- October 14, 2019

- admin

- 0

With the recent IPO of IRCTC making headlines everywhere with stellar listing making more than 100% returns for those who invested through IPO.

There are many companies that go for IPO in Indian Stock market, however only very handful of well know companies Indian Investors go after. Many investors subscribe to their IPO with different demat account with a hope that they get allotted with shares. Few people are lucky enough to get allotment and make some quick listing gains when the share gets listed on exchange with certain premium. However, many investors do not get allotment and if the brand is very well known, people don’t hesitate to go after it when the stock gets listed on the Stock exchange.

So we did a 11 years data analysis to find out what are some of the well known brands that has gone for IPO and what would have been the returns if we have bought them on listing day instead of IPO, and hold onto it for a month. Not everyone is lucky enough to IPO allotment, so buying them on listing day is possible for every investor, if we could analyze the multi year data and see how’s the returns if buy and hold for a month, then it would help many investors to make right decision.

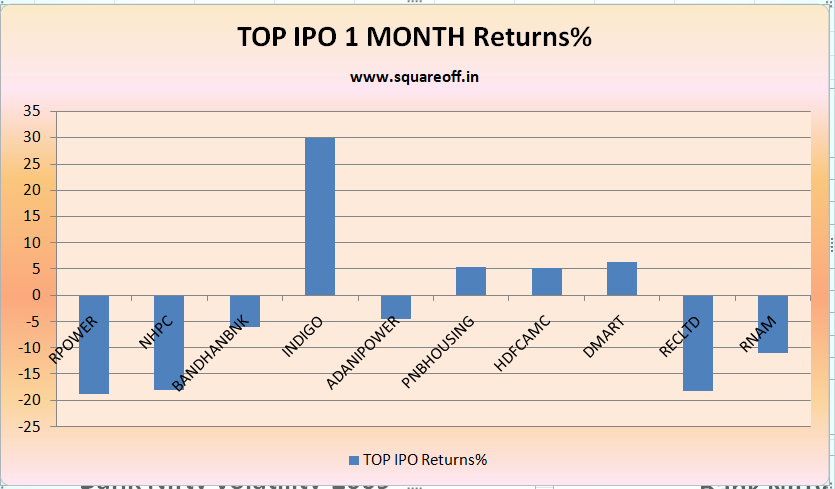

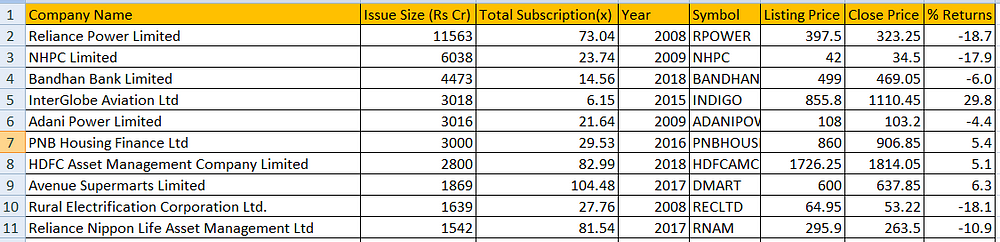

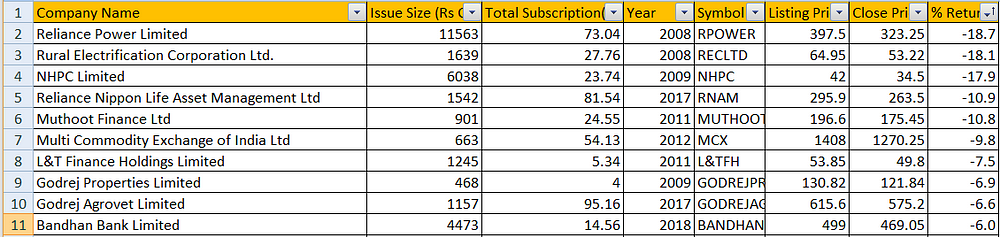

Since we cannot go after every IPO that are getting listed, we shall focus on only IPOs that are a well known among Indian investors. Here’s the list of some of TOP IPO in last 11 years based o issue size. I still remember Reliance Power IPO, from Chaiwala to Investment Bankers, everyone were after Reliance IPO during those time, but the Global financial crisis of 2008 made it one of the worst IPO, as many investors lost money on it.

