- October 3, 2023

- admin

- 0

If you put a frog in hot boiling water, it immediately jumps out. However, if you place the frog in a normal room temperature water, then if you start boiling it slowly, the frog won’t react to it immediately. Instead, it tries to adapt to the environment by the time it realizes that it is the hot boiling water he is sitting on, it will be too late, and eventually he gets cooked to death. Most of us are familiar with this story. Momentum Trading is all about Frog in the hot water.

When you read about a stock news which is going to help the company to achieve super profits (Hot water), people flock together and buy the stock, making the stock price hit upper circuits back to back in a few days. However, we tend to ignore the news of stocks that are not going to have any significant impact on its growth in the near future (Normal water). But such kinds of stocks slowly react to these lesser impact news and start moving up gradually (Boiling water). This is when people notice the stock has gained momentum, and they get into this moving train, expecting it to move faster in the coming days so that they can get a few stations down the line with handsome profits.

Just like how option selling gained more traction post covid, in the recent past momentum trading has gained significant traction among short term traders.

Most traders wanted to buy low and sell high. However, momentum traders would be buying higher and selling much higher with the expectation of the stock continuing to move up.

The momentum strategy is based on the idea that if there is enough force behind a price move, it will continue to move in the same direction. Momentum trading is about identifying stocks that are already on the move, rather than predicting their future value.

As long as momentum lasts, all types of momentum trading works fine. During a bull market, it gains higher traction.

Easy to Execute:

