- March 27, 2024

- admin

- 0

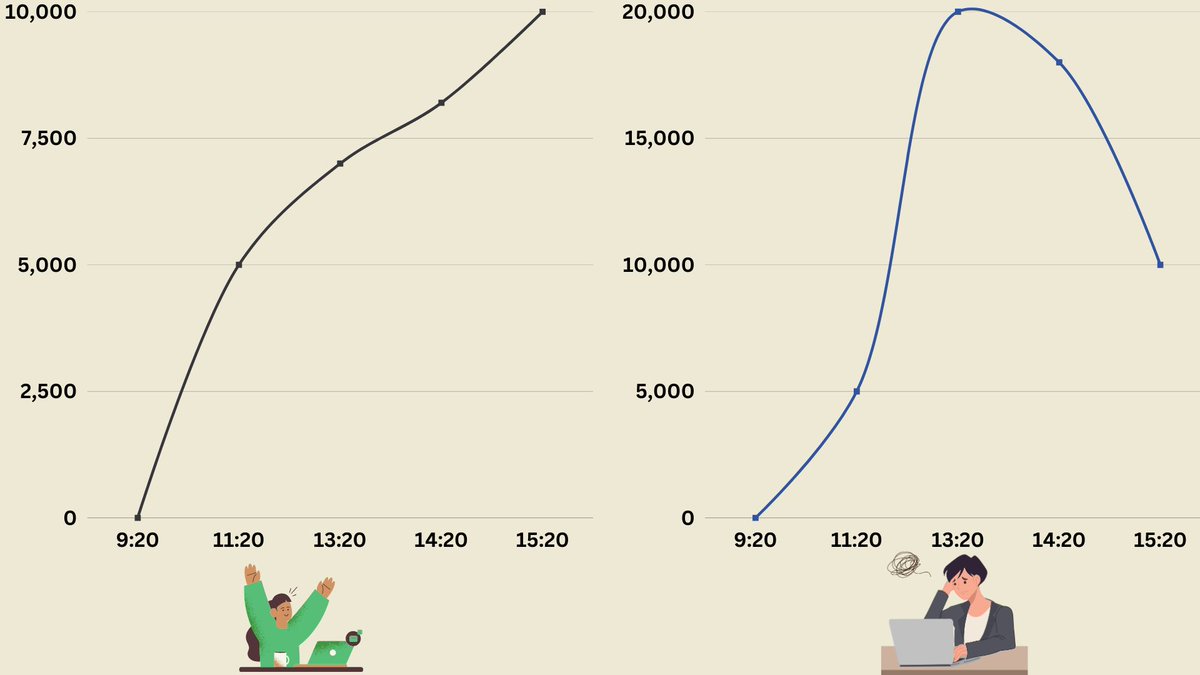

Ten years before hardly anyone know about backtesting due to lack of right tools. But now the problem has increased multi fold because these tools made many traders get into automated trading but very few do it the right way. Out of these two system which one would you choose?

Most traders inspite of checking all other parameters like Max DD, Expectancy etc, most give preference to total profits. People always focus on end result. But that’s a major problem when you finalise a trading system based on the overall profits in the backtest report.

