The Intraday ORB Trading bot has been made as fully automated now, zero manual intervention. Entry,target and stoploss will be taken care by Fully automated trading bot https://squareoffbots.com

Strategy:

The strategy is plain 15 mins opening range Breakout. The system calculates what’s the first 15 mins high and low of the stock, so after 9:30 AM, when high range is broken Buy order is triggered with 15 mins low as stop loss. If low range is triggered, then short order is triggered with 15 mins high as stop loss.

No Targets or Trailing stop loss used, all position gets closed by EOD.

List of stocks:

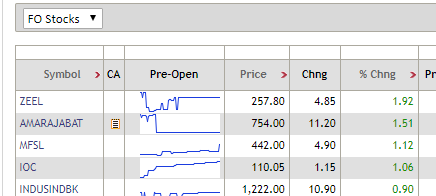

Daily 10 stocks will be selected by the bot based on pre-open session. Top 5 gainers and Top 5 losers will be selected from the fno list.

https://www1.nseindia.com/live_market/dynaContent/live_watch/pre_open_market/pre_open_market.htm

At times when high priced stocks like Eicher mot, page industries or when penny stocks like Idea comes in the list, such stocks will be ignored by the bot.

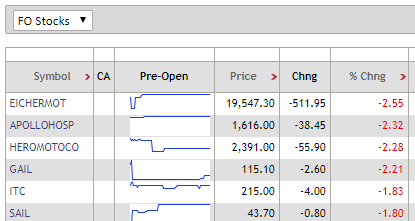

Quantity:

Capital entered to the bot will be allocated to each stock, if you enter Rs.10,000 as capital, then each stock will be allocated with Rs.10,000 capital and total exposure will be 1 lac, as ten stocks will be traded.

Consider the below example, 10k capital and 10 stocks has to be traded, the bot calculates the orb ranges and based on stock price entry and capital, quantity is calculated, Zeel buy price is 257.8 and capital is Rs.10,000 so quantity is 10000/257.8=39.

You can check the performance report here http://performance.squareoffbots.com/

Please note that all orb parameters are fixed.

Places both buy and sell orders for 10 stocks

Order type MIS (Not CO/BO)

Market order

Entry time 9:30 AM

Stop loss is default, which is 15 mins orb high or low

No targets, No TSL.

All position should be exited at 3.10 pm by users by clicking day end button available in our platform or it exits when stop loss hits.

Subscription cost:

Its Rs.17,700 per year. https://rzp.io/l/ORBBOT