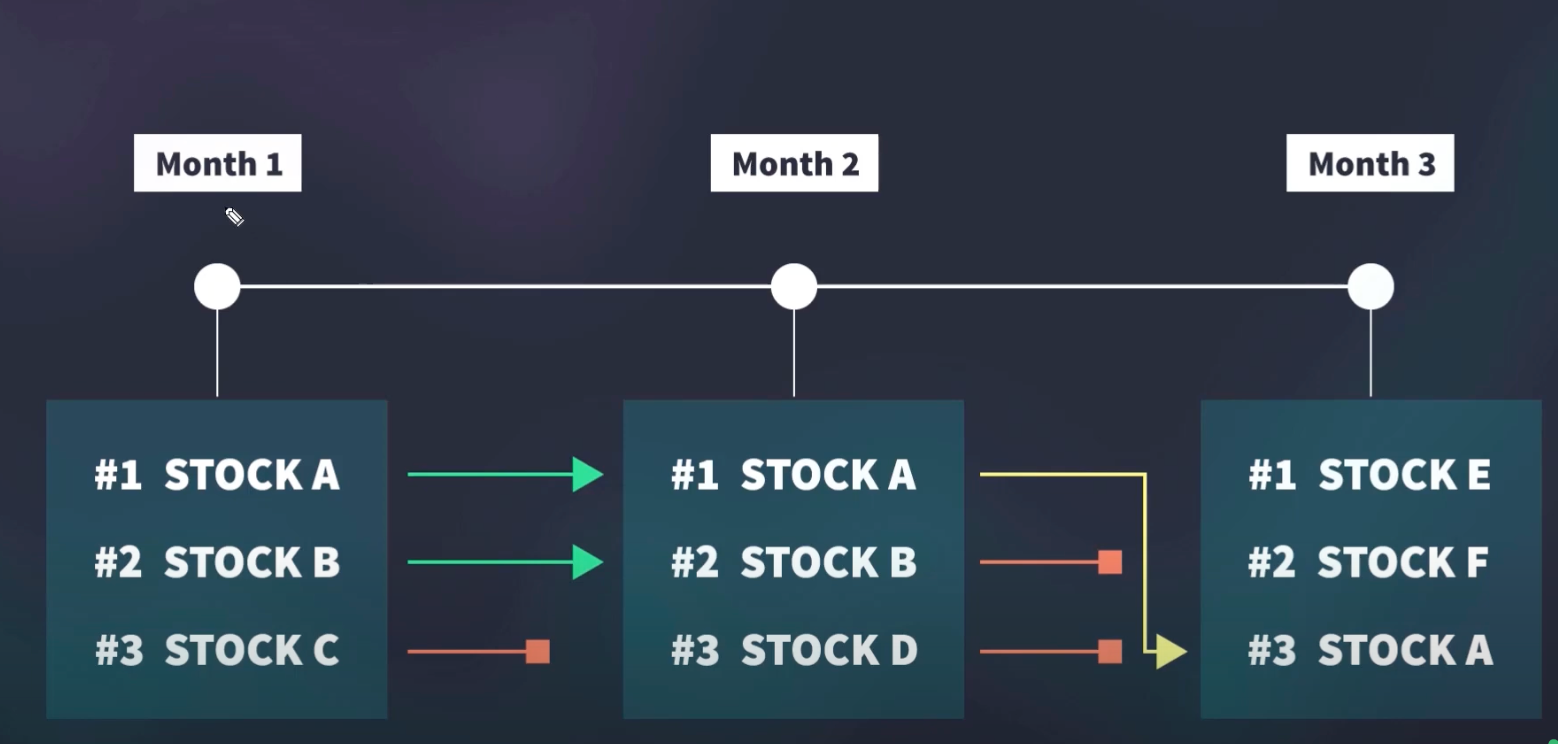

The main reason why momentum trading gained much traction is mainly because of its ease of execution. Where you don’t need to spend so much of time in analyzing and executing, all you have to do is just spend 10 to 15 mins of your time every weekend. That helps in choosing the top N momentum stocks, invest in them, rebalance it every week/month by repeating the same method. Keep top momentum stocks, exit bottom momentum stocks from the list. That’s the whole idea.

The right way:

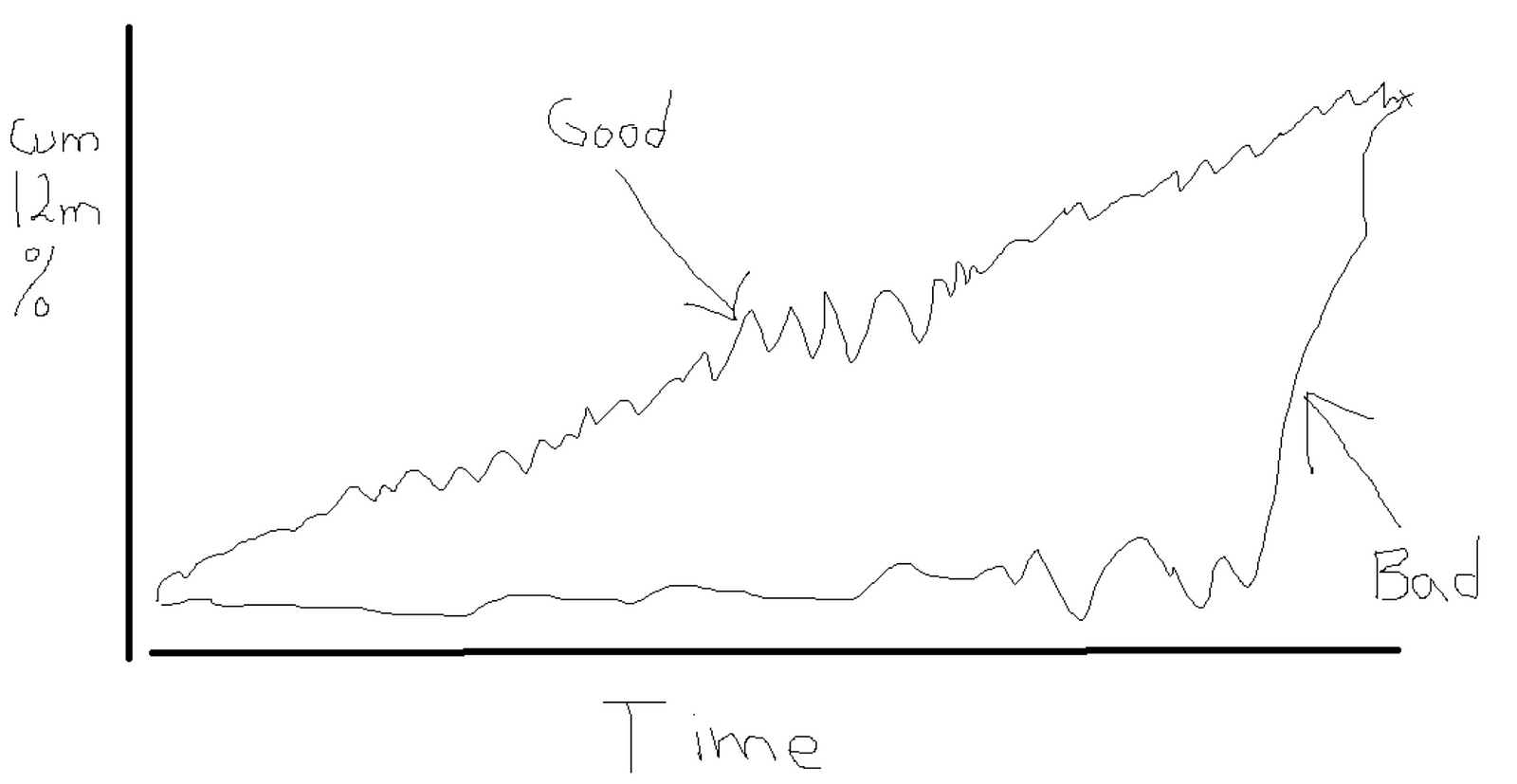

Most momentum traders simply follow a relative strength method where they check how much a stock has gained over N periods and simply invest and rebalance. They don’t consider the most important factor, which is volatility. Wesley Gray, PHD explained it well in a subtle way. If you check this below graph, consider Stock A and Stock B, both gained similar traction. Stock A moved slowly and gradually, but Stock B was dull most of the time, but suddenly picked up momentum. Normal momentum based traders would pick both the stocks based on relative strength however Stock A (Good) should be considered here over Stock B (Bad) since returns with volatility adjusted basis, Stock A (Good) is the right choice.

So don’t simply go by the strength of the stock, consider the path of the stock as well. Check if the stock reaction was due to hot water or was it a late reaction due to normal water which turned into boiling water.