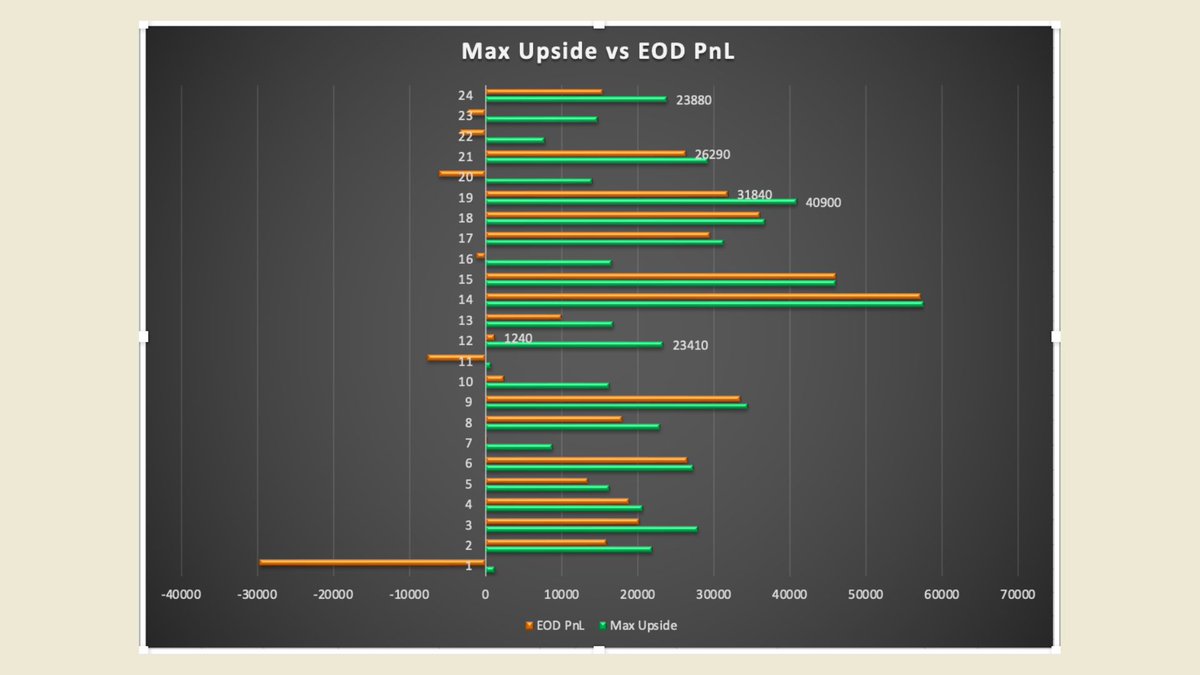

Two types of system, both ended up with same Rs.10,000 profit by day end. But one guy is happy other one is really sad inspite of making same profit. Because the second guy who watches is MTM every now & then, literally saw 50% of his MTM profits gone. He wasn’t ready for it.

