we will repeat this approach from 2006 to 2022, with this approach of making SIP investment only during uptrend we would have invested 1.98 crores so far and the fund value would be 4.13 Crores.

Let’s see what’s the maximum drawdown in both the cases.

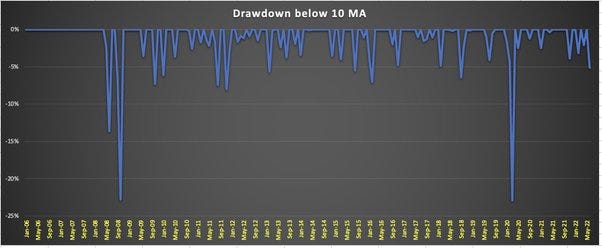

Downtrend SIP Investing:

The maximum drawdown is around -23% when you make your SIP investment during downtrend.

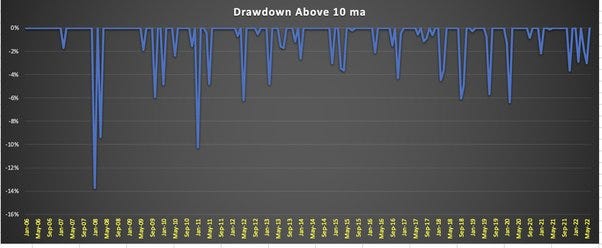

Uptrend SIP Investing:

The maximum drawdown is around -14% when you make your SIP investment during uptrend. The drawdown is relatively lower in this scenario because we completely book profits and stay away from bear markets or prolonged downtrend period, hence our investment value doesn’t go down.

Let us bring in a third approach

Invest every month:

In this approach, we follow the boring method of regularly investing every month. No analysis. No worry about downtrend or uptrend. Just keep investing. To our surprise, this approach of regular SIP investment every month has given the highest returns compared to any other approach of investing during uptrend vs downtrend. With this approach we would have invested 1.98 crores so far and the fund value would be 4.88 Crores.

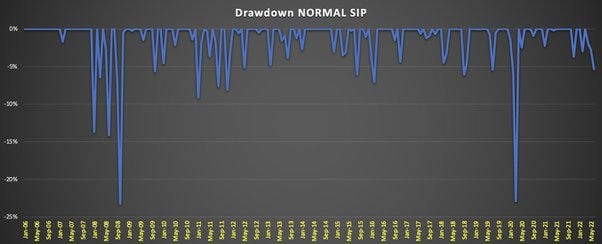

Even the drawdowns with normal SIP is around -23% only

Conclusion:

Market always tends to go up in the long run since economy of most of the countries might face short term pressures but over the larger period due to rise in working population, the economy does well which in turn reflects in stock market. We can never be sure about any single company, so betting our savings through SIP on stock specific might be riskier, instead investing in index funds is comparatively less risker. Since the exchange keeps adding good performers to the index and keeps removing bad ones from the index, this ensures smooth upward journey in index move.

By testing our SIP investing approach in both scenarios uptrend and downtrend, we can conclude that the regular boring approach beats every other type of investing strategy.

Just keep investing!

Do first 2 methods (selective SIP) take the gain (interest) into account when cash is not invested in Market ?

This is really fascinating, You are a very skilled blogger.

I’ve joined your rss feed and look ahead to seeking

more of your great post. Also, I have shared your website in my social networks

What is the drawdown for sip every month

Great analysis.

What if we add some minimum ROI on the accumulated cash in approach 1 & 2. Like, may be can accumulate the cash in LiquidBees till we get a chance to invest.