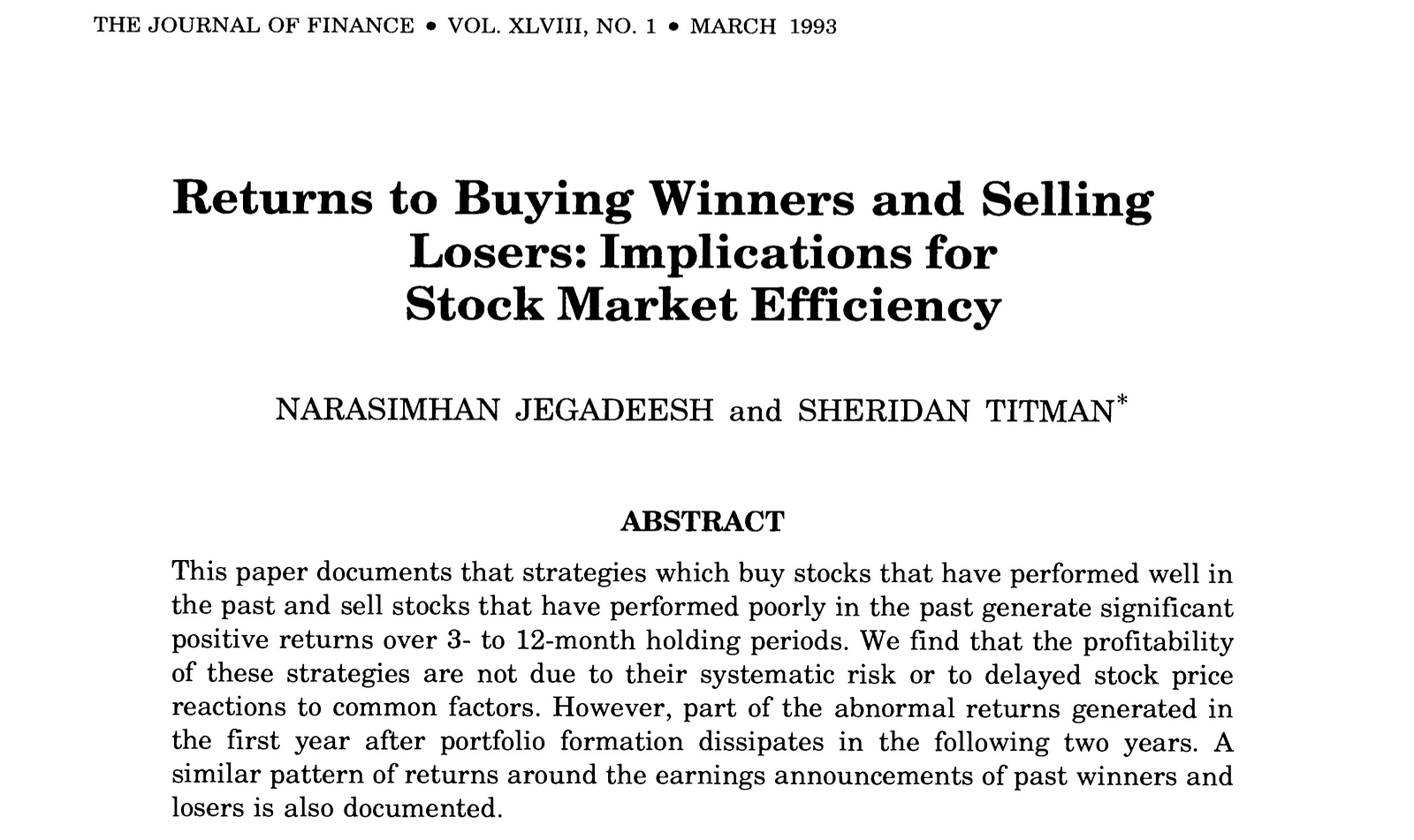

Who Invented Momentum Trading:

NARASIMHANJEGADEESH and SHERIDAN TITMAN published a research paper in 1993 about the significance of momentum based approach and how it beats benchmark index to a greater extent. Post that, many CTAs & fund managers started following momentum based approaches. In fact, there were multiple other authors as well who have been talking momentum trading even from 1937. In India, only during the 2017 bull run, Momentum based trading gained traction when few traders started talking about it.

Momentum Index Fund / ETF:

There are many small cases or traders who actively follow momentum trading with baskets of Nifty 200 stocks. If it’s working well, then it’s good. You should continue doing it. However, for people who are primarily into option trading and who want to get into Momentum Trading, can opt for Momentum Index Fund / ETFs.