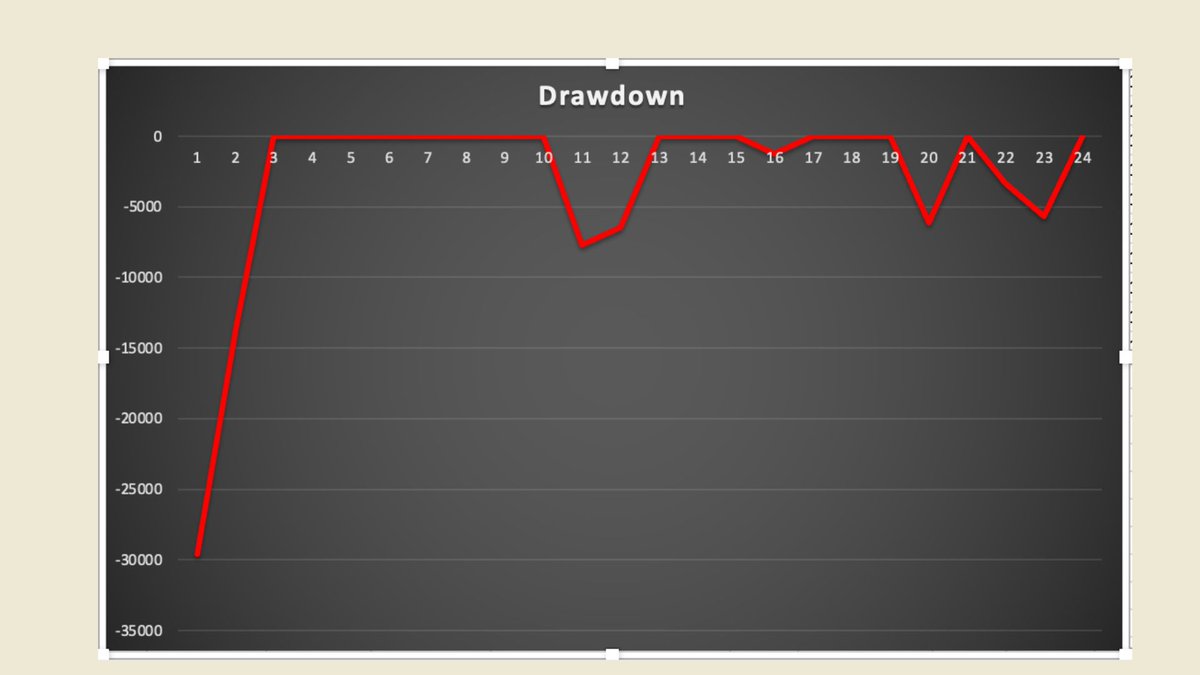

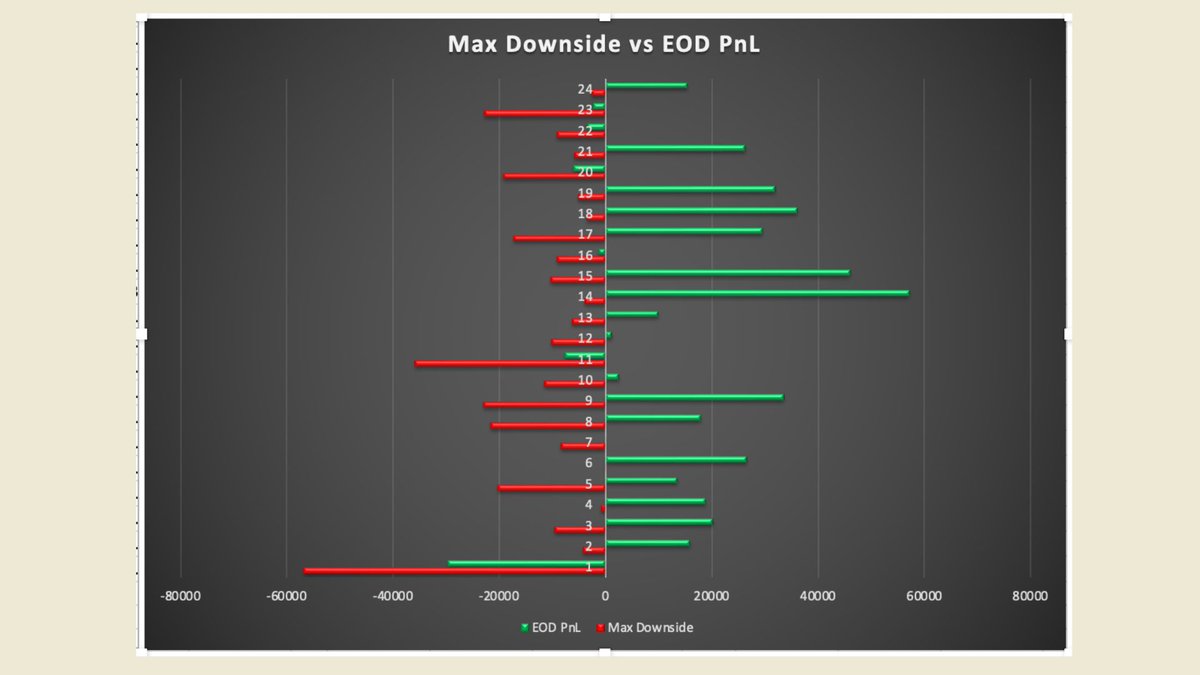

Once you dissect your backtest results trade by trade,you will get an idea what to expect when you go live. All backtest platform provides drawdown data based on trades that are closed. As per this trading system,drawdown shown is Rs.30,000 per lot. Based on this, you trade live