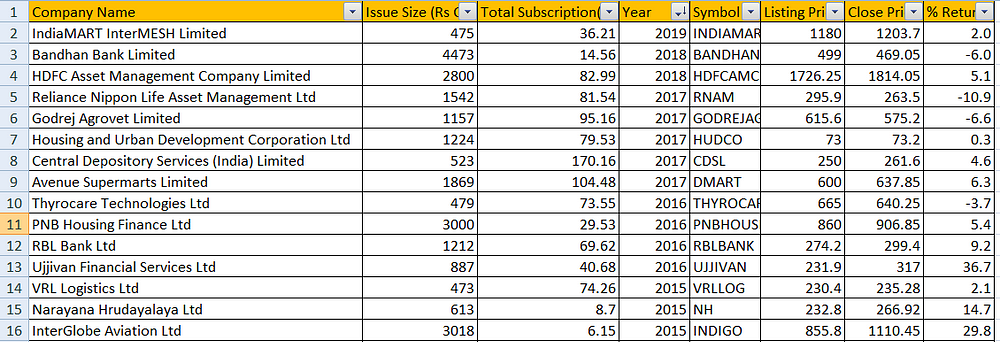

Of all the famous IPO, Indigo stock has made the highest returns for investors who bought the stock on listing day and hold it for a month. Even the most chased DMART ipo returned only 6% returns to investors who bought it on listing day.

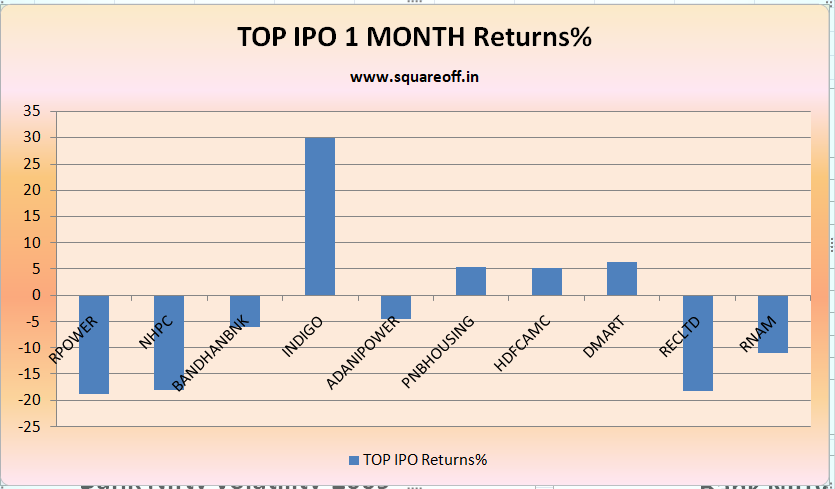

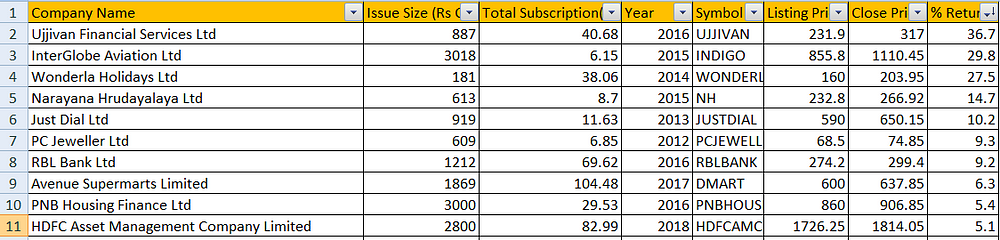

Here’s the list of TOP 10 IPOs that given the highest returns to the investors who bought the stock on listing day. Ujjivan stock has given the highest returns to investors who bought the stock on listing day and hold it for month.

And here’s the list of TOP 10 IPOs that given the worst returns to investors who bought the stock on listing day and holding it for a month period.

And here’s the list of IPOs and its monthly returns sorted based on recent listing period.

If we go by the above data, it is evident that during the short term period, most of the well known IPOs did not perform well after the listing date. However, over the long run the fundamentally good stocks like DMAR, HDFC AMC, BANDHAN BANK etc started performing well. If you are a long term investor, its better to avoid buying the stocks on listing date and wait for correction in the stock price, you will get opportunity to buy at a better price.

Follow us at https://t.me/squareoff_