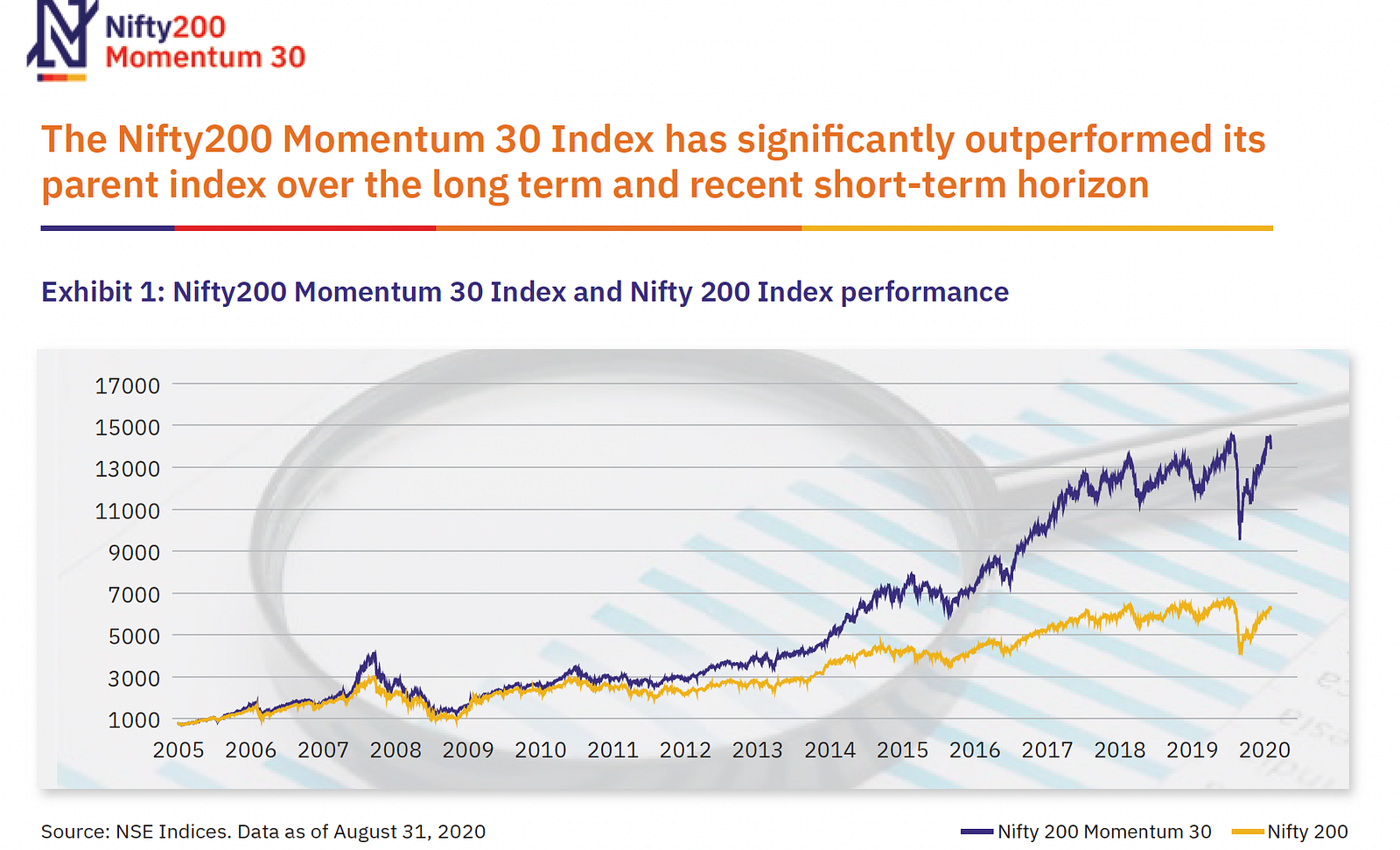

NSE Indices has developed the ‘Nifty200 Momentum 30 Index’ which aims to track the performance of the top 30 companies within the Nifty 200 Index selected based on their normalized momentum score. The normalized momentum score for each company is determined based on its 6-month and 12-month price return, adjusted for its daily price volatility.

The Nifty200 Momentum 30 Index has outperformed the Nifty 200 Index since inception, with an 18.6% CAGR return against 12.7% return for the Nifty 200 Index. The best part is the drawdown is almost similar in momentum index vs Nifty 200 but returns wise Momentum Index has outperformed significantly.

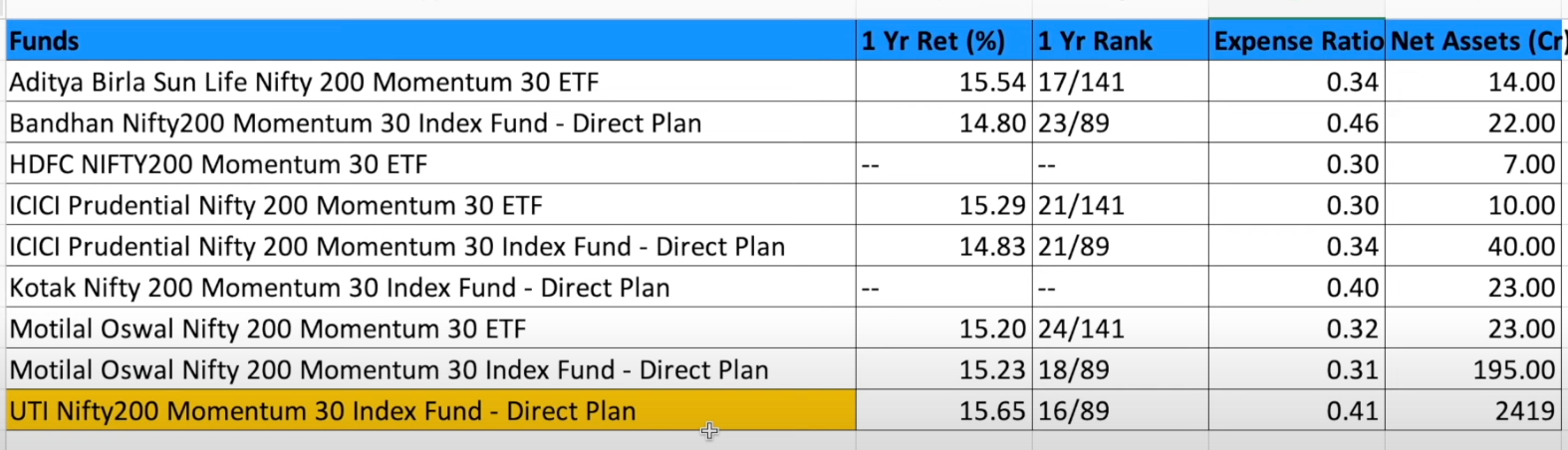

People who want to take advantage of this momentum index can invest in any of these index/ETF mentioned below. Expense ratio is relatively much lesser. Out of all funds, UTI Nifty 200 momentum 30 index fund has a good AUM with decent expense ratio.

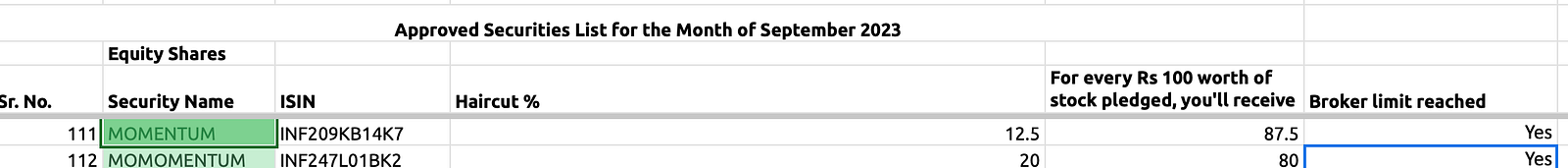

The best thing is, as an option trader instead of keeping your cash idle or investing in Nifty bees, you can buy this Momentum Index, pledge that and continue to trade your option selling system. Please note, for Zerodha users, the broker limit is already breached for Momentum ETFs. So you can’t get margin. However, other brokers might allow it.

But Zerodha users can invest in UTI Momentum index fund, where haircut is only 7.5%, if you invest 1 lac, you can get margin up to Rs.92,500. So you end up getting a good margin plus the appreciation of the underlying asset, plus you are indirectly participating in the momentum trading without the need for any weekend analysis .

Here’s the detailed video and article regarding the same https://www.youtube.com/watch?v=OLhgCiCvqh8