Once you trade live, the intraday fluctuations could be much higher. That’s why focusing on Maximum Adverse Excursion (MAE) is important, it refers to the maximum loss experienced from entry point before the trade is closed. Max unrealised loss went to -Rs.60k then closed at -30k

When you do detailed analysis of your backtest report trade by trade, your expectations will be in sync with your trading system and you will not panic when 50% of MTM profits gets wiped off by day end. You should be comfortable enough in leaving some profits on the table.

Consider you were given two options to choose from, Which one Would you prefer? A. 100% chance to win ₹1000 B. 50% chance to win ₹2000 Most people would prefer Option A.

People do not want lose an opportunity on making a confirmed profits.

Even though they were given a chance to make higher profits, they are content with lower profits because they want to be certain, they are happy with the Rs.1000 profits which is in their hand right now, than the Rs.2000 profit that may or may not come tomorrow.

If question is changed from Winning to losing, what would you prefer A. 100% chance to lose ₹1000 B. 50% chance to lose ₹2000

Most will prefer Option B. People wanted to take chance this time when they were given a chance to lose, they prefer to bet on that 50% luck.

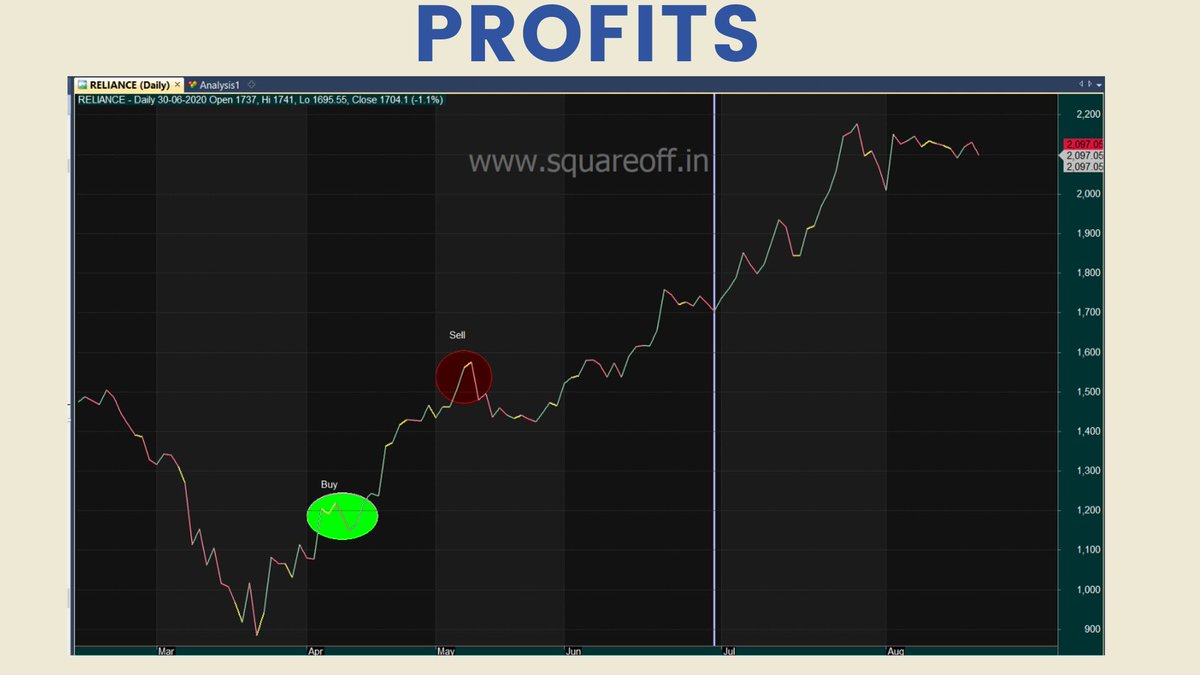

Consider you buy Reliance, you enter at Rs.1000 and you exit at Rs.1500, you are happy with the 50% profits, even though the stock went to Rs.2000, a chance to make 100% profits was missed, still you are happy with the profits in your hand.

