- September 10, 2019

- admin

- 2

Here’s a strategy for BTST (Buy Today & Sell Tomorrow), the logic behind this strategy is derived from Open=Low, Open=High intraday strategy.

Open High Low — Trading Strategy

The open = high, Open= low strategy is quite popular intraday strategy, simple and easy to use.

Find the scrips with open = low and they are your BUY scrips

Find the scrips with open = high and they are your SHORT SELL scrips

Enter the trade after 15–30 minutes of trade if the opening low is not breached

This is the trade setup, but at the initial level or beginer stage, traders use it, but later they drop this strategy, mainly because of high failure rate.

After few mins, these open=high, open=low stocks tend to reverse to hit our stop loss/breaks low or high. If you enter trade after 15 mins, 30 mins or even after 1 hour, the breakout failure do happen.

We did a data analysis, to find out what would be the result if we use the same condition for BTST? Buy Today and Sell Tomorrow.

Condition would be, after 3:25 PM,

check the list of stock that satisfies the condition Open=Low, go long on these stocks and exit at next day close.

When the stock stays Open=Low for the entire day, it shows significant buying strength and more upside is expected on coming days and by entering after 3:25 PM, we are entering almost at day close, so its impossible for the stock to breach Day low in 5 mins.

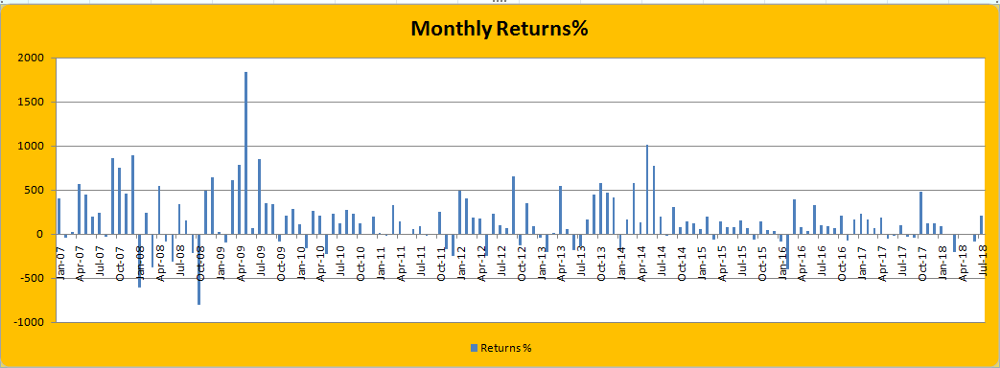

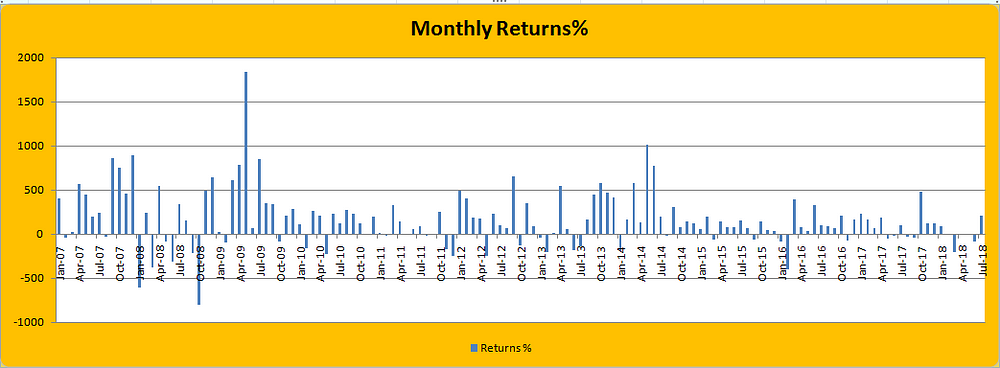

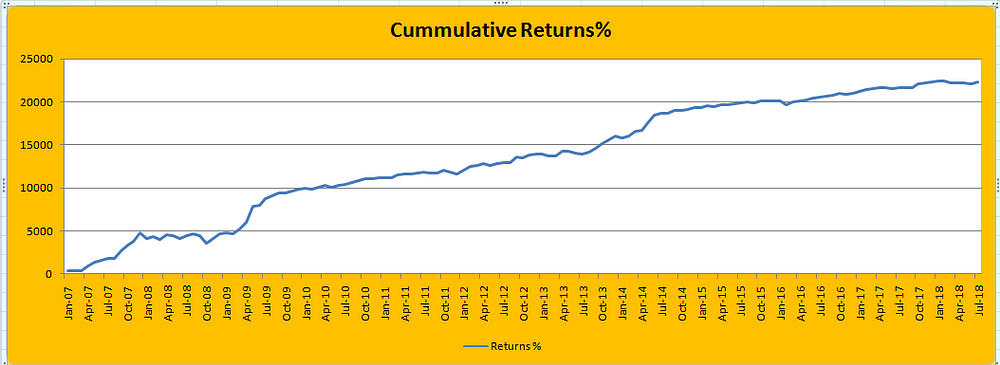

I have considered only FnO stocks for the backtest, so that we could avoid getting trapped in cheap that stocks that has circuit filters. The backtest period is between 2007 to 2018, 11 years of data. The results are much better than the intraday strategy.

During the times of High volatile period like 2007/2008 it has provided exceptional returns. As I have considered basket of all FnO stocks, the no of trades are higher. Total sum of Returns for last 11 years is 22350%, with average of 28 trades per day, which is practically impossible to implement.

However, it shows that the logic behind the strategy has a positive edge and if we just have a basket of 10–15 stocks, it is more easier to implement and follow.

And please note that this is a plain simple strategy and doesn’t have any high winning accuracy, it has just 50% accuracy with a risk reward ratio of 1.3

Traders who want to increase the accuracy can add more condition to the strategy by applying filters like choosing stocks only that trades above 200 DMA, or stocks that are near 52 week high or only uptrend stocks etc which would increase the deficiency of the system.

The backtest results can be downloaded from here.

For more such analysis and articles, follow us at our Telegram Channel and blog.

What will be the outcome if we come out at 9.20am next day.???

Do add for Buy RSI(10)>60 and Sell RSI(10)<40 and see the Magic…:-)