Consider you have bought Yes Bank at Rs.300 levels, it went down to Rs.200 levels, you did not sell it, you want to make profits from the trade, so you held onto it, even though it came back to your buy price, but you did not sell it.

Then stock dropped, dropped, it kept going down, but you did not exit, because you are still hoping that stock would bounce back one day, but that one day never came. We are reluctant to book loss, because we want to take chance.

People are willing to take serious risk to avoid losing money, when it comes to winning they want to be certain, but when it comes to losing money, they dont want be certain, they want to bet on chance.

The pain that you get in losing trades are always much higher than the feel good factor that you get in winning trade. Instead of getting out at smaller loss, they hope, they pray, they wait for market to reverse so that their loss would be minimal.

We should always cap the risk, you should know how much you are willing to lose before you put in the trade, be certain how much you are willing to lose and leave the profits to the markets. That’s how most of the professional traders make money.

They want to be certain with what they want to lose, you just have to live another day to take that risk, that’s all you need to survive in the markets. Don’t take chance on your loss, Markets can be really brutal at times.

Another mistake most traders do when backtesting is giving importance to Day wise filters. Changing stop loss based on the day, people believe Monday/Friday use to be trending, lets use higher SL, other days use to be range bound, let’s change SL accordingly. But this wont work.

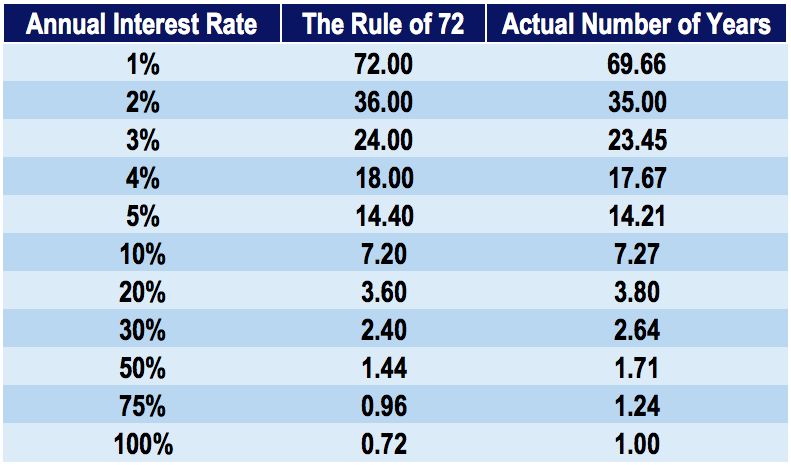

Most problem arises when a trader have unrealistic expectations, that’s when they increase leverage or go after system that can generate high returns with high risk. Based on rule of 72, If you can make 30% returns per year you can double your capital every 2.5 years.

Here’s my last one year verified pnl buff.ly , I always focus too much on how much am going to lose in a trade, never tried to control how much am going to make, controlling the risk is in our hands, leave the returns in market hands. This has greatly helped me.

Always remember, in trading finding a profitable strategy is not a problem but finding a trading strategy that suits our mindset is the real problem. We trade based on our belief. There are certain core principles we believe in, our trading system is built on these beliefs.

A hardcore momentum trader will only focus on other momentum traders, he tends to ignore all mean reversion ideas. Similarly, all these Option greeks guys firmly believe on it, they tend to disregard all other traders who dont believe in greeks. We trade what we believe in.

So just because some experts suggest something, don’t blindly believe in it. You need to align your trading system based on your belief system about the markets. Only you can find it, once you go in this route everything will